Are we in a buyer’s market? Some data seems to indicate that is the direction we are headed but, hold on, we have more evidence that argues otherwise.

Sure, the higher-priced areas of King County – Medina (where this month’s main photo was taken) and Hunts Point – are clearly showing buyer-friendly conditions. These areas have 5-plus months of homes on the market today, signaling a buyer’s market. These neighborhoods – where median single-family homes are priced well above S3M – should naturally be the first locales to show slower activity amid a shrinking buyer pool.

We are also seeing glimmers of buyer-favorable submarkets in downtown Seattle, Belltown and SODO/Beacon Hill, where monthly inventories for all home types combined are in the range of 2.6-4.2 months, better conditions for buyers than earlier in the year when all areas were in a seller’s market below 2 months’ inventory. King County overall has 1.7 months’ inventory, or about 50 days to exhaust existing supply if nothing else came on the market, indicating a solid seller’s market.

“Our weekly data suggests that the U.S. housing market keeps progressing toward a more balanced market,” notes realtor.com economist Jiayi Xu. The data for King County, while more favorable for buyers than since the start of the pandemic, remain less convincing.

Housing supply is one data point, but the demand side of the scale is still influencing the market. It’s too soon to describe King County as a “buyer’s market” amid an active pool of buyers. Plus, prospective buyers who have watched rents jump in the past year make owning a financially attractive option.

Remember, too, unlike expansive areas of land in Phoenix or Las Vegas, Seattle, Bellevue and other urban areas here are geographically constrained from building out. In addition, our Growth Management Act limits suburban sprawl and maintains strict laws against building near environmentally sensitive areas. These factors pressure the supply/demand equation and generally keep prices higher than in other big western cities.

To be sure, the glory days for home sellers of offers over the asking price and without contingencies are gone. We can point to two key factors that have been rising most of the year – inflation and mortgage interest rates – for the housing cooldown.

Realtor.com estimates that a buyer looking to purchase a median-priced home in the U.S. today would pay about 60% more in the monthly mortgage outlay than a year ago. At least the price of gas, eggs and lumber have fallen this year.

