For 34 consecutive months ending in March, buyers enjoyed mortgage interest rates of 4.0% or lower – as low as 2.77%, according to Freddie Mac. Sellers, meantime, could put nearly any home on the market and expect a reaction of irrational exuberance from financially sound consumers submitting high-priced offers without buyer-favorable contingencies.

That real estate party of unquenchable buyer demand against a backdrop of low inventory is over. Popping sounds can be heard from party balloons, one by one.

In its place, rising everything – home prices, mortgage rates and inflation (Why are eggs so expensive? Are hens sending their chicks to college?!). Only recently have we seen an easing of these key indicators (except for those darn eggs!).

Housing demand significantly cooled, first in U.S. markets more dependent on the multi-billion-dollar tech industry. What followed was a consumer public unwilling – or unable – to qualify for mortgages with interest rates more than double from the start of the year.

That is the scene following a wild and highly unexpected residential real estate year. What’s next?

Welcome to our fifth annual look at predictions and projections in real estate for Seattle/King County and beyond.

The bloom came off the financial rose in 2022, leaving behind thorny issues as we enter an uneasy new year for residential real estate across Puget Sound. An economic slowdown is well underway and the greatest risk to the region is whether the potential for rising unemployment and lower available household income caused by higher inflation will impact the demand from consumers seeking homes and other pricier goods.

This year’s steep rise in mortgage rates – and monthly borrowing costs – put a major dent in the hopes and dreams of lower- and middle-income buyers. By all measures, our region (and the rest of the country for that matter) experienced one of the worst six months (June-November) any housing market has seen in at least a decade.

Realtor.com estimates that a person looking to purchase a median-priced home in the U.S. today would pay 28% more in monthly payments than a year ago. John Burns Real Estate Consulting calculated that the number of U.S. households that could afford a modest $400,000 mortgage – about the amount required to purchase a median-priced home in the U.S. with a 5% down payment – dropped by 16.5M in the first half of 2022. One can surmise the situation has only gotten worse for consumers.

Yes, the great housing market reset is in full swing.

Interest rates are generally offered today in a range of 6.5%-7.0% (no discount points) and have moved in a narrow range for more than a month (as of early December). They are off their yearly high of about 7.375% in our area but significantly above the 3.11% mark on Jan. 1, causing the sharpest year-to-date increase in more than 50 years. For context, the average U.S. mortgage rate over the last 50 years ending December 2021 was 7.8%, peaking in 1981 at 16.6%.

The ability (or inability) of the Federal Reserve to tame inflation – at 7.1% year over year (YoY) through November nationally (and falling since July) and 8.9% in King and Pierce counties combined through October – is the key to both interest rates and consumer confidence. As inflation moves lower, rates will follow and confidence will increase (at least historically).

Most forecasts call for the rate of inflation (based on data from the Consumer Price Index) to be about 3%-4% by this time next year. The Fed has a 2.0% target for inflation, which soared to levels this year not seen since the early 1980s, so we have a long way to go.

Fed Chairman Jerome Powell and his fellow board members have noted in recent weeks the need for continuing hikes in the rate charged between banks to help curb inflation. So far this year, the central bank has raised these short-term rates six times totaling 3.75 percentage points. (Editor’s Note: The Fed board announced a seventh rate increase – of 0.50 percent – on Dec. 14, after the publication of this blog post.)

While it doesn’t set mortgage rates, the Fed does control the overall borrowing environment and Americans will feel the pinch on credit card interest, home equity lines of credit and auto loans. (My blog post on how mortgage rates are set is a good side topic.)

The Fed’s actions this year also soured the stock market, dealing a harsh blow to people with 401(k) investments. This includes potential buyers wishing to use some of their nest egg – including vested stock shares – toward a home down payment.

Most housing experts believe consumers will return to home buying when the conditions are right for them. They feel the marketplace should rebound when rates start with a “5” – but there is no certainty when that may happen. Mathew Gardner, an economist with Windermere, believes it may occur as early as the fall.

