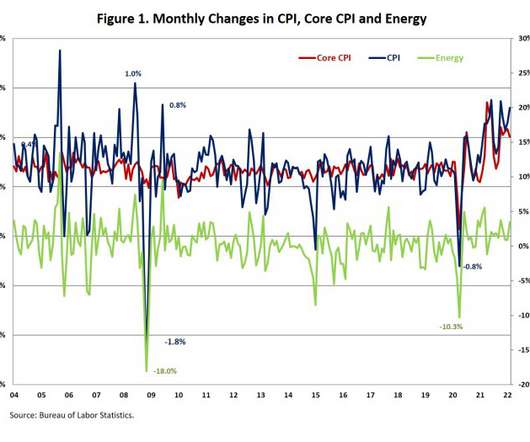

Volatile mortgage rates rise to 3.85% amid war, record inflation

Housing Wire

MARCH 10, 2022

Mortgage rates have been all over the place lately. They rose this week, reflecting the volatility of the U.S. economy brought by inflation and Russia’s war in Ukraine. The average 30-year-fixed rate mortgage increased to 3.85% for the week ending March 10, up from 3.76% in the previous week, according to the latest Freddie Mac PMMS Mortgage Survey.

Let's personalize your content