The Fed admits the economy is slowing

Housing Wire

JULY 27, 2022

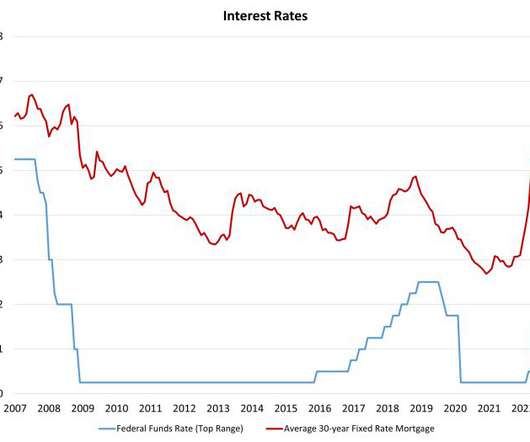

The Federal Reserve hiked rates 0.75% on Wednesday, which was mostly expected by market participants before the announcement. The question is, will the Fed keep aggressively hiking rates if the economic data worsens? I say this because I’ve raised all but one of my six recession red flags. I need to wait for one more report to officially raise the last flag, but it is certain to happen in August.

Let's personalize your content