The National Association of Realtors® agrees, with a mortgage-rate forecast of 5.7% in 12 months’ time. Realtor.com is bearish with its mortgage forecast. It believes rates will rise to about 7.4% early in 2023 and drop to 7.1% by the end of the year.

“The housing market is expected to face continued uncertainty heading into 2023 as consumers, financial markets, and policymakers work through their respective challenges in today’s economy,” said Ali Wolf, chief economist for real estate research firm Zonda. “We are watching for any additional stability in the [mortgage] market, signs of cooling inflation and/or less aggressive Federal Reserve action to give us confidence that mortgage rates are past their peak.”

Questions to ponder as we enter the new year include…

(Click on the Question to jump to our assessment.)

Will we have a recession?

The answer depends on who you ask but most experts believe a recession is almost unavoidable. The Fed is determined to lower inflation through higher interest rates, which in turn historically leads to a recession.

The war in Ukraine and continued geopolitical uncertainty in China, Taiwan and who knows where else in 2023 add significant headwinds to the global economy. Despite severe energy challenges in many parts of the world, U.S. fuel prices continue to decline.

The cost of energy when supply is impacted – from war, natural disasters or production issues – will be one of the keys to the speed of an economic rebound in the U.S. Fuel to fill our vehicle gas tanks and to transport goods weigh heavily on inflation; 18% of the Consumer Price Index is for transportation costs – the second largest component of the CPI after housing/shelter (42%). At least for now, economic forecasters say prices at the pump in Seattle metro are expected to continue their decline, likely until Q2.

Housing is a significant “X” factor. This CPI component includes the cost of rent and lodging outside of a home – which soared this year amid rising operational expenses – and data show that America needs to get through the early part of 2023 before lagging YoY numbers come off the index, according to experts, which in turn will help lower the CPI. (In 1983, the government removed home prices from the CPI and replaced them with rent-cost data.)

Contributing to improving the mood should be the anticipated 900,000 or so two-unit-plus housing under construction across our country that will start to come online in 2023. Adding supply to satisfy demand will help lower rental inflation – but there is a long way to go.

Robert Dietz, the chief economist for the National Association of Home Builders, described today’s environment as a “housing recession.” In his estimate: “Homebuilding’s going to contract.”

Locally, permits for single- and multi-family home construction are down about 20% from this time last year. They are forecast to fall another 8% to an estimated 15,550 permits for King County in 2023.

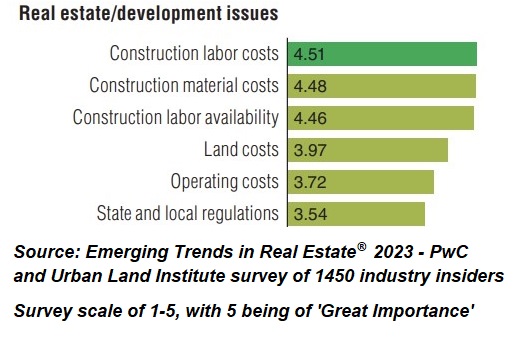

All this to say, the overall activity level of the housing market is slowing in Seattle metro, as noted by real estate consultants John Burns:

Dylan Simon, co-founder of the Seattle Multifamily Team at Kidder Mathews, predicts that although Seattle will not be immune to the recession, “we’ll weather it better than most other markets, and I expect we’ll come out of it sooner.” Simon spoke on a commercial real estate webinar hosted by Connect CRE.

If inflation eases in the coming months, the local economy should move through 2023 without significant economic difficulties. King County forecasters call for inflation to end 2022 at 8.9% and ease to 4.9% in 12 months.

Most economists expect any recession to be relatively short and shallow – certainly nothing like the Great Recession of 2008-2010. “Everyone is sort of on pause,” Katie Parsons, a Seattle-based managing director in valuations for commercial real estate firm JLL, told The Seattle Times.

