Refi applications fall to 53% of mix amid rate spike

Housing Wire

FEBRUARY 16, 2022

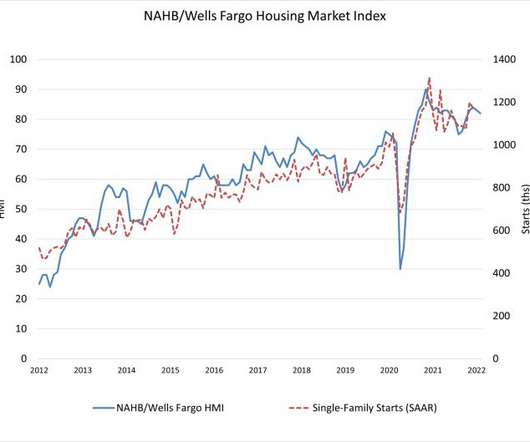

Mortgage applications decreased 5.4% for the week ending Feb. 11, reflecting what the mortgage market looks like when rates eclipse 4% for the first time since 2019. The Mortgage Bankers Association ‘s seasonally adjusted refi index fell 8.9% from the previous week, bringing its share of total applications to the lowest level in 19 months. Meanwhile, the purchase index dropped a mere 1.2%.

Let's personalize your content