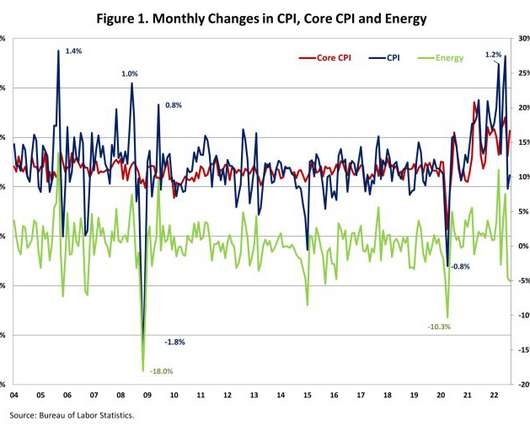

Are we seeing a mortgage rate lockdown?

Housing Wire

SEPTEMBER 13, 2022

The premise of a mortgage rate lockdown is simple: so many American households have such low mortgage rates that some will never move once rates rise, which then locks up housing inventory. This is something I’ve never believed in because we hadn’t had a period where mortgage rates moved up so quickly and then held higher for an extended period.

Let's personalize your content