Amazon news raises new recession red flag

Housing Wire

MAY 6, 2022

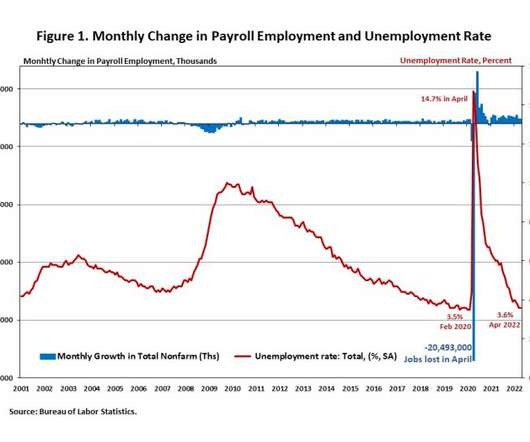

Two significant things happened on Friday: the Bureau of Labor Statistics reported that the U.S. created 428,000 jobs in April, and I had to raise another recession red flag. First, let’s look at the jobs picture. string of positive job revisions we’ve seen this year ended with a negative 39,000 print; however, the job report was solid and continued the trend of good reports in 2022.

Let's personalize your content