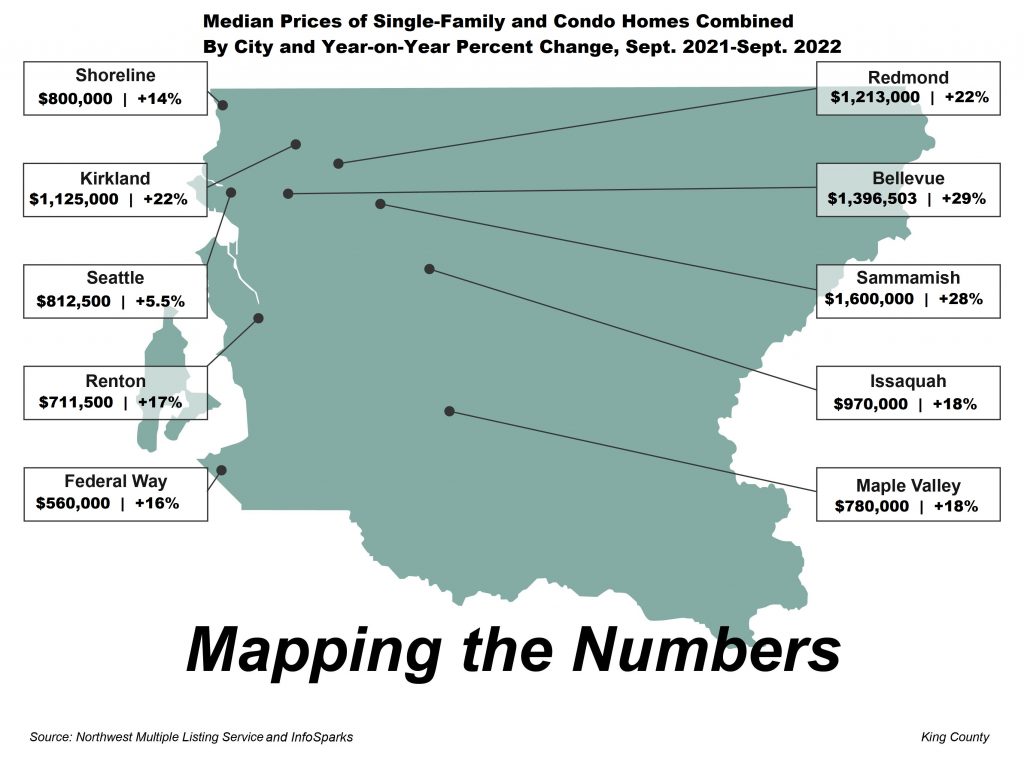

Inflation and interest rates have helped apply the brakes on a rather-speeding (dare I say out-of-control) market that saw median single-family-home prices jump 41%, or $355K, between March 2020 and March 2022 in King County and 62%, or $737K, on the Eastside. Seattle single-family prices “only” rose 31% in that time. Now prices have fallen three consecutive months by a cumulative 10% on the Eastside and 7.3% in Seattle. Single-family prices across the county are down 4.1% in those three months despite rising 1.1% in August, thanks to an anomaly in North King where prices jumped 4.6% for the month.

“The month-over-month decline suggests further deceleration on the horizon,” said Selma Hepp, an economist with real estate data firm CoreLogic. “The higher cost of homeownership has clearly eroded affordability, as inflation-adjusted monthly mortgage expenses are now even higher than they were at their former peak in 2006.”

The key for buyers is not to focus on the interest rate but the monthly payment, and mortgage holders can always refinance later if the rate “feels” high. There is an industry saying: “You marry the house and date the rate.”

Where is the housing market headed in 2023?

A survey of economists working with Fannie Mae suggests we are at the mortgage rate peak and should expect a slow decline through 2023 to about 4.4% this time next year. Fannie Mae also forecasts inflation will tick down gradually to 7.2% by the start of 2023 and 1.8% by the end of next year. The survey was conducted just before Federal Reserve Chairman Jerome Powell issued a warning about more “pain” to come for consumers.

Moody’s Analytics recently released a forecast in which the firm predicts U.S. home prices will remain flat in 2023, a dramatic drop from the 20% national price increase we saw over the past 12 months or so and a far cry from the 18% price-growth forecast issued by Zillow in March for the period ending next February (oops!). In our area, Moody’s believes median prices will decline at least 5% in the 12 months ending Q4 of next year and possibly another 2%-3% in 2024.

While I’m not sure I would agree with those bearish sentiments for our area, buyers will certainly welcome the price relief – whenever and wherever it occurs – and likely scoop up enough homes to maintain a slightly more level field for months to come.

STUFFING YOUR STUFF

If you have more years in the rear-view mirror of life than miles ahead like me, then you may recall the great comedian George Carlin and his bit on “stuff” – 5 minutes’ worth of classic viewing (NSFW).

Then and arguably more so now, we are living with more stuff in our homes. It has gotten so bad (my word, not yours) that the car is taking a proverbial backseat to personal possessions. A survey this year of California single-family homeowners showed 37% have so much stuff in their garage that there is no room for the item the space was designed for – the car. The figure is as high as 49% in the Mission District of San Francisco.

I am sure many of you can relate.

Thank goodness for driveways, excess yard space and nearby streets to park your four-wheeled vehicle. Putting your extra fridge, sofa or golf clubs outside wouldn’t please the neighbors – but the car is okay.

And what happens when your stuff takes up too much garage space? It’s shifted into another stuff holder – storage space.

I don’t know about you, but maybe Carlin wants us to re-evaluate all of our stuff and decide whether some of it – you know, the 1990s tableware, outdated electronics or beat-up luggage – is really the other “s” word and has to go!

ALL OF THE ABOVE … AND THEN SOME

Why is it so hard to build a house in America? There are several reasons, many of which we have covered here in this newsletter: strict zoning laws, the high price of land, NIMYB-ism and rising construction costs to name a few. The answer is like marking “E” on a multiple-choice question – All of the Above.

Housing should always be an opportunity, not an obstacle. And yet, we are seeing more reasons than fewer facing our nation’s for-sale housing shortage. The latest phenomenon is an increasing number of institutional investors playing in the residential real estate arena.

