Home sales beat estimates: no housing crash in sight

Housing Wire

AUGUST 23, 2021

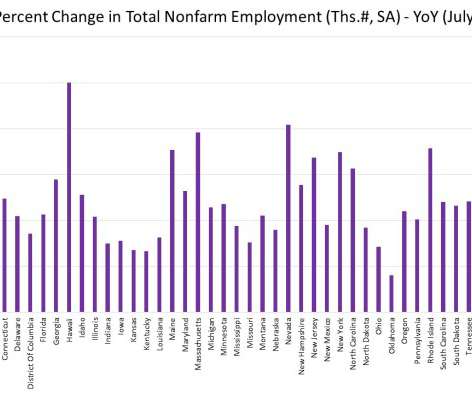

The National Association of Realtors reported 5.99 million home sales for July, which was an excellent beat of estimates and a dagger into the hearts of the 2021 housing crash crew. Mother demographics and low mortgage rates , two things that have been transparent to human beings for a long time, are powerful economic forces. Both together make it very difficult for an epic housing crash in sales to happen, especially when the years 2008-2019 had the weakest housing recovery ever.

Let's personalize your content