Where are home prices headed?

Like all items sold on an open market, supply and demand generally dictate pricing. The number of homes for sale is not expected to rise significantly as many homeowners refinanced their mortgage loans during the Covid recession and have locked in historically low rates. There is little incentive for these households to move with mortgage rates far higher today – unless they must.

Affordability remains elusive. To be sure, factors are shifting in buyers’ favor: workers are receiving pay boosts above historical norms, mortgage rates appear more stable and home prices are softening. Sellers are even willing to negotiate on things like repairs, sharing in closing costs and paying down mortgage interest.

There are about two months of supply on the market today across the region. That’s better than a year ago but far from satisfactory for a healthy market. A balanced market in our region – in which buyers and sellers enjoy a natural rhythm of residential activity – is 2-4 months of supply, with anything above four months considered a buyer’s market. Housing supply will likely inch toward a balanced market in 2023 but remain tight.

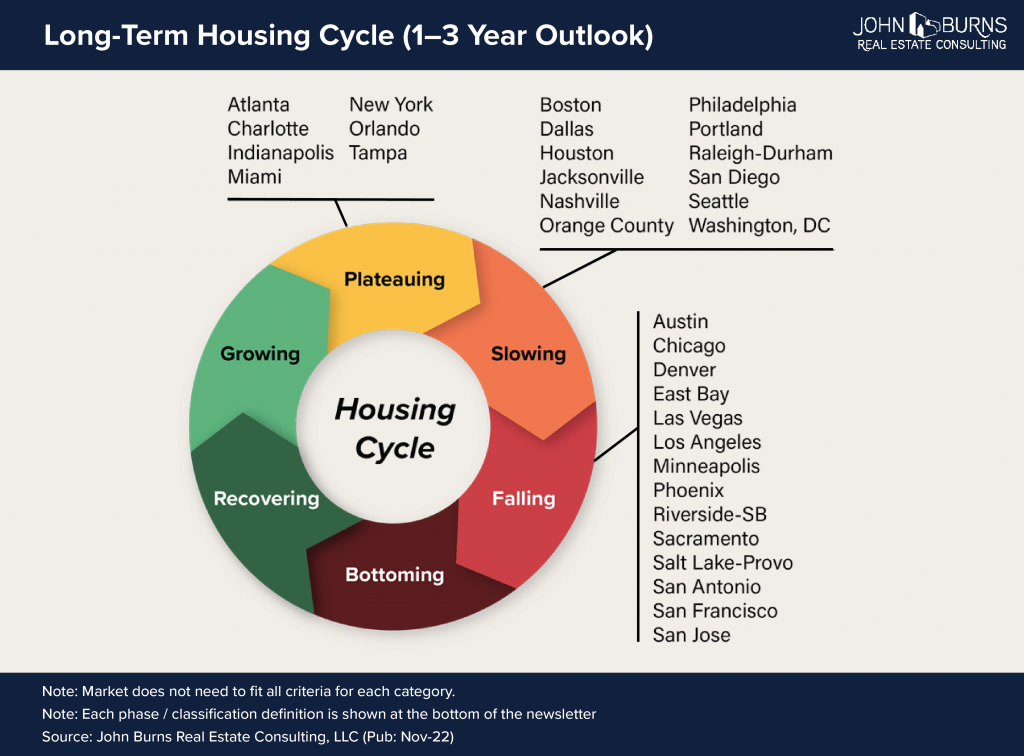

Median prices in King County peaked in April or May, depending on the sub-market. They tickled the $900K mark for all home types combined (single-family, townhome, condo) before settling north of $700K at the end of November. After notable monthly drops in June and July, prices have recently moved in $65K range countywide; prices tend to decline more sharply in the three months between November and January before they rebound for the next buying season.