At issue, investors are buying homes with the purpose to rent them. Or, they are investing in the single-family market to construct for-rent, instead of for-sale, homes. More than a third of U.S. rentals are single-family homes and the sector is only expected to grow. Some 14,000 build-to-rent homes are under construction across the U.S., according to property investment research firm Yardi Matrix, more than double the number of completed build-to-rent homes in 2021.

Want to build the whole thing yourself? Good luck finding skilled workers to attach the sticks and bricks. The construction sector hasn’t hired enough people to keep up with demand since the Great Recession pushed some developers out of business and about 60% of the workforce to find work elsewhere or at least wait for the industry to rebound. Workers – many immigrant laborers – moved to heavy-industry positions that pay better than pounding nails into 2 x 4s.

The housing collapse of 2008-2010 wiped out many specialists. Since 2006 in California, the number of rebar workers has declined 52% and there are 30% fewer carpenters on the job.

The combination of deep-pocketed investors and a smaller pool of workers is putting a tighter squeeze on buyers seeking to get into a new home.

BY THE NUMBERS

>> Seattle is among the best cities to raise a family, according to a study from WalletHub, which used 46 metrics – from housing affordability, quality of schools, vaccination rates and more – to develop their research. Our region was seventh in the nation behind the likes of Fremont, Calif., and Overland Park, Kan. Detroit was last at 182nd.

>> Washington’s real estate industry accounted for $108.3B, or 16%, of the gross state product in 2021, according to data from the National Association of Realtors®. New home construction was 53% of that total.

>> International buyers purchased $59B worth of U.S. residential properties from April of last year to this March, up 8.5% year on year. In its annual report, the National Association of Realtors® said 98,600 existing homes were sold, the lowest since NAR began tracking this stat in 2009. China, Canada and India were the top countries of origin by U.S. sales dollar volume. Florida, California and Texas were the leading beneficiaries of the foreign purchases.

>> Homeowners who sold in Q2 owned their homes an average of 5.9 years, down from 6.3 years just 12 months ago, according to ATTOM Data Solutions. The decline to just under 6 years is the second-shortest length of ownership since records were kept and was led by sharp declines in Lakeland, Fla. (down 61% year on year), Salem, Ore. (down 51%) and Yakima (down 24%). The longest tenure among U.S. cities is right here in Bellingham (9.6 years), followed by Manchester, NH (9.1).

>> ATTOM also reported that nearly half of all homeowners are now considered “equity rich,” meaning the combined estimated amount of loan balances secured by those properties was no more than 50% of their estimated market values at the end of Q2. The 48% of U.S. owners that are now equity rich is a jump from 45% in Q1 and 34% a year ago. Washington, at 63%, ranks fifth among states for equity-rich homeowners, with Vermont leading the pack (71%) followed by Idaho (70%), according to the report.

>> A minimum-wage worker in King and Snohomish counties would need to work 92 hours a week to afford a typical one-bedroom apartment. The figure is about 70 hours across the state. The figures come from the National Low Income Housing Coalition. For context, the average renter in Seattle earns a hefty $36/hour, while the city’s minimum wage is $17.27.

>> Seattle ranks near the bottom, 211 out of 240, among affordable places to live in the U.S., according to Q2 data from the National Association of Home Builders. Only 18% of homes sold in our area – which also includes Bellevue and Kent – were deemed affordable for a person earning the median income of $130,300. The association reported a median sales price of $805K. Los Angeles (3.6% of homes sold) was the least affordable market, while Elmira, NY (92%), was the most affordable place to live based on home sales and median incomes.

SEPTEMBER HOUSING UPDATE

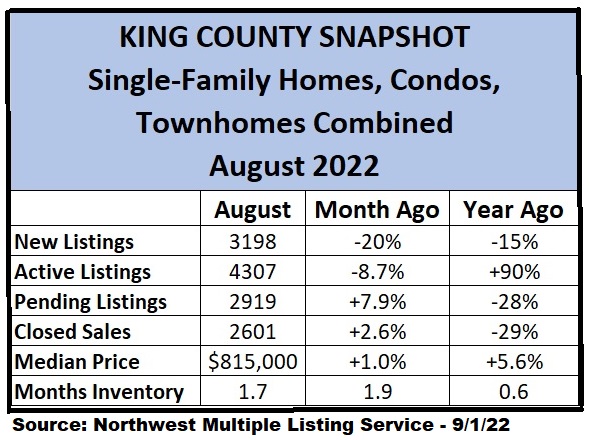

Following a July when the number of active listings jumped by 12% in a month, August experienced a summer slowdown in overall activity including an 8.7% monthly decline in listings available today. The mood of the market is mostly wait-and-see for buyers watching inflation and mortgage-rate trends.

