Pennymac imposes a new round of layoffs ahead of Q3 earnings

Housing Wire

OCTOBER 26, 2022

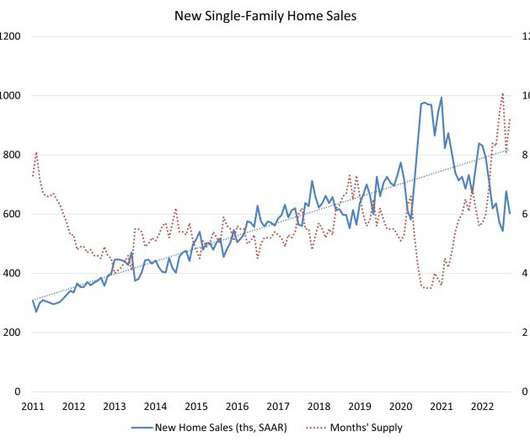

Nonbank mortgage lender and servicer Pennymac Financial Services imposed a new round of layoffs to its employees this week, ahead of its third-quarter earnings report on Thursday. . The California-based company had several rounds of layoffs this year, including a workforce reduction of 236 employees in March, another 207 staff members in May and additional 32 jobs in July. .

Let's personalize your content