How home-price growth has damaged the housing market

Housing Wire

JUNE 28, 2022

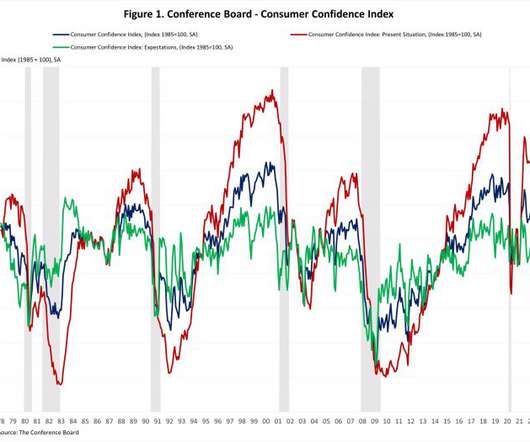

The S&P CoreLogic Case-Shiller Home Price Index just recorded 20.4% year-over-year growth nationally and a record 21.2% growth for its top 20 city composite, and now you know why my most significant concern for housing was home prices overheating , not crashing like people have warned about from 2012-2021. From S&P : The S&P CoreLogic Case-Shiller U.S.

Let's personalize your content