Attracting More Appraisal Business

Cleveland Appraisal Blog

NOVEMBER 3, 2022

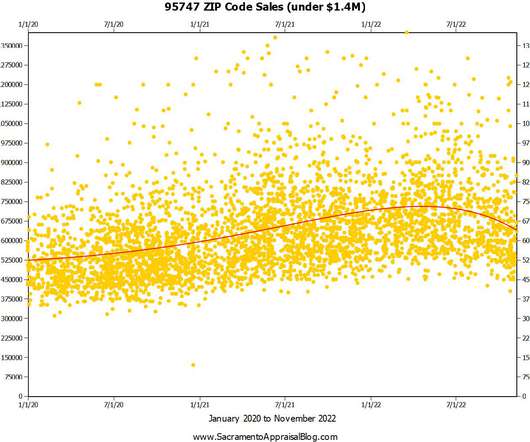

Most appraisers are experiencing a significant slowdown in mortgage lending work due to rapidly increasing mortgage rates which are slowing down the housing market. I have seen a slowdown in my lending work also. So what can we do? Half my work is non-lending work, and that’s been a blessing. Mortgage lending work is only one type of business where appraisals are needed.

Let's personalize your content