Mortgage applications continue fall amid 5% rate

Housing Wire

APRIL 13, 2022

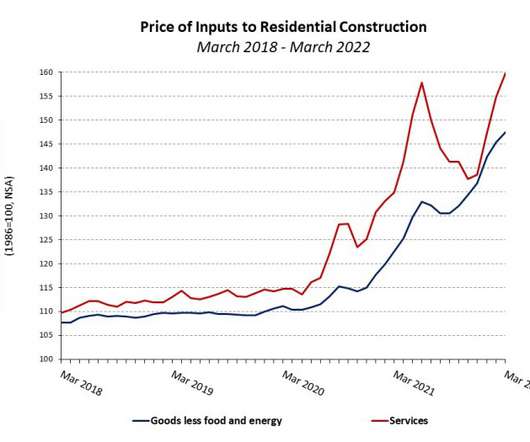

Mortgage application volume dropped 1.3% for the week ending on April 8, from the previous week, as mortgage rates eclipsed the 5% mark. Refinance applications fell 5% from the prior week and 62% from the same week a year ago, according to the Mortgage Bankers Association ‘s weekly survey. “Mortgage rates have spiked more than 1.5 percentage points thus far in 2022,” Mike Fratantoni, MBA’s senior vice president and chief economist, said in a statement.

Let's personalize your content