The opening months of the Seattle/King County housing market can best be expressed as sparks of activity within a mostly tentative purchasing environment. Unless the listed home is in a favorable location, priced competitively and move-in ready, activity has been somewhat muted as prospective buyers and sellers wait for economic conditions to improve.

Sellers who priced their homes appropriately enjoyed busy open houses in their first weekend on the market followed by multiple offers. However, many potential buyers appeared to be in a wait-and-see mode amid a backdrop of rising mortgage rates that usually spell affordability challenges. General uncertainty about the future of the economy and job security have helped to slow market mojo and wrench power away from buyers and sellers alike.

“Today, real estate is ‘nobody’s market,’” notes realtor.com’s chief economist Danielle Hale. “The number of homeowners deciding to sell continues to lag, but inventory and time on market continue to [mostly] climb, reflecting still-hesitant buyers.”

The number of new listings of all home types (single-family, townhome and condo) in King County climbed 6.4% (1866 units) from January to February, as expected, and total inventory at the start of March (2064) was 111% higher than a year ago. The median days on market for resale homes across the county is now 20 days, up from only 5 days this time last year, suggesting a significant market slowdown.

Notably, there are 185% more listings available today across the Eastside of the county compared with February 2022. This time last year, buyers were aggressively scooping up available homes before the predicted increase in mortgage interest rates.

With rates surging today – to near 7.0% for many mortgage applicants – the annual rite of springtime buying enthusiasm might be in short supply. At least prices are falling in our area year-on-year (YoY) – one of the few signs of annual price depreciation in any U.S. market.

While the median price of all home types in King gained 1.0% since January to $726,700, they are 4.4% lower YoY, the sharpest yearly price drop in the county since the 7.8% decline over the 12 months ending March 2012. February prices included a 9.4% monthly decline on the Eastside ($1.05M) and a 1.3% drop in Seattle ($750,000).

The single-family-home segment offers a similar picture, with county prices up 2.4% for the month ($800,000) but down a sharp 6.7% YoY. The monthly price gain was the first since August, the greatest increase since April’s rise of 7.0%, and suggests buyers are showing a spark of interest through competitive bidding on limited quality homes in preferred locations.

“Desirable areas, good school districts and good quality homes are still going to sell well and [still] face bidding wars,” says Ali Wolf, chief economist at real estate consultancy Zonda. “But that’s not going to be the norm.”

Prices of Eastside single-family homes, which peaked last March at $1.7M, fell for the fifth consecutive month, down 21% from this time last year to $1.34M, while they were down 11% YoY in Seattle ($825,000). North King County saw a surprise 10% price hike from January ($810,000), though prices were down 4.7% YoY. The figures are by no means a sign of a pending pricing meltdown.

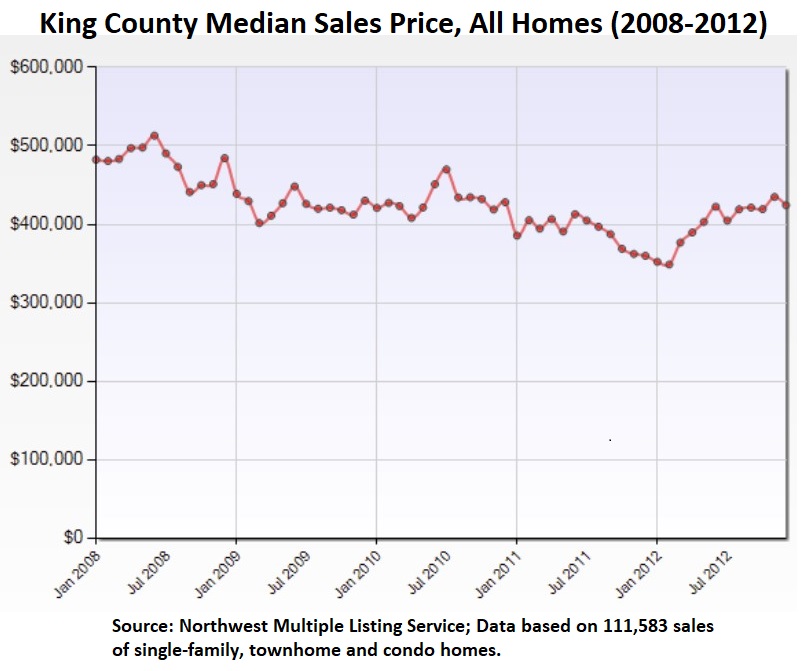

By contrast, between June 2008 ($513,077) and February 2012 ($348,790), King County home prices experienced a peak-to-trough change of 32% (graphic below) as the housing market struggled through a financial crisis of epic proportions. Today, even while owners are no longer going through the heartbreak of losing their homes amid a subprime mortgage crisis, we are seeing a mild price correction in pockets of our region.

