How to Buy a Home From a Family Member Without the Risk of a Huge Feud

Realtor

JUNE 12, 2018

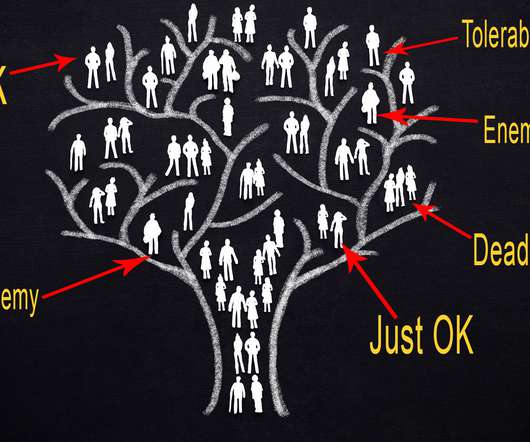

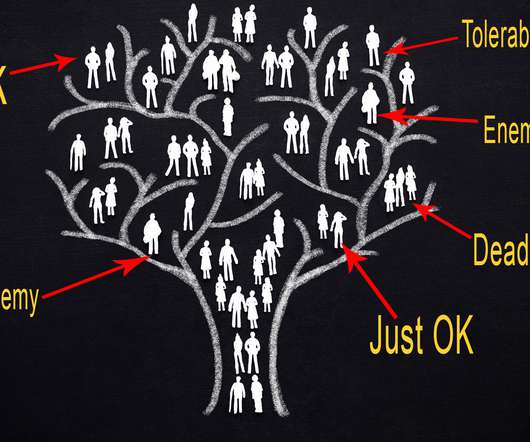

pepifoto/iStock; realtor.com Buying a home is hard, but if you want to learn how to buy a home from a family member, you’re entering truly treacherous territory. Because, let’s face it, we’ve all been to family dinners where a seemingly benign issue can instantly turn into a blood feud. And when it comes to real estate—usually the largest asset most people have—there’s a lot at stake financially.

Let's personalize your content