Home prices were mostly lower from July to August but remain higher year-on-year. And, somewhat surprisingly, inventory figures dropped as fewer new listings hit the market while owners chose vacation time over selling time.

Until August’s 8.7% decline in Active listings, the county experienced seven consecutive monthly increases in homes available for buyers. The end to the streak is more of a deceleration of the market as we head toward a seasonal slowdown.

While Active listings were 90% above last year’s figure for August, they were still down 17% compared to pre-Covid levels in August 2019 and off 22% from August 2018.

After steadily climbing to the 2022 peak of $880,000 in both April and May, median prices across the county for all home types have slowly slipped to $815,000, down a significant 7.4% from only three months ago.

Pulling out single-family-home figures, new listings were down 22% (2466) for the month, led by a 31% decline (93) in North King County and 30% lower (681) on the Eastside. Active listings for sale as of Sept. 1 were off 9.6% (3328) in King but 124% higher YoY, with the Eastside market having 15% (1022) fewer listings since July but 268% more YoY.

Single-family pending (2270) and closed (2039) sales were up 8.2% and 4.5%, respectively, across the county – improving month-to-month activity despite economic headwinds. The figures are down about 28% YoY in both categories.

Median prices for single-family residences offered a mixed bag, down 3.6% ($599,950) in Southwest King County, 3.5% ($695,000) in Southeast King and off 4.9% ($1,350,000) on the Eastside – but prices were up 1.1% ($899,999) across the entire county since July. Median prices for single-family homes in King were 5.9% higher YoY, far lower than the double-digit increases we saw in the past two years. Seattle single-family prices were off 2.9% ($927,000) since July but up 5.9% YoY.

“Demand has fallen off, and supply has increased. Economics 101 says prices have to decelerate, and that’s what we’re seeing today,” says Devyn Bachman, senior vice president of research at John Burns Real Estate Consulting. “It’s the polar opposite of what we’ve seen over the last few years.”

The average length of time a home sits on the market waiting for a seller and buyer to reach mutual acceptance stands at 21 days, nearly a week longer than the 15-day average from a year ago, for all homes listed in King County. The figure was only 9 days in April of this year.

Total for-sale inventory reversed course after climbing in July. It slipped to 1.6 months in the county, down from 1.9 a month ago, and fell in key areas, including Seattle (1.4, down from 1.5 in July), the Eastside (1.8, down sharply from 2.5) and Southeast King (1.8 from 1.9).

As for condos across the county, median prices dropped for the month, off 1.0% ($485,000) overall, down 4.4% ($619,000) in downtown Seattle and 3.2% ($520,000) across the entire city. North King, however, experienced a 67% ($830,000) median price increase from July on 25 sales; the doubling of price from a year ago was primarily caused by eight sales at a new high-end condo community in Shoreline, The Towns on 145th. Inventory for the county stood at 1.7 months, down slightly from July, and was lower in Seattle (2.4 months) and the Eastside (1.6).

In addition to King County’s 1.0% median price month-to-month increase on all home types, to $815,000, Snohomish County saw the sharpest change – a drop of 5.1% from July to August ($700,000). Pierce median prices fell 2.7% since July ($550,000) while Kitsap saw a 2.3% monthly increase ($435,000). Single-family home prices in King added 1.0% in a month ($899,999) and Kitsap prices rose 2.2% ($550,000), however prices dropped since July in Snohomish (down 2.6% to $749,999) and Pierce (3.5% to $555,000). Year-to-year, single-family median prices are higher but in the single digits now, led by Kitsap up 9.2%, Snohomish up 7.9%, Pierce up 7.8% and King up 5.9%.

