Is the Sun Setting on High Prices? – August Newsletter

“It is almost impossible to watch a sunset and not dream.” – Bernard Williams

We recently had an extended trip to send our son off to college in Colorado. When we returned I snapped this photo of Lake Ray Roberts as we were arriving in our hometown. It was so peaceful. I was thankful to be home and excited for his future. It symbolized a sunset in this part of my life, as this kid was now launched. Our lives are a journey of constant changing and adjusting. How does that apply to the housing market? Well, things are definitely changing in our local markets and nationwide.

As mortgage rates have risen the demand for housing has cooled down a bit. Are they falling off a cliff? No. In fact, they are still up from the same time last year. They are, however, down from the previous month and this decline is a clear shift from the frenzied pace we have been at in the last year. Also indicating a cool down is the number of homes sold declined, the number of days on the market has increased and supply is growing.

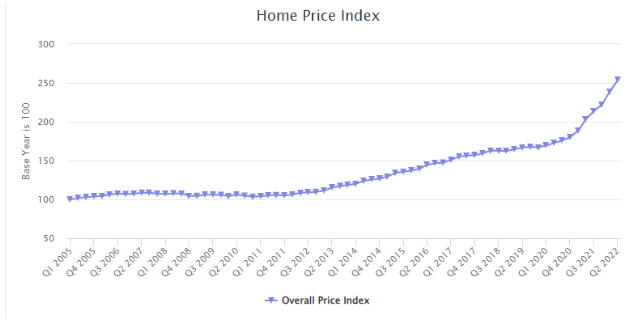

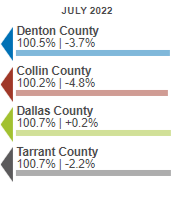

Our market has been very unbalanced for an extended period of time. The high demand and low supply have increased home prices at a much higher rate than wage growth. This has deminished the affordability that our area once had. Here is a look at the Home Price Index from Texas Real Estate Center for the Dallas-Fort Worth-Arlington area.

There is much debate about the future of the housing market. Some are predicting that we will have another huge crash similar to 2008 and others are predicting a steady to slow decline to such low inventory in housing. Thus we all wait and watch each month and each day to see the trends.

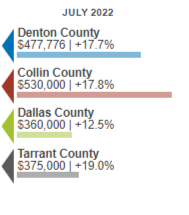

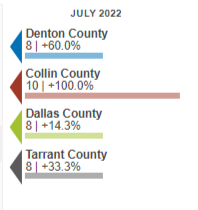

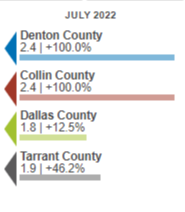

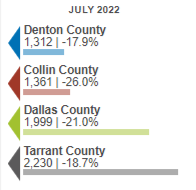

The current trend in North Texas is a very slow decline. Buyers are gaining some ground in the market as the number of days on the market has been increasing as well as the supply. It is noted that part of this decline is a part of seasonal trends as the markets do typically cool in the fall, however, July is typically the peak but this year prices peaked in May, a clear sign of cooling off and a move to a more balanced market. Here are the numbers for July:

Median Sales Price

Days on Market

Supply

Percent of Original Price

Volume

Sneak Peek 👀

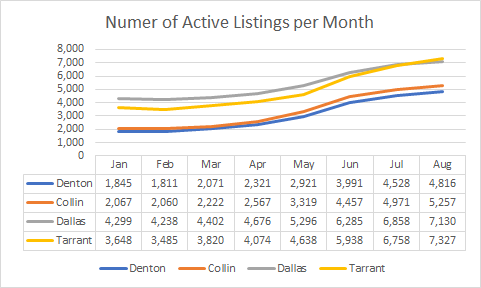

Here’s a look at the number of active listings in August. All four counties are showing increases. Stay tuned for next month’s newsletter!

Check out this month’s information just for real estate appraisers. If you have information that you think would be good here, please let us know.

Read 📖

Why Price Indexing? – George Dell

Existing home sales are still savagely unhealthy– HousingWire

New home sales make it clear: Housing is in a recession- HousingWire

Are Buyers In The Driver’s Seat Now?– Birmingham Appraisal Blog

Spacing Out On Inflation And Crying About The Housing Market Pause– Housing Notes

What’s Happening With the Nation’s Housing Inventory?– McKissock

7 Ways for Appraisers to Spend Less Time on Email- McKissock

Housing prices are cooling fast—and it’s hitting these homes the hardest- AEI

Pricing a Home In A Softening Market- Birmingham Appraisal Blog

Is Truth A Credible Edible? – George Dell

Have Land Values Peaked?– AgWeb Journal

2022’s Best Real-Estate Markets– WalletHub

Dallas-Fort Worth-Arlington Housing Affordability Outlook– Texas Real Estate Center

Changing housing temperature– Sacramento Appraisal Blog

Do Appraisal Gap Clauses Impact Appraisals?– Cleveland Appraisal Blog

Watch 📺

Live Webinar: The Appraisal Foundation 2022 Q3 Update (Non-Credit)– McKissock (Free)

The Latest Signals for the Fall Real Estate Market- Altos Research (Free)

Live Webinar: UAD and URAR Redesign-What Appraisers Need to Know (Non-Credit) – McKissock (Free)

An Appraiser’s Guide To Quality Appraisals: How To Avoid Common Conventional Loan RevisionsForecast for the Fall Real Estate Market– Altos Research

Listen 🎧

The Appraisal Update – Episode 109 | Fannie Mae’s New ANSI FAQ– Appraiser eLearning

Don’t Be a Blockbuster!– The Real Value Podcast

The Sales Used are the Best Available- The Appraiser Coach

Appraisers’ jobs just got harder– HousingWire Daily

Logan Mohtashami: Will we see a soft landing for housing?– HousingWire Daily

USPAP, Facts, and Opinions- Talking Real Estate Appraisal

As always, we will continue to watch our local markets as well as what is going on nationally. We will be watching the impact of rising rates, inflation, and economic data on the housing markets. If you have thoughts, comments or questions let us know. If you need appraisal services please contact us at www.dwslaterco.com.