Chasing the ball down the road in real estate

Sacramento Appraisal Blog

SEPTEMBER 14, 2022

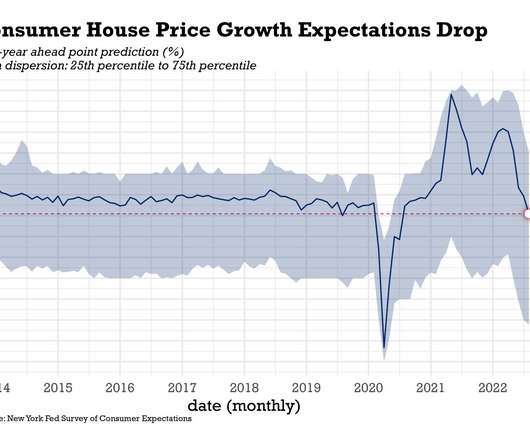

Sellers have been chasing the ball down the road. What I mean is prices have been going down lately, and sellers are trying to find the market through price reductions. I can’t speak for the entire country, but I’d like to talk about what’s happening locally. I’m not writing as a housing bull or bear […].

Let's personalize your content