CPI report is good news for mortgage rates

Housing Wire

MAY 10, 2023

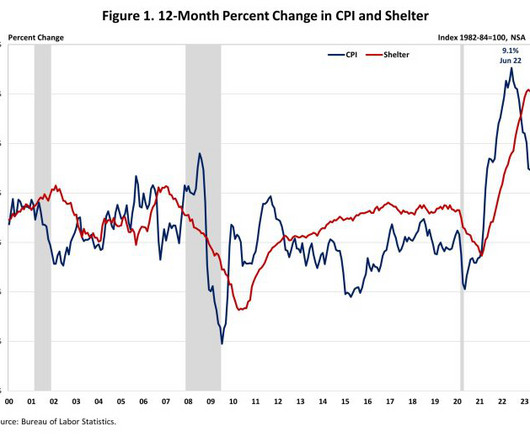

The massive inflation and double-digit mortgage rates of the 1970s and early 1980s seem to haunt the Federal Reserve , which wants to cool the economy and even provoke a job-loss recession to avoid that scenario. But the latest Consumer Price Index inflation report shows how the fear of 1970s-style inflation is wildly overblown. Today’s numbers don’t look like the 1970s at all, when rent, wages, and oil shocks sent inflation running hotter than anything we have seen in recent modern-day hi

Let's personalize your content