Investors from 3 Asian nations have heartiest appetite for U.S. MBS

Housing Wire

JUNE 10, 2022

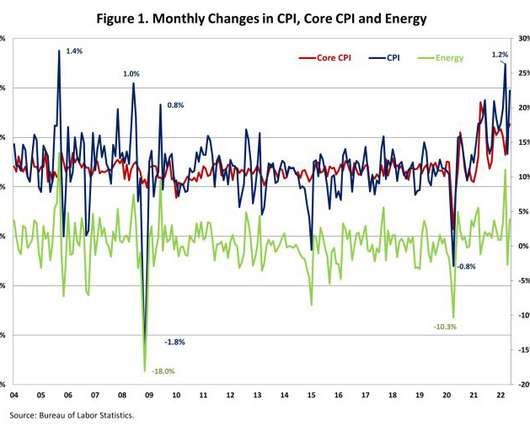

The Federal Reserve ’s (Fed) efforts to beat back inflation with its monetary tools have already shifted the winds in the secondary market for mortgage-backed securities (MBS). The Fed’s continuing effort to wind down its $2.7 trillion MBS portfolio helps fuel widening interest-rate spreads in the MBS market by creating additional MBS supply to be absorbed by investors.

Let's personalize your content