In the best scenario, prices will continue the same course in 2023 or, in a worst case, decline 5%-10% amid sharply lower buyer demand. A new “pricing norm” will likely be established in the spring and play a bit of a waiting game for inflation to cool.

Some economists are bullish and predict YoY price drops of 15% or more. That is highly unlikely in our area unless inflation manifests or unemployment knocks out a broad swath of the workforce.

Home prices “don’t go down as quickly as they go up, usually,” said Steven Bourassa, chair of the University of Washington’s Runstad Department of Real Estate. “What happens is people just don’t sell,” he told The Seattle Times.

To be clear, we are not heading toward a housing market crash – not even close. Most experts define such an occurrence as one when home prices tumble across the wider market by 30% or more. A crash happens with oversupply.

Gardner, the local economist, says any price declines “won’t be enough” to make homes affordable for first-time buyers.

Forecasters expect “a dramatic decline in the number of homes sold and a modest decline in prices” for our area, Ben Noble, director of the Seattle Office of Economic and Revenue Forecast, told City Council in November. Average home prices will fall about 11% across King County, according to a forecast issued last month, and the number of homes sold could decline a sharp 13% (24,000 units). (The Northwest Multiple Listing Service [MLS] typically uses median prices when reporting its monthly data. Average prices can be skewed by ultra-luxury home sales.)

Across King, median prices for all home types slipped 1.4% in the 12 months ending in November while total sales dropped a hefty 46%. Prices for single-family homes were off less than 1% and sales tumbled 45% YoY.

Realtor.com groups King and Pierce counties when assessing the Seattle metro area. It believes prices will decline 6.8% across the region in 2023 on a sales decline of 10% YoY.

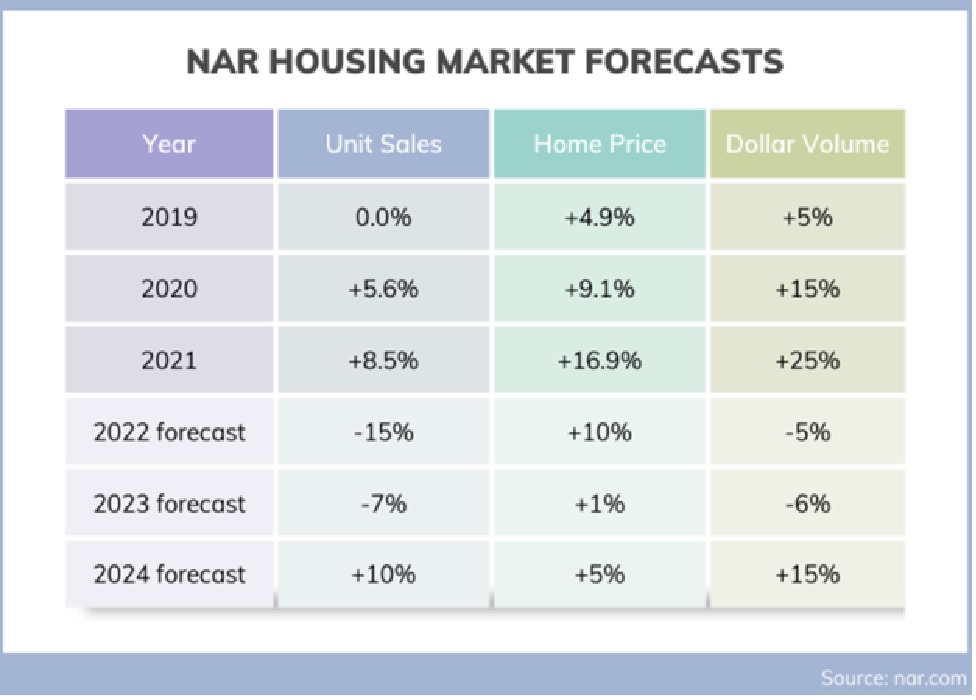

Nationally, the experts believe home sales will sink between 7% (National Association of Realtors®) and 14% (realtor.com) from 2022. Prices will rise between 1% (NAR) and 5.4% (realtor.com) YoY. (Figures are for resale homes only and not new construction.)

