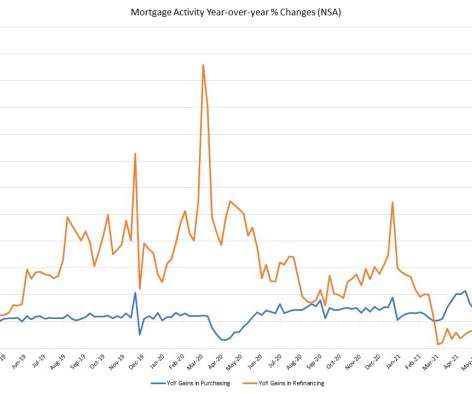

The purchase mortgage market continues to pick up steam

Housing Wire

SEPTEMBER 15, 2021

Mortgage loan application volume rebounded from the week prior, increasing by 0.3% for the week ending Sept. 10, according to the Mortgage Bankers Association’s weekly report. The increase in application volume was predominantly driven by purchase mortgage activity , which grew by 8% from the week prior , the trade group said. . Not surprisingly, the refi index has continued to slip, dipping 3% from the previous week, the MBA noted.

Let's personalize your content