The Tide is Turning- July Newsletter

Here in Texas, we are dealing with a heat wave and drought, reminiscent of the 1980 heat wave. Our power grid and ERCOT (the power grid regulating entity) have been challenged and I found myself checking their real-time grid that tracks the supply and demand of power. As appraisers, we are finding ways to stay cool while working in this heat. The heat can be dangerous and unbearable at times, making me appreciate the works of William Carrier!

The temperatures may be hot but our markets are starting to cool. The tide is turning. The housing markets have been experiencing extremely high rates of price appreciation as home prices are up in our markets by 17-29% from the same time last year. How can I say the markets are cooling if the prices are still up? Well, the signs of a cooling market are not just the prices. Real estate doesn’t move or change as rapidly as other markets, such as the stock market. The prices that we are seeing for June are really reflective of what was happening when those sales went under contract about 30 days earlier. So, we look at not just the sales prices but the supply of homes, the number of days on the market, volume, and if the homes are still selling over or under the list price

A rise in mortgage rates has certainly, slowed down the frenzied market. The current average 30 year fixed rate is 5.51% per Freddie Mac.

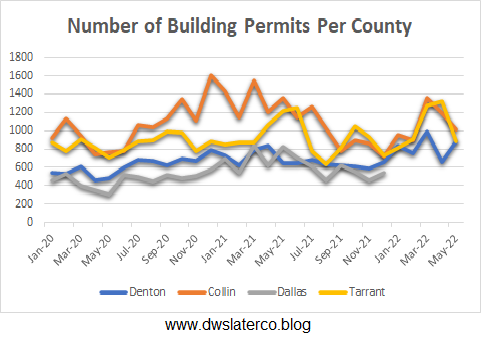

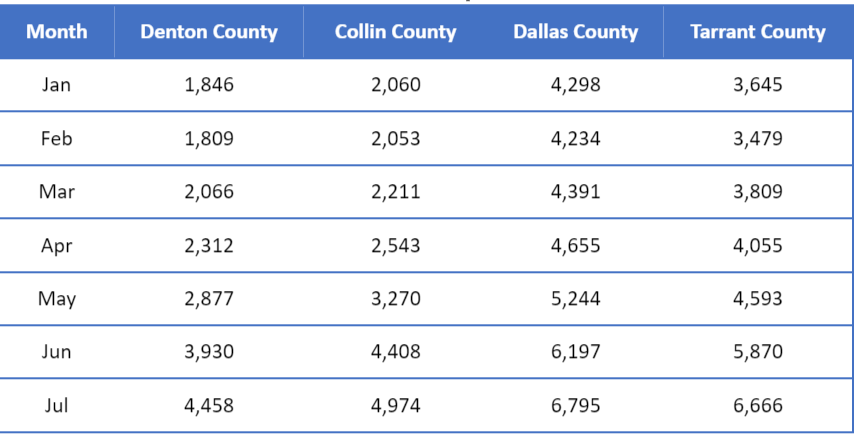

The supply has been extremely low for the last few years causing the rapid price inflation in housing. Builders have not been able to keep up with demand. Here is a look at the latest most update builder permit numbers in our four counties. This data is from the Texas Real Estate Center.

We’ve been watching our markets and seeing signs of a slowdown but this past month the signs are getting stronger. We are not seeing a crash. We are not going off a cliff, just a turn of the tide. Our four counties show prices are up from the same time last year but they are down from the previous month. Supply is up 90-100% from the same time last year in Denton & Collin Counties. The percent over list price has declined in all four counties, meaning that the bidding wars are subsiding. Sale volume is down from the previous year. Here is a look at the numbers for our local markets.

Median Sales Price

Supply

Days on Market

Percent of Original Price

Volume

More Signs of Slowing- A Peek at July Data

All of these charts are from the June data. Here is a glimpse into what is currently happening in July. You can clearly see that inventory is increasing as the number of active listings is growing and we are not finished with July.

Clearly the market is shifting more toward a balance. We will continue to watch how mortgage rates, the economy, inflation, and governmental policies will impact real estate in North Texas. Stay tuned for next month’s newsletter!

Appraiser’s Corner

Check out this month’s information just for real estate appraisers. If you have information that you think would be good here, please let us know

Read 📖

- 8 Signs of an Increasing or Declining Real Estate Market Trend– McKissock

- Top Questions Appraisers Have About the New Desktop Appraisal Rules- John Dingeman, Working RE

- In Pursuit of Affordable Housing: The Migration of Homebuyers within the U.S.—Before and After the Pandemic- Freddie Mac

- Where Does Water Frontage End?-McKissocK

- 1004MC or 1004 ANSI? – George Dell

- All Risk, No Reward? For Appraisers, a Question Worth Asking– Appraisal Buzz

- What is a Valuation Model?– George Dell

- Charted:4 Decades of Inflation– Visual Capitalist

- Love What You Do, Do What You Love– The Appraiser Coach

- Indemnification Clauses: What Appraisers Should Know– Working RE

- With home sales down, why are home prices still up?– Housing Wire

- 2022-23 Top Ten Issues Affecting Real Estate– CRE

- Lawn Chair Precision Shows Us Folding Chair Sanity In A La-Z-Boy Housing World-Housing Notes

- Is the housing market getting back to normal?– Sacramento Appraisal Blog

- Is A Cubicasa Scan an Inspection?– Cleveland Appraisal Blog

- 6 Reasons Your Home May Not Appraise In Today’s Market– Birmingham Appraisal Blog

Watch 📺

- Live Webinar: Appraisal Board Complaints and What Every Appraiser Should Know (Non-Credit)– McKissock

- Staying Relevant in the Appraisal Industry – Appraisal Buzz

- Tips for Reducing Revision Requests That Top-Performing Appraisers Swear By– Clear Capital

- Avoiding Discrimination Claims and Protecting your Business– OREP

- Are You Ready for a Wild Real Estate Market This Fall?– Altos Research

- The Floor Plan Court Case – What You Need to Know– Appraisal Buzz

Listen 🎧

- Recession Proof Your Business- Part 1– The Real Value Podcast

- Recession Proof Your Business- Part 2 -The Real Value Podcast

- What You Need to Worry About Now in Real Estate Appraisal…and What You Don’t-The Appraiser’s Advocate

- Information for Old, New, and Aspiring Appraisers– The Appraisal Update

- How To Predict the Future of the Housing Market– Top of Mind

- Jonathan Miller on Urban Real Estate– Masters in Business/Bloomberg

As always, we will continue to watch our local markets as well as what is going on nationally. We will be watching the impact of rising rates, inflation and supply chain issues. If you have thoughts, comments or questions let us know. If you need appraisal services please contact us at www.dwslaterco.com. Want this monthly newsletter?

Nice job as always Shannon. It’s hard to stay cool in this weather! Fortunately, we’re close to both the mountains and the ocean so we can plan weekend escapes.

Thanks! I actually created this newsletter almost 2 weeks ago but Mailchimp was having trouble with the RSS feed and it just now sent!

I wish we had mountains nearby to cool off!

Great info. Shannon! Sounds similar to what is happening in the Birmingham market. Looking forward to fall and cooler temperatures.

Thanks Tom! This weather is grueling. We’re not predicted to get out of the triple digits until September! I think next month’s housing numbers will be interesting.

Nice job as always. You are on top of trends and reporting the facts. On a related note, I really hope to see the drought change. It’s basically all my kids have ever known in California. Sigh.

Thanks, Ryan! Yes, the drought has really taken its toll here and elsewhere. It’s always disheartening when some places need rain and others, like in Kentucky, are getting too much.

checking