Mortgage rates rebound after five straight weeks of declines

Housing Wire

APRIL 20, 2023

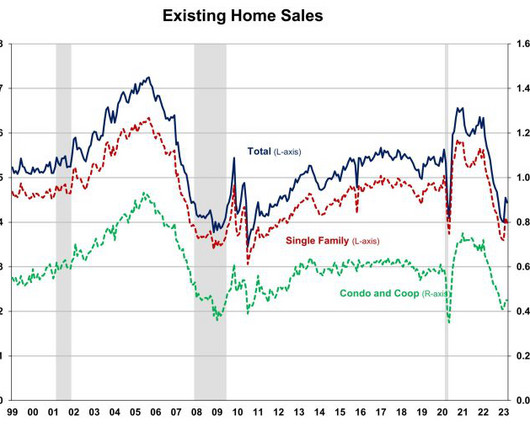

Interest rates for mortgage loans broke five straight weeks of declines caused by the bank crisis. This week, the 30-year fixed rate rebounded due to recent data indicating a still-resilient economy, the potential continuity of the Federal Reserve ’s tightening monetary policy, and pressures in the secondary market. “For the first time in over a month, mortgage rates moved up due to shifting market expectations,” Sam Khater , Freddie Mac ’s chief economist, said in a statement.

Let's personalize your content