A good jobs report, but also another recession red flag

Housing Wire

APRIL 1, 2022

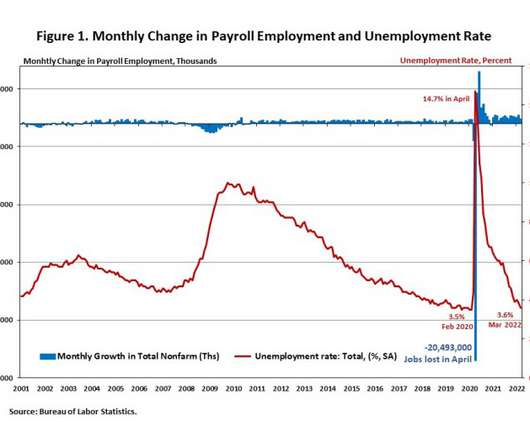

Today, the Bureau of Labor Statistics reported that the United States Of America created 431,000 jobs in March. We also had 95,000 positive revisions, and although this was a slight miss of estimates, it continues the solid trend of good job reports in 2022. On another note, I raised my third recession red flag, since the inverted yield curve happened this week.

Let's personalize your content