Will hotter inflation data trigger more rate hikes?

Housing Wire

OCTOBER 13, 2022

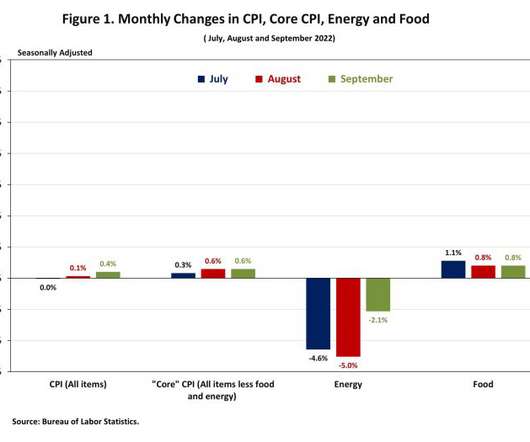

On Thursday, the Bureau of Labor Statistics (BLS) reported that Consumer Price Index (CPI) inflation came in hotter than expected, and people are scared that the Federal Reserve will now be more aggressive with their rate hikes. Personally, I believe the Fed knows that rental inflation data can lag so at this point of the rate hike cycle, they won’t act in a more aggressive fashion.

Let's personalize your content