What Omicron, bond market and jobs mean for housing

Housing Wire

DECEMBER 3, 2021

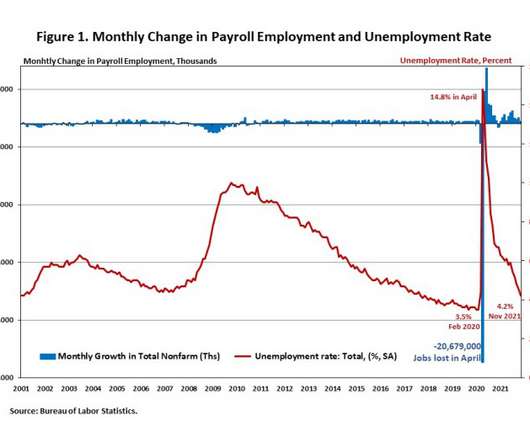

Today, the Bureau of Labor Statistics reported 210,000 jobs were created in November — a miss from estimates. They also reported 82,000 in positive revisions to the previous jobs report. The unemployment rate is currently at 4.2%. For men and women age 20 and over, it stands at 4.0%. Job reports can be wild, and we often have two to three reports per year that miss estimates badly.

Let's personalize your content