“Compared to the wild ride of the past two years, 2023 will be a slower-paced housing market, which means drastic shifts like price declines may not happen as quickly as some have anticipated,” said realtor.com chief economist Danielle Hale. “It will be a challenging year for both buyers and sellers, but an important one in setting the stage for home sales to return to a sustainable pace over the next two to three years.”

Realtor.com anticipates the market recalibration could last through 2025. In other words, we may have to say “wait till next year” for a little longer before starting to see better market conditions.

How will hiring freezes and job cuts impact home buying?

It’s safe to say that no other workforce drives our economy and helps set the temperature of our housing market more than the tech sector. When companies such as Microsoft, Meta, Convoy, Zillow and others announced (or were reported to include) job losses totaling about 12,500 people in October, the region started to pay attention.

Amazon followed by saying it would halt its aggressive hiring spree of many years – a workforce that exploded by more than 50% worldwide in 2020. About 10,000 of the company’s approximate 1.3M global workforce, less than 1%, will reportedly be axed in a process that should run well into 2023. The news weighs on housing activity – in a state where approximately 85,000 work for Amazon – but the degree it will impact the market will take many months to measure.

“Housing demand in tech-heavy metros is expected to be lower in the near-term,” Zonda’s Ali Wolf is quoted by The Hill as saying. “In some cases, prospective homebuyers will lack both the financial ability to purchase a home and the consumer confidence needed to go through with the purchase.”

Any job loss is painful to learn and can be devastating to those most impacted. Putting it into context, however, the number of job cuts so far has reportedly amounted to roughly 4% of the current tech workforce in Washington compared with losses in the dot-com crash at the turn of the century of about 11% in the sector.

Real estate-related businesses are also targeted for job cuts. Redfin and Compass both announced significant job losses and finance experts are forecasting up to 30% of the 1000 largest independent mortgage banks in the nation will disappear by the end of 2023 via mergers, acquisitions or closures.

While the cuts in tech and finance may appear notable, many signs show a continuing unmet demand for workers in a range of sectors. Job figures are still growing – the second-highest rate this decade in our region – while unemployment remains in check. Even with the largest workforce in King County history – 1.51M – unemployment is at a ridiculously low 3.0% (October).

U.S. unemployment is at 3.7% (November) with a forecast from the Fed for the rate to reach 4.4% this time next year – and some people aren’t waiting around to receive that pink slip (if one comes). About 20% of U.S. workers aged 25-54 reported actively applying for new positions in October, according to data-intel company Morning Consult.

In these uncertain times, the job numbers almost belie logic. There are about 10M openings across the U.S. and 6M unemployed Americans searching for work – or 1.7 available positions for each jobless person. That excludes approximately 3M people who stopped looking for work since the start of the pandemic. There are now more people in the U.S. workforce than before Covid – the strongest sign yet that the pandemic has lost its firm grip on our lives.

The latest report from King County (Q3, before layoffs) showed across-the-board hiring – from tech (up 11% YoY), to hospitality (up 15%) and construction (up 8.1%). With a minimum 285 cruise-ship sailings scheduled from Seattle ports in 2023 and more events at the expanding Seattle Convention Center (the Summit building opens in January), the need for more workers to support the leisure & hospitality industry is a priority for local commerce.

Unexpectedly, several companies have signaled plans to retain workers even as the economy slows. “It was just so difficult to attract them and retain them over the last few years,” Cleveland Federal Reserve Bank President Loretta Mester was quoted as saying in November. “That would be a good thing in the sense that the unemployment rate would not have to go up as much.”

