Feds seek to enlist real estate agents in anti-corruption push

Housing Wire

JANUARY 19, 2022

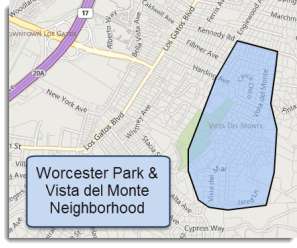

The Financial Crimes Enforcement Network , or FinCEN, is floating a proposed anti-money laundering rule that could impose reporting mandates on a broad swath of professionals in the residential real estate market, including real estate agents, brokers, attorneys, title insurance companies and settlement agents. FinCEN’s proposed regulation, outlined in an “advanced notice of proposed rulemaking” published in the Federal Register , seeks to create general recordkeeping and reporting mandates — n

Let's personalize your content