Sprout Mortgage to shutter

Housing Wire

JULY 6, 2022

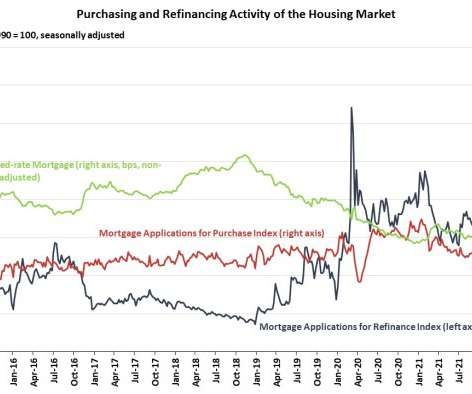

Non-QM lender Sprout Mortgage is shutting down operations, multiple workers said on Wednesday. The company informed workers of the shut down in a conference call on Wednesday, a former staffer said. Sprout had already instituted several rounds of job cuts in the months leading up to the shutdown, the ex-employee said. The closure of Long Island-based Sprout, headed by industry veteran Michael Strauss, represents the second non-QM mortgage lender to close in recent weeks amid historic volatility.

Let's personalize your content