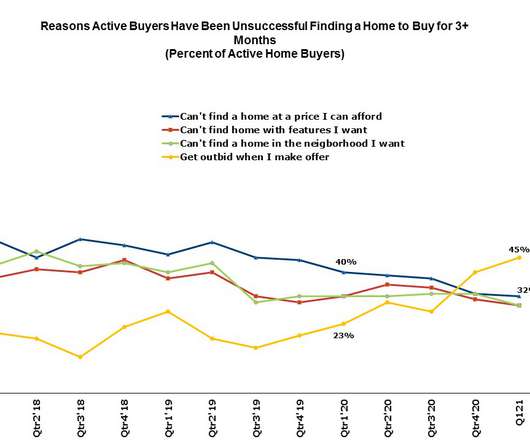

We’ve got rising home prices but no housing crash in sight

Housing Wire

MAY 10, 2021

The key to the U.S. getting back on track economically is for its citizens to freely walk the earth again without the existential threat of COVID-19. The U.S. is getting closer and closer to meeting that goal, while other countries are still trying to control the virus. Before the successful vaccination program, I targeted Aug. 31, 2021, as the launching point for when we can fully achieve this, with the mindset that all jobs lost to COVID would be back online by September 2022 or earlier.

Let's personalize your content