Comparing the most recent peak of the market, April 2022 ($1.13M), and the low point, December ($848,367), median prices for the same group of resale homes (single-family, townhome, condo combined) fell 25%. While not as bad as the Great Recession, it is certainly one of the sharpest price depreciations in a short amount of time. (The Federal Reserve produced an interactive map that shows how home prices evolved across the U.S. each month between 2003 and 2022.)

The main reason for declining prices is the sharp reduction in demand amid a shock of mortgage rates more than doubling in 2022 and continuing to rise (as of this writing). No existing homeowner wishes to finance a new property if locked in to a pandemic-influenced mortgage with an interest rate of around 3.8% (the national average of all mortgage holders). The Federal Housing Finance Agency reports 65% of all mortgage holders are enjoying an interest rate of 4.0% or less. Moreover, a survey from Fannie Mae in February found that only 59% of respondents said now was a good time to sell.

“It feels like the market isn’t working for anyone,” says Hale from realtor.com. “That probably contributes to everyone’s sense of fatigue.”

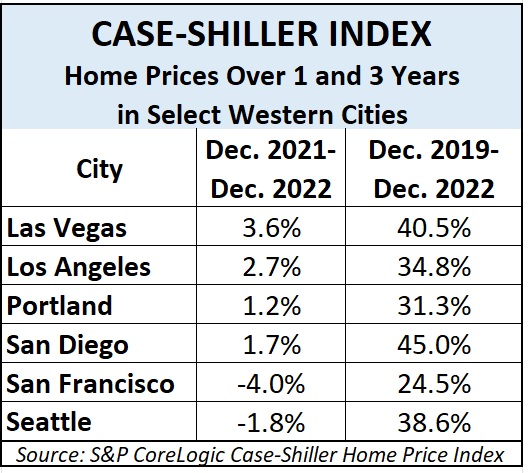

Seattle (-1.8%) and San Francisco (-4.0%) are the only big U.S. metros to experience YoY price declines, according to lagging data from the Case-Shiller Home Price Index. Portland, Ore., and San Diego are heading in that direction as well. Still, home appreciation remains solidly higher between 2019 and today, at least out West.

The Case-Shiller indices are accurate measures of home price appreciation because they track the sales prices of very similar homes. In other words, the results are not skewed by the mix of high-end and low-end homes sold but that accuracy comes at a cost – the figures are two months old once released.

As for the local condo market, median prices rose 4.1% from January to February in King County ($468,500) but have tumbled 12% YoY. Eastside condos are fetching a median price of $540,000, down 1.0% for the month and off 15% for the year, while Seattle saw a 5.6% price rise since January to $515,000, a 6.2% decline from February 2022. Condo inventory stands at 1.7 months in the county, including 1.1 months on the Eastside and 2.6 in Seattle, where the market experienced a brutal 50% drop in YoY sales through February.

Overall, the county has 1.4 months’ inventory for all home types, down sharply from 2.3 months in January. Eastside inventory is 1.4 months and Seattle’s is 1.7. Among single-family properties, inventory for King was 1.3 months, down from 2.1 in January, while there was 1.6 months’ inventory on the Eastside and 1.4 in Seattle.

In addition to King County’s 1.0% median price month-to-month rise on all home types, to $726,700, Snohomish County saw the sharpest increase – 3.1% from January to $664,975. Kitsap saw median prices climb 2.7% for the month ($499,950) while Pierce gained 2.0% since January ($519,997). Single-family home prices in King rose 2.4% in a month ($800,000), as did Pierce ($529,900), followed by Kitsap, up 2.1% ($499,995). Median prices fell 1.2% in Snohomish since January ($690,560). Year-to-year, single-family median prices were all lower, down 7.4% in Snohomish, off 6.7% in King, 4.8% in Kitsap and a modest 1.0% softer in Pierce.

