Mortgage rates collapse on softer inflation data

Housing Wire

NOVEMBER 10, 2022

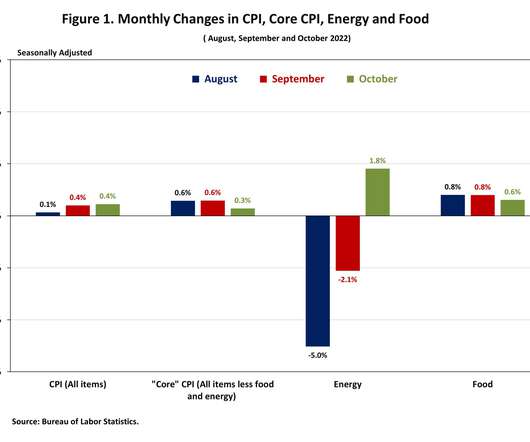

Finally, some good news: the growth rate of inflation is cooling off for now, and with the CPI inflation report being positive, the 10-year yield fell noticeably, and mortgage rates will fall with that! So, the question is, are we reaching the peak of inflation and close to the end of the Fed rate hike cycle? Let’s take a look at today’s data.

Let's personalize your content