How Zillow’s model crushed its iBuying business

Housing Wire

NOVEMBER 2, 2021

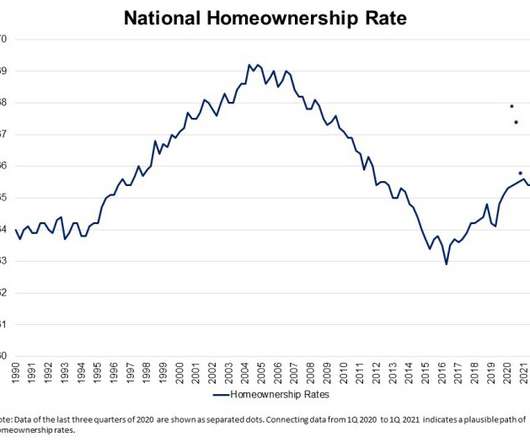

On Tuesday Zillow announced it will be shutting down its Offers business, which wasn’t too much of a shock considering how their stock had been performing for some time. The news was that they had been overpaying for homes and their losses on those purchases were getting larger and larger. Life being a publicly traded company can be fantastic or brutal at times.

Let's personalize your content