Mortgage rates fall slowly after a month-long rise

Housing Wire

JANUARY 27, 2022

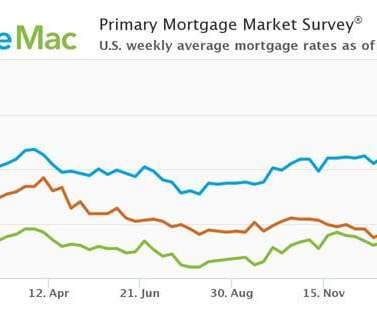

The average 30-year-fixed rate mortgage declined one basis point from the week prior to 3.55% during the week ending Jan. 27, according to the latest Freddie Mac PMMS Mortgage Survey. A year ago, the 30-year fixed-rate mortgage averaged 2.77%. Most economists believe rates will continue to climb in the weeks and months ahead. “Following a month-long rise, mortgage rates effectively stayed flat this week,” Sam Khater, Freddie Mac’s chief economist, said in a statement.

Let's personalize your content