The housing market is now savagely unhealthy

Housing Wire

MARCH 18, 2022

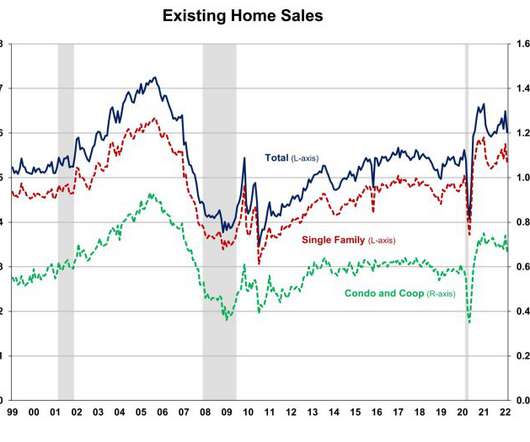

The National Association of Realtors reported that existing home sales for February came in as a miss of estimates at 6.02 million. This level is still within my 2022 forecast sales range between 5.74 million and 6.16 million. Last year I discussed sales levels coming back down to 5.84 million and I am looking for more of the same in 2022, at the 5.74 million level.

Let's personalize your content