5 steps to choosing a home that will appreciate

Housing Wire

JULY 30, 2021

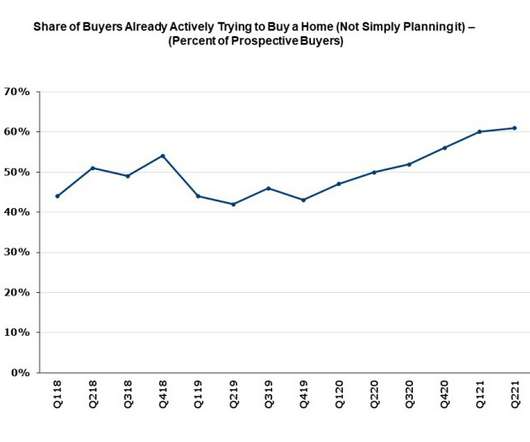

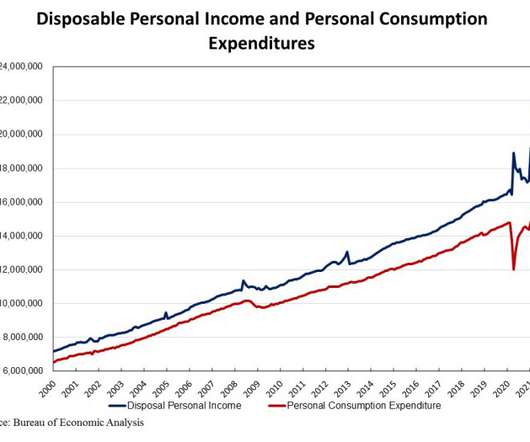

In 2020, the S&P CoreLogic Case-Shiller price index reported the highest annual housing growth since 2013. Due to low inventory, sellers are able to put their homes up at a higher rate. And with today’s low interest rates, buyers have been rushing to purchase what’s available. The problem is, rushing to buy property might force you to settle for a house that won’t reward you financially.

Let's personalize your content