Mortgage rates jump back up to 3.02%

Housing Wire

JUNE 24, 2021

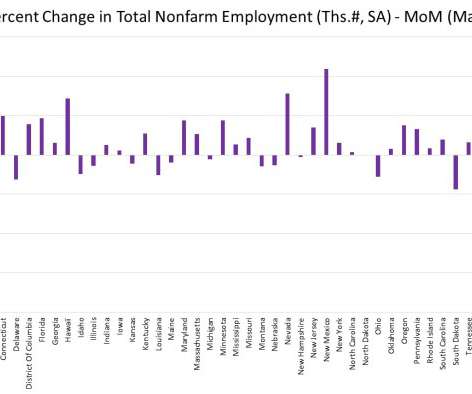

The average 30-year fixed-rate mortgage rose nine basis points from the week prior to 3.02%, according to data released Thursday by Freddie Mac ‘s PMMS. This is the first time in 10 weeks mortgage rates have risen above 3%. “As the economy progresses and inflation remains elevated, we expect that rates will continue to gradually rise in the second half of the year,” said Sam Khater, Freddie Mac’s chief economist. “For those homeowners who have not yet refinanced – and there rem

Let's personalize your content