Condo prices are now showing a YoY decline in Kitsap (9.3%) and Snohomish (5.0%) counties, while Pierce has experienced an extraordinary 16% rise since August 2021 and King is up 5.9% for the year, with about 6-8 weeks of available inventory across the region.

Looking for a bargain? Median prices for all home types in Ferry County, Northeast Washington, are down 41% YoY to $172,450. Prices are also down for the year in Pacific (15%) and Grays Harbor (1.3%) counties.

Click here for the full monthly report.

CONDO NEWS

You can count on one hand the number of high-profile condo projects under construction in our area. Only one major opening is expected over the next 18 months – Graystone on First Hill. It’s not until late 2024 that Seattle’s next ultra-luxury project will open.

It’s called First Light, at the corner of 3rd Avenue and Virginia Street across the street from the back entrance to the old Bed, Bath and Beyond. Like most construction projects, this one faced strong headwinds – pandemic slowdown, supply-chain delays, concrete workers strike, rising costs – but it has moved into high gear and appears to be about one-fifth of the way finished.

The 47-story, 459-unit community will feature some of the most incredible amenities one could imagine. The top floors will feature a fitness [aka wellness] center, residents’ lounge, spa tub and fire pit, along with meeting space, screening lounge, bike clubhouse [for storage and repairs] and apple orchard on the lower floors. The icing on the cake will be the heated cantilevered rooftop pool, believed to be the only of its kind for a U.S. residential tower – and certainly the highest at about 480 feet into the sky.

Vancouver, B.C.-based Westbank is shepherding the project. It reports 70% of the residences are taken, leaving studios and 2-bedroom units with views as the most popular options still available. All 1-bed units are sold. Prices are not for the faint of heart – very roughly $1700/sq. ft. after double-digit price increases since 2021 to address rising construction costs. HOA dues average about 91 cents a month per sq. ft. Parking is $130K extra and $135K for a spot with electric charging capability. Storage units are another $9.8K each.

Target opening is now planned for the fall of 2024 but the opportunity to buy at today’s prices makes this place one to consider when wishing to live in ultra-luxury within Seattle’s urban core. Contact me if you’re interested in learning more.

LUXURY LIVING

This month is all about big-ticket properties that hit the market in recent weeks – and there are many jaw-dropping new listings.

Let’s start with a Lake Washington waterfront property on immaculately landscaped grounds in Leschi. It’s a 3-bedroom, 4.5-bath, 3632 sq. ft., 1-story home (with basement). Built in 1948, the home was fully renovated last year and includes a breathtaking open-plan main floor with walls of windows that feature amazing vistas. The outdoor pool with cabana will help residents and friends beat the heat in the summer. List price: $10.5M ($2891/sq. ft.).

Many homes in Bellevue are some of the most beautiful in the country, like this 7-bed, 7.75-bath, 10,270 sq. ft. multi-level masterpiece. What makes it so special? Start with its one-of-a-kind contemporary architecture with striking two-story entry, then enjoy the waterfall-edge-stone countertops, butler’s pantry with prep kitchen, stunning covered outdoor entertaining space with Cascade Mountain views, game room with bar, theater, outdoor sports court and six-vehicle garage. Museum-level artistic elegance. The $1000 annual HOA dues include the use of a community pool and tennis courts. List: $11M ($1071/sq. ft.)

Climbing the price ladder, we introduce a 5-bed, 6-bath, 14,314 sq. ft., 2-story (with basement), pre-construction home on 1+ acres along Newport Shores, Bellevue. The home includes an accessory dwelling unit on the lower floor for guests, an infinity pool with spa tub and cabana, 175 feet of waterfront and access to Newport Shores Yacht Club. An epic location. HOA dues are an estimated $1200 a year. Target completion of project: autumn 2023 (TBC). List: $17.775M ($1242/sq. ft.)

