The honey badger labor market will still bite housing

Housing Wire

NOVEMBER 4, 2022

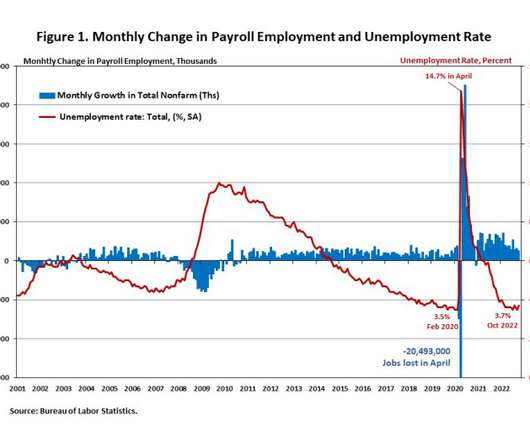

On Friday, the Bureau of Labor Statistics reported that 261,000 jobs were created and we had 29,000 positive revisions to prior reports. This means the honey badger labor market will keep the Federal Reserve from pivoting anytime soon. . This has been a theme of mine lately. Since all my six recession red flags are up, the only data lines that I am focusing on regarding the cylce of economic expansion to recession are job openings and jobless claims data.

Let's personalize your content