Fastest market ever & price deceleration

Sacramento Appraisal Blog

MAY 23, 2022

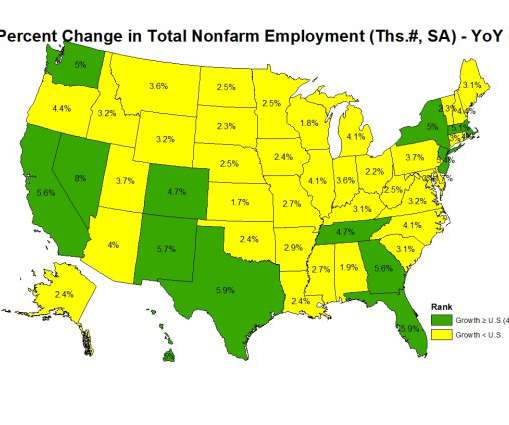

The housing market has been changing these past couple of months. As I’ve been saying, it isn’t cold, but the temperature is surely different. Anyway, let’s talk about two things to watch in months ahead – price deceleration and days on market. Any thoughts? This post feels a bit nerdy or heady, but this stuff […].

Let's personalize your content