Renter market picks up in suburbs

Housing Wire

SEPTEMBER 21, 2021

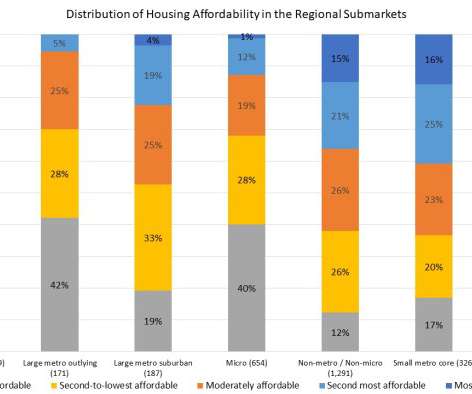

American suburbs surrounding the nation’s 50 largest metropolitan areas gained a total of 4.7 million new residents since 2010, with 3.7 million of them renters, according to a report by nationwide apartment search website RENTCafé on U.S. Census Bureau data. Today, an estimated 21 million people rent a suburban home in one of 50 largest metros. On average, renters made up 39% of the suburbs surrounding these metros.

Let's personalize your content