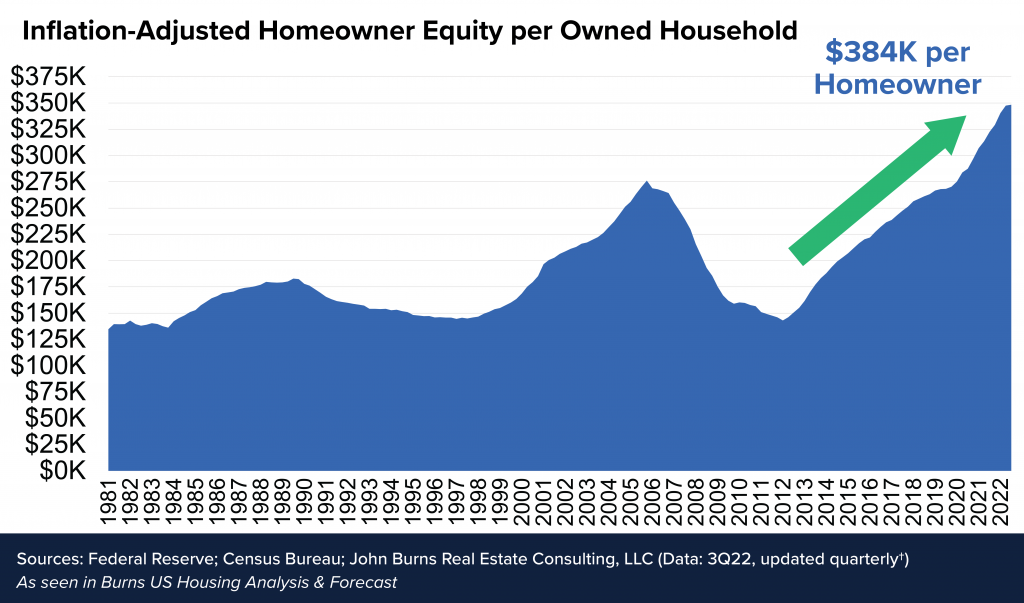

Even if home prices fell, say 5%-10% as has been forecast for this year in our area, most homeowners will maintain substantial equity. Since the end of 2019, prices have increased more than 40% in the U.S., and aggregate homeowner equity has skyrocketed about $10T. That equity provides a welcome buffer for households to absorb modest price declines without falling into negative equity.

Meantime, some of the bigger home builders – who are in the business of constructing and quickly selling product – are showing signs of financial stress. Companies like KB Home are cutting prices on new construction units and adding greater buyer incentives to move inventory. The actions are fueled by a growing number of buyer contract cancellations, rising to 68% of all KB Home deals in Q4, up from only 13% in the same period a year ago. This, along with higher building costs, will lead to a construction slowdown this year.

Whether new construction or new buyers, the prime driver of the market continues to be interest rates – the cost to finance purchases. Persistently high inflation – with new data to be released on March 14 (just as we published this blog post) – is prompting the Federal Reserve to raise its short-term rates, which can then influence the financing of other future loans from cars to homes and construction projects.

The next meeting of the Fed’s board is March 21-22, with another increase of 0.25 percentage points expected on its short-term lending rate. While the action of the central bank does not directly alter future mortgage rates, they affect the overall mood of investors who often finance those loans.

“The prospect of stable, or higher, interest rates means that mortgage financing remains a headwind for home prices, while economic weakness, including the possibility of a recession, may also constrain potential buyers,” warns Craig Lazzara, managing director at S&P Dow Jones Indices, which produces the Case-Shiller house price report.

Purchasing a home is now about 50% more expensive than it was a year ago for those who rely on a mortgage. And about 40% fewer consumers have applied for a mortgage compared with a year ago, according to the Mortgage Bankers Association.

“It’s going to be a tough market for both buyers and sellers,” says Mark Zandi, chief economist at Moody’s Analytics.

The question of job security has been more acute in West Coast tech hubs. Most U.S. cities have enjoyed persistent demand for jobs, up 33% on average from January 2020, according to job postings site Indeed.com. But San Francisco and Seattle have fewer job openings today, down about 6.5% each from just before the start of the pandemic, as tech companies focus more on profitability than growth. This should lead to a deeper, possibly longer economic slump for those cities, experts warn.

Even though we have yet to see all the factors that signal a recession, such as reduced consumer spending and higher unemployment, many economists still believe a recession will arrive this year. If it does, it will eventually contribute to lower financing costs, which will make mortgages more affordable.