Looking for something a little more traditional (and pricier)? Capping this month’s luxury listings is a 5-bed, 6.25-bath, 8562 sq. ft., 2-story (with basement) home in the Laurelhurst neighborhood of Seattle. The 2017-built estate harkens to days gone by of stately homes on the Monterey Peninsula or Martha’s Vineyard – tastefully designed with mature landscaping and elegant interiors. Instead, this home sits on 140 feet of Union Bay waterfront with dock, boathouse and private beach. Coffered ceilings adorn the living and dining spaces. The kitchen with multiple ovens and built-in, center-island cutting board would pass the test of Julia Child. The top floors include double-height ceilings and room for games, TV and relaxation. This is a special home (with 5 fireplaces and 3 fire pits!) that in times past would easily be passed through the family for generations. List: $18.7M ($2184/sq. ft.) … and property taxes of about $130K a year.

For the record, the highest-priced listing on the market today is an $85M estate on Hunts Point – which we reported on in the May newsletter. And don’t forget, the Wilsons – Russell and Ciara – have a stunning waterfront property for sale in Bellevue listed at $26M after a recent $2M price drop.

What else is happening in and around your Seattle?

Polish Festival, Sept. 24

I love dumplings and anything that resembles them. That’s why the Pierogi Fest is a prime event for me. Pierogis deliver savory delights wrapped in a blanket of dough. They are a must-have at the fest, along with potato pancakes, Polish beer and much more. Enjoy the food, crafts, kids’ activities and folk music. It all takes place at the Polish Cultural Center, 1714 18th Avenue, south Capitol Hill. 12-4pm

LEGO Exhibit, Oct. 1-2

Thousands of LEGO models are on display at the BrickCon Public Exhibition in Seattle Center Exhibition Hall, 301 Mercer Street. Saturday and Sunday, 10am-4pm

Seattle Mariners, October Baseball!

Mark it down: Oct. 7. That’s the scheduled date for the first postseason baseball games in 2022 – and hopefully the day the Mariners end their 20-season playoff drought, the longest in U.S. professional sports. Julio, J.P., Ty and the boys need to finish off the regular season in winning style to reach the postseason. That includes closing out the campaign at home against the Detroit Tigers, Oct. 3-5. Tickets.

Documentary Festival, Oct. 6-13

I enjoy a good documentary. That’s why you’ll likely see me attending DocFest. The non-fiction film festival covers politics, music and social issues. Catch it at SIFF Cinema Egyptian, 805 East Pine St. Tickets.

Pet Parade, Oct. 8

Pet owner? Love a parade? Here’s your chance to blend the two! The Halloween Pet Parade features your four-legged friends in costume at Volunteer Park, 1247 15th Ave. E. in north Capitol Hill. There are six judging categories to win prizes, plus vendor booths and food trucks. Sounds like fun – and it’s free to attend! 11am-2pm

Kraken Home Opener, Oct. 15

It’s time for Season 2 of Seattle Kraken hockey, baby! The team added new talent to the roster and is ready to rock and roll for a chance to reach the Stanley Cup playoffs next spring. The newest NHL franchise starts its second campaign with a two-game California road trip before hitting the ice at Climate Pledge Arena on the 15th against the Las Vegas Golden Knights. 7pm. Tickets.

Halloween on a Farm, Oct. 15-31

Can you believe we’re already talking about pumpkins, hayrides and corn mazes?! It’s that time of year for all things Halloween. Have a look for an event near you.

Seattle Arts & Lectures, Oct. 26, 30

Here’s an early heads-up: One week in late October, the Seattle lecture series will welcome two highly accomplished writers to the stage. John Irving, author of Cider House Rules and newly released The Last Chairlift, will discuss his many works. Four days later, Pulitzer Prize-winning biographer Jon Meacham will share treasured memories of his time within the D.C. Beltway, as well as talk about his new book And There Was Light. Both events take place online and live at Town Hall Seattle. Tickets.

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

Parks have profound health, environmental and social benefits for residents. I enjoy visiting the many greenspaces across Seattle … so much so that I wrote a blog post that features five of my favorites.

I am often asked how much specific home projects cost. That’s a difficult question to answer without researching to find out expenditures related to availability – both materials and labor – and the timing of the project. You know me, I’m always up for taking a stab at these questions.

In other stories recently published to my Living the Dream blog, we covered the potential for delays in closing a sale based on issues with the title, offered tips and insights when living in a home that uses propane, and examined home options along the new Link light rail stations north of Seattle.

Thanks for reading!

Will