The 2023 housing market is at odds with itself

Housing Wire

MAY 4, 2023

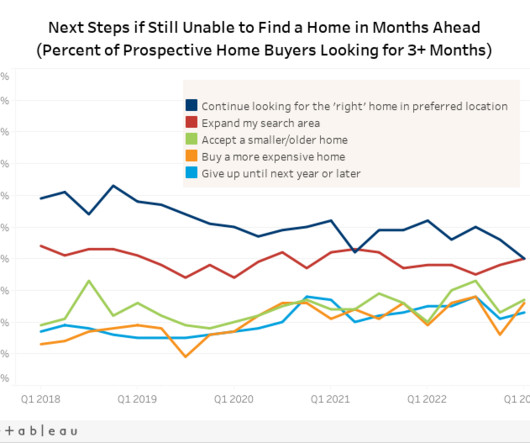

A paradoxical picture is emerging as the spring market is underway. On the one hand, elevated mortgage rates continue to erode buyers’ purchasing power, and in some markets, home prices are falling. On the other hand, inventory is still low, and homes are still selling fast, often with multiple offers. All major housing market metrics point to a restrained housing market.

Let's personalize your content