The numbers tell economists that the growth of Gross Domestic Product nationally may fall back into negative territory in early 2023 before getting traction for the rest of the year. Locally, expect slower growth but nothing like a deep or long recession. The county forecasts GDP YoY growth of a modest 1.7% at the end of this year and 1.6% growth at the end of 2023.

Who is buying and where?

We all love a good bargain and it’s no different when shopping for a home. They’re just more difficult to find in our part of the country.

In sifting through mounds of data from the MLS, buyers are attracted to many great areas of King County. A few that stand out include:

West Seattle – Now that the bridge has reopened, we can expect to see a modest increase in activity. Median prices on all homes have settled at $762K, up 12% YoY, after hovering around $800K for several months. Sales are down 43% from November 2021, a figure that looks ominous but is better than many other sub-markets. Homes are sitting on the market for a median of 14 days before finding a buyer.

Queen Anne and west – The swath between QA and Magnolia is popular for a wide range of residents – from large families to condo dwellers, with many choosing to be in proximity to their offices downtown or Interbay-based Expedia Group. Median prices in the area are only 3% higher YoY at $1.025M amid 29% fewer sales. Homes go under contract in a median 20 days, up an additional 11 days from only a month earlier.

Kirkland – Median prices in this beautiful part of the Eastside (including Bridle Trails) have climbed to $1.495M. That’s down 0.3% from last year but 47% higher since November 2019 (before the pandemic). Homes remain on the market for about 16 days, a 9-day jump from October but two fewer days from three years ago.

Central District – The gentrification of this large section of the city has attracted many buyers in recent years. Home prices have straddled the $850K mark since 2019. November median prices for all home types stood at $949K, up 20% compared a year ago and up 13% from just before the pandemic. Homes are going under contract at a median of 15 days, 10 fewer days from three years ago.

Elsewhere, it’s a safe bet that home sales in so-called Zoom towns and vacation destinations – quite popular at the height of the pandemic – will continue to slow. Many working families, for example, are realizing that their companies will require more in-office appearances, placing commuting pressures on employees living beyond normal travel distances.

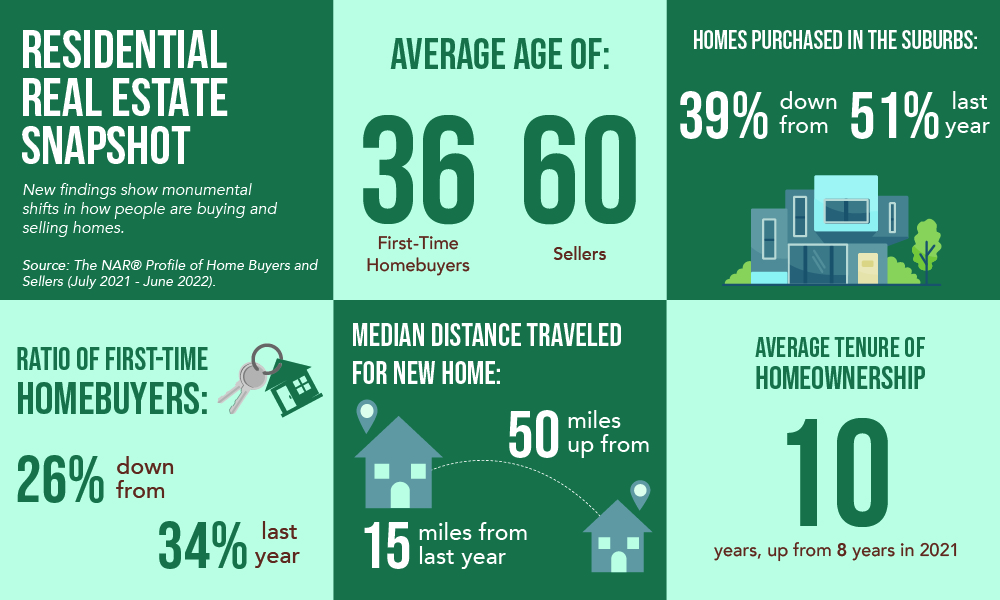

The makeup of the typical buyer and seller across America has changed significantly in a short time, as this summary from an NAR survey shows (click on graphic to enlarge):

Today’s challenges described here cast a harsh spotlight on the difficulties younger buyers – mostly Millennials – face as they attempt to get on the property ladder. It’s as if the first rung is missing.

