Buyers preparing to pay for their new home must plan to ensure all funds are liquid – or ready – to complete the purchase. That may include the use of both contingent and non-contingent funds.

The primary legal document with your seller is the purchase and sale agreement. And paragraph A of the contract states, “Buyer has sufficient funds to close this sale in accordance with this Agreement and is not relying on any contingent source of funds, including funds from loans, the sale of other property, gifts, retirement, or future earnings, except to the extent otherwise specified in this Agreement.”

To be sure, a buyer may pull from various contingent sources of funds. They include the more common practice of relying on a mortgage from a lender to help cover the price of a home. They also may include a home-sale or pending-sale contingency whereby the funds from the sale of a buyer’s home are required to help cover the purchase of the new property.

There are documents within Washington’s form system specific to these scenarios that would accompany the main purchase and sale agreement. Cash, of course, is always the king of non-contingent funds – delivered to escrow in the form of a wire transfer or cashier’s check.

Non-contingent funds are those that are readily available at a U.S. financial institution in an account carrying the buyer’s name. Buyers are not usually required to disclose those funds.

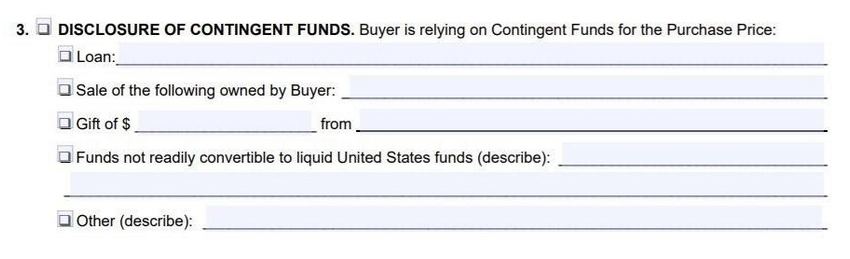

If, however, some of the funds are coming from a source other than those noted above, then they must be disclosed with some detail on a separate form known as Evidence of Funds. Failing to include this form when using contingent funds is misrepresenting the facts and potential fraud on the part of the buyer and broker.

Contingent funds are those a buyer does not currently have – but expects to – in his/her possession by closing. They can take a variety of forms:

- Stocks and bonds

- Retirement account or pension

- Gift money from a friend or family member

- Personal loan, other than mortgage

- Foreign monies

- Sale of personal property (boat, car, jewelry)

- Future earnings, such as a year-end bonus

- Money from a legal settlement

- Crypto-currency

What’s important is whether those funds can be withdrawn today and used toward closing costs or the down payment. If the answer is “no,” then the buyer must declare what those contingent funds are and share with his broker how and when they will become available.

Buyers have 10 days (negotiable) before the closing date to receive those contingent funds for the purpose of immediately using them toward the home purchase. They must provide evidence the funds have shifted from contingent to non-contingent status, usually by showing a copy of a bank statement with the newly deposited amount.

Sometimes a buyer chases the stock market in hopes of collecting gains on certain equities until the last minute. As we know, there are no guarantees in the stock market and a sudden loss in value could present buyers with a harsh reality of being unable to deliver those contingent funds. Failing to provide evidence of the funds can lead to buyers losing the house but usually receiving back their earnest money.

[As for the earnest money deposit, escrow companies typically will not accept cash, foreign monies or crypto-currency and many do not take automated clearing house (ACH) funds or money orders. Some escrow companies do not accept so-called official checks (as opposed to cashier’s checks). Buyers should specifically ask for a cashier’s check or wired funds when working with a bank. Read more.]

This section of the Evidence of Funds form shows the options that could be included and shared with the seller when presenting an offer:

It’s important to note there is no protection for the buyer against losing the earnest money deposit should the contingent source of funds fail to materialize at closing. Buyer beware!