Compass and Redfin make cuts amid volatile market

Housing Wire

JUNE 14, 2022

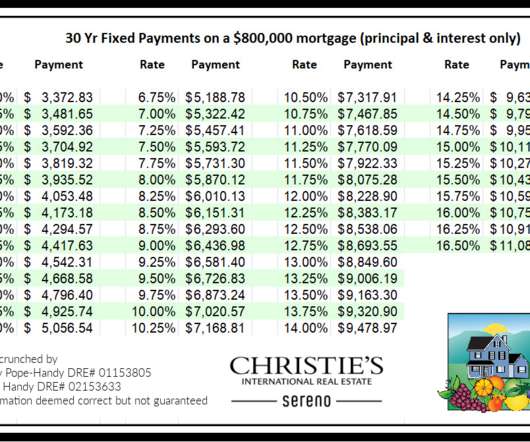

On Tuesday, the other shoe dropped. With mortgage rates now north of 6% and the stock market officially in bear territory, two of America’s most prominent real estate brokerages instituted large-scale layoffs and halted expansion efforts. Redfin CEO Glenn Kelman said the brokerage/listings platform made the tough decision to lay off 470 workers across several divisions, including its engineering department.

Let's personalize your content