Millennials represent the largest and most diverse segment of the U.S. workforce and yet they are also the least financially stable group. They have fallen behind older generations in getting into their first home, with high student debt, incomes lagging inflation and steeper borrowing costs making the goal of homeownership feel nearly insurmountable.

When (and if) they do dig out of debt and save for the future – often with the help of family gift money – they would benefit from interviewing more than one lender to understand their financing options. Remember: Homebuyers can always refinance their mortgage when interest rates fall.

Meantime, there is no indication owners are willing to put their homes on the market at an earlier age, with many locked into lower interest rates. Ninety-nine percent of outstanding mortgage debt is locked in at a rate that is lower than the current 6%+, according to real estate data giant CoreLogic.

With little incentive to lose their low-rate mortgage, homeowners will choose renovations and home equity loans over moving for the foreseeable future.

What’s the latest on the condo front?

While I prefer to be a glass-half-full real estate consultant, the condo market in and around Seattle offers few glimmers of optimism heading into 2023. Some evidence:

- The post-pandemic allure of urban condos has yet to materialize. Potential buyers point to affordability, safety concerns and the smaller footprint that condos offer as their reasons to stay away. Employees will continue their preference to work from suburban or exurban locales until/unless the number of commuting days outweighs the inconveniences of getting to the office.

- While the number of Seattle high-rise developments – as measured by construction cranes – has increased in the past year, few are earmarked for the purchase market. Of the 36 residential cranes around the city (as of August), only two were developing condos – First Light and Graystone. Avenue Bellevue and a couple of other condo projects are under construction on the Eastside.

- No new grand projects opened this year and only one – Graystone – is scheduled to debut in 2023. In addition, there is no guarantee a project that has yet to close on current sales commitments will open as a condo, as a few recent projects converted to rentals just before making their debut.

One person who has worked more than 10 years in Seattle-area new construction believes it will be another five years before a major condo project surfaces. One new project announced in March – just west of Seattle City Hill – was paused in July, reportedly because of rising construction costs and market uncertainties.

The numbers bear out a bumpy market. For the 12 months ending Nov. 30, 14% fewer Seattle condos at a median price of $485K traded hands on the resale market. In the same December 2021-November 2022 period, 353 new-construction condo residences closed deals in the city, up a resilient 7.0% from the previous 12-month timeframe ending November 2021. Today’s median price of $755K is up 14% YoY.

About 350 units within recently opened downtown Seattle area condos remain unsold. That includes more than 140 for sale in Spire and about 90 in KODA – buildings that are less than two years old. Eight of the nine penthouses – mostly 3-bedroom residences – are unsold at Spire. Fewer than 70 residences each remain available at The Emerald and Nexus – both of which opened just before the pandemic hit.

A back-of-the-napkin calculation shows about 18 months of unsold inventory among these luxury Belltown/downtown residences.

November saw only four Pending sales among the above-mentioned opened buildings. Four sales in November from this group went for an average of $947/sq. ft., $100 less than typical sales two years ago.

In some cases, buyers are canceling orders for new homes and extracting themselves from waitlists for the next great condo. Higher mortgage rates have pushed their dreams of owning a new-construction condo beyond their financial reach or other circumstances prompted a change.

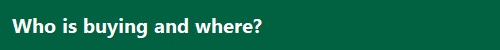

Making matters worse are the challenges facing building developers today. The costs alone shorten the list of developers willing to take the risk.

What does the office of the future look like?

One continuing intangible is the speed of recovery in downtown Seattle and to what extent offices reopen.

