Market Still Holding On as Low Inventory Persists- February Newsletter

It’s hard to believe that it has been 2 years since we experienced the great Texas Winter Storm when the Texas power grid failed and we went several days without power in our Texas homes that are not built to keep heat. As much as I love the beauty of snow and the colder temps we occasionally get in North Texas, I still worry about the grid. I called it PTSD from that storm. So far, so good with the grid. Let’s keep it up. We are now entering the time of year when one day you need shorts and the next day you have to bring out your jacket. Gotta love North Texas weather!

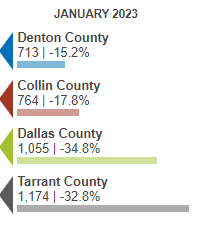

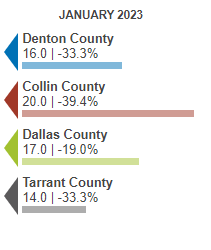

So what’s happening in the housing markets here? The past six months have been full of very drastic changes as the rapid mortgage rate increases causing many markets to begin to decline. Some may have a bit of PTSD from the 2008 Housing crash but just know that this is a different market with different factors impacting it. Our markets are still strong. If you look at the charts below, you can see how the price declines were more than the typical seasonal trends.

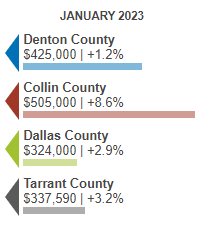

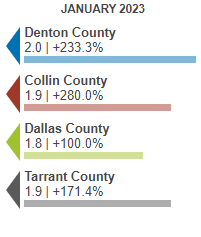

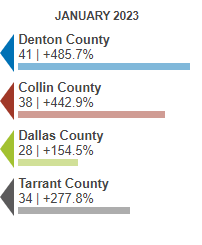

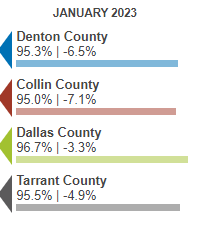

The demand for housing decreased with the higher mortgage rates as it decreased buyer power. So why didn’t that lead to a bigger drop in prices? The biggest answer is inventory. The inventory is still at very low levels. So the decrease in demand, really lead to the decrease in the frenzied multiply offer environment we had been in. No longer are homes selling above list price (see Percent of Orignal Price chart below⬇️) In fact they are selling at a more reasonable 5% below list price. There are multiple reasons that inventory is still low but two major reasons, are that building costs and supply chain issues keep new construction from building as much to meet demands and existing homes are not coming on the market. Many homeowners were able to take advantage of the previous record low mortgage interest rates and don’t see a need to sell unless life changes necessitate it.

Closely studying our markets is very crucial in understanding current market value for appraisers. Not every market is the same. The charts presented here are just overall trends for all single-family homes in each county. Each specific market is different. We are seeing some areas with much greater declines and some with little to no decline or even price increases. Looking at the more recent sale trends as well as the current pendings and listings will give us the most accurate current market value of that property.

As we enter the spring market, which is typically when things begin to heat up, we will see what happens. Until we have more inventory, prices will hold. There are still enough buyers out there looking to buy what is available. Possible economic impacts on housing would be continued inflation and job losses. Currently, the jobs market is strong but if inflation persists and the economy goes into recession this could change. Mortgage rates are still heading up, which will weaken demand and lessen buying power. In the meantime, the North Texas market is still strong. We are really headed back down into a more normal less frenzied environment. Check out all of the charts below to see how prices have flattened, days on the market have increased, supply is still low and volume is down.

Median Sales Price

Months of Supply

Days on Market

Percent of Original Price

Volume

Showings to Pending

Read 📖

Top 10 Things Appraisers Wish Real Estate Agents Understood– McKissock

Grocery and House Shopping Hasn’t Changed Dramatically Since The Eighties– Housing Notes

How to Level Up as an Appraiser-McKissock

8 Ways to Protect Against Appraiser Identity Theft– McKissock

Exploring Alternative Explanations for Appraisal Under-Valuation– AEI

The Real Cause of the Home Value Gap Is the Income Gap– Appraiser Blogs/Mary Cummings

Housing Affordability Hits Record Low but Turning Point Lies Ahead– NAHB

The Scientific Method for Appraisers- Appraisal Buzz/Brent Bowen

Even in a Competitive Market, Here’s How Appraisers Can Grow Their Businesses-Appraisal Buzz

Existing Home Sales Lowest in 12 Years, But It Could Be Worse– Mortgage News Daily

The housing market is heating up & still frozen– Sacramento Appraisal Blog

Surviving the Slowdown– Working R.E.

The Hard to Find (Important) Details– The Appraiser Coach

Notice of Data Breach Incident– Appraisal Subcommittee

Measure Credibility? – George Dell

Why You Should Hire Professionals to Measure Your Home– Cleveland Appraisal Blog

How Was The Housing Market in 2022?– Birmingham Appraisal Blog

Listen🎧

Logan Mohtashami on finding the bottom for housing inventory– HousingWire Daily Podcast

Supplement or Scale? – Real Value Podcast

The fascinating journey of John Dingeman’s career path and the valuable business lessons he learned- PahRooZings: Appraisers on Purpose

Watch📺

George Dell’s Things You Need