An open letter to home sellers in a crazy market

Sacramento Appraisal Blog

MAY 25, 2021

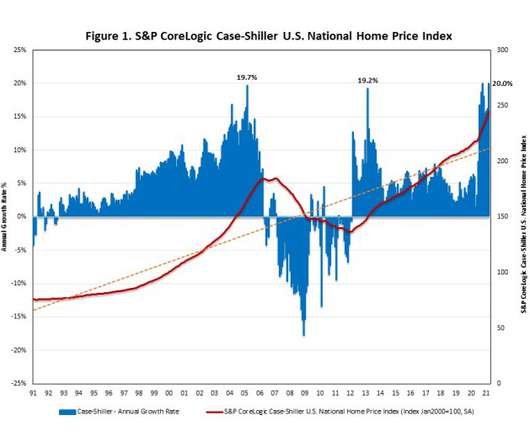

Dear Sellers, How are things? I hope all is well. The housing market is so chaotic right now, so I wanted to share some thoughts and advice that I thought might help. This is coming from a good place and it’s based on observations and conversations with the real estate community. I hope this helps. […].

Let's personalize your content