The pandemic forced structural shifts in how and where we live and work. The impact on office use is still evolving but the extremely slow return to “normalcy” should be worrying to city officials and businesses roughly located between the waterfront and I-5 from Belltown to Pioneer Square.

Only 37% of Seattle workers have returned to downtown offices compared to pre-pandemic times – among the lowest rates of any major U.S. city. Commercial real estate brokerage Savills reports 20% of city office space is vacant – an all-time high. The national office-vacancy rate is 13%, the highest since 2011, according to CoStar, a commercial real estate information firm.

“There are times to buy, times to sell, times to develop, and times such as now to be patient,” John Kilroy, CEO of Kilroy Realty, said this fall. “Patient” is not a word typically uttered by the head of an office building developer.

What makes this element of real estate significant is that workers have little to no interest in returning to the office full-time. Nearly 80% of them want to work remotely at least one day a week, and economists estimate that 50% of the workforce could continue working in a hybrid format in the future.

Inflationary pressures and workers’ unwillingness to return to the office may be contributing factors for Amazon’s surprising announcement in July to postpone or cancel construction projects on the Eastside. Some are calling this the “Amazon pause.” In addition, Microsoft’s long-range commitment to Bellevue’s central business district reportedly appears uncertain.

Broderick Group, a commercial real estate brokerage, put it in perspective, telling Puget Sound Business Journal: “The brakes have been slammed on the five-year party of relentless Big Tech expansion on the Eastside.”

The push and pull between employer and staff will be a dynamic worth watching in 2023. For now, tight labor markets should ensure that employees have the upper hand in these home vs. office negotiations. But that could change if unemployment rises in an economic downturn and employees display their value by showing up in person more frequently to stay away from the chopping block.

Most corporations want to maintain a strong office presence in the region but tough questions lie ahead. Flex space might be the answer for many companies as they try to figure out office needs.

It will take more time – and possibly more perks such as free lunches to employees – for firms to figure out space needs and location.

I am a big sports fan and ice hockey – featuring tremendous speed and skill – is my favorite. Having a National Hockey League team helps showcase our great city to a wider audience.

After struggling in the first season, the Kraken have played surprisingly well and are flying high in the Pacific Division against tough challengers from Vegas to Vancouver. But is Seattle good enough to get to the postseason this spring and spark even great excitement?

I say an emphatic “YES!” Of all the predictions in this annual assessment, this is the easiest. Barring injuries to key players, the Kraken should be playing hockey into late April … or even, dare I say, May.

To celebrate the Kraken’s success, I am offering two tickets to a regular-season game in March or April. The first person who contacts me by phone or email about the tickets will get to see the Kraken in person. (The winner agrees to subscribe to my monthly newsletter. That’s it! Sorry, real estate professionals do not qualify for this offer.)

Bottom Line: Housing affordability has fallen to its lowest level in more than 30 years. Prices (and, until recently, rents) have soared relative to incomes. Even if we experience a mild recession, it is not projected to provide significant relief to consumers – especially first-time buyers – seeking a home.

Gyrating mortgage rates and stubbornly high home prices have pushed the brass ring to homeownership further out of reach for a growing share of potential buyers, though the days of sharp ups and downs on those indicators seem to be over.

The consensus appears to be one of cautious optimism that can be ridden through any short-term slump and position buyers and sellers for another period of sustained growth and strong returns. But it will take time – possibly years and not months.

John L. Scott Real Estate has been around for more than 90 years. Since opening its doors in Seattle, the brokerage has seen many ups and downs with the housing market; it grew and flourished in parallel with the success of this region. It’s the expertise and stability drawn from those years of residential real estate acumen that attract thousands of buyers and sellers to John L. Scott every year.

In a period of uncertainty like this, people seek out our insights and advisership. When looking for a trusted representative in the PNW, please consider knowledgeable and experienced John L. Scott brokers like me for your next real estate transaction. Thanks!