How do you know if your home has enough insurance coverage? The quick answer is that you are probably underinsured – and homeowners usually receive the bad news after submitting a claim.

About six in 10 homeowners are insufficiently insured, according to CoreLogic, a property data research firm. That’s roughly 51M homeowners currently underinsured, and CoreLogic estimates homes are insured at about 73% of the actual property value.

Think about it: Facing a disaster – whether created by neglect, accident or Mother Nature – can be a life-changing moment. In most cases, homeowner’s insurance is the only resource available to recover the loss. Without that safety net, the result can be destructive to not only the home but to your finances.

Mortgage holders are still on the hook to make their monthly payment whether or not they can live in the home following a disaster. Mortgage defaults doubled in the metro areas most affected by Hurricane Florence in 2018, arguably in some cases because homes lacked sufficient insurance coverage to meet the cost to fix the damage. CoreLogic estimates homeowners affected by Hurricane Ian this year will face about $15B in uninsured losses.

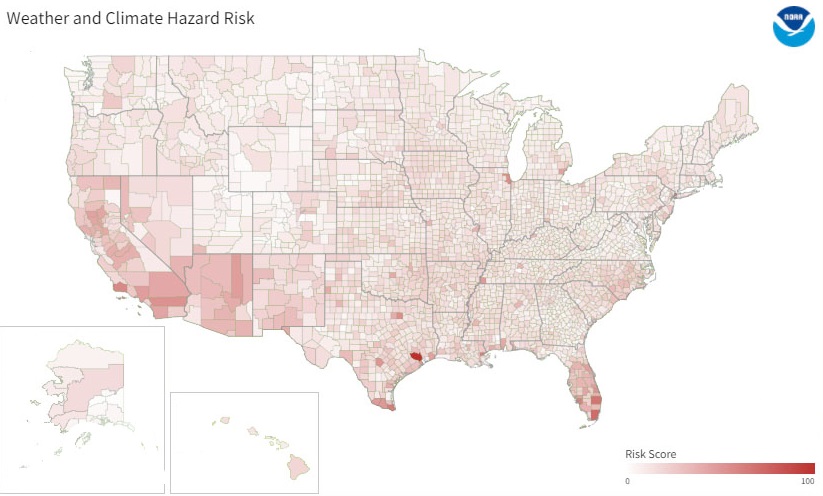

U.S. households typically place an insurance claim for wind and hail damage (34%), followed by water damage (29%) and fire/lightning (25%). Washington residents know a little something about wind, rain and wildfires. Fortunately, we are in a lower-risk area of the country for natural disasters, according to the National Oceanic and Atmospheric Administration:

Many homeowners may think they are covered in most situations. Underinsurance can be the result of:

- Undervaluing the property – Always insure a home for the full amount it will take to rebuild/replace the loss.

- Misunderstanding the coverages on a policy – Ask questions from your local insurance representative to ensure you grasp what’s covered and what’s not. For example, flood insurance – which is federally mandated in certain high-risk areas – is typically a separate premium from the homeowner’s policy.

- Failing to account for construction costs (see below)

- Not reporting home upgrades to the insurer – Forgetting to tell the insurer about the new garage door for a home is one thing but not mentioning that the garage was converted into a fully finished room is another.

- Choosing to keep premiums down through lower coverages – Skimping on coverage is common but that roll of the dice can be financially devastating. (The average homeowner’s policy across our state was $924 in 2022, according to quotewizard.)

How does one determine the cost to replace something – a fire-damaged bedroom, a flooded basement or wind-damaged chimney? It’s impossible to know what it would cost for each of those claims. That’s why some insurers offer a type of “gap coverage” that can protect against rising replacement costs with annual inflation-based increases to keep up with changing costs.

Beyond structural repairs to a home, there is also coverage for personal property, which can be insured on a basis of actual cash value or replacement cost. Households should insure homes for the replacement cost, which is the dollars required to repair/replace the property without depreciation. Actual cash value insures personal property based on its depreciated value.

Insuring the home for, say, $20,000 may be too low to cover the full replacement costs. Remember: Home items can add up quickly – new kitchen appliances, TVs, entertainment system, jewelry, furniture and clothes.

It’s not always clear-cut whether to file a claim; insurers may increase rates as much as 20% the following year or even decline to renew the policy, according to the Insurance Information Institute. However, fewer than half of all property claims result in a rate hike, the industry reports, which notes insurers typically raise rates when they think the incident may recur or was due to negligence. Many states prohibit insurers from raising rates for weather-related claims.

The general belief is that when a claim is less than $1,500 above the deductible, it may be worth swallowing the cost, AARP estimated. Insurers call this number the pseudo-deductible – the amount a consumer is willing to pay over the deductible for damage to a home.

A note to condo owners: Do not confuse the building’s master insurance policy for homeowner’s protection. The master policy covers the condo association against property damage to the structure and common areas, as well as for liability issues. Water damage from a burst pipe is the association’s problem in the common areas such as hallways, garage and lobby but damage within the home is an owner’s responsibility.

Home prices in Washington have skyrocketed in recent years, a full 42% by one measure since 2020. The average home price across the state is about $606,000 and around $1M in King County. Now, ask yourself if you’re fully insured!

Yes, it’s probably time to call your insurer for a chat and make it a habit to conduct an insurance audit every year on all policies – home, second home, car, boat. Here are some tips to start 2023 off right:

For more information on homeowner’s insurance, read my blog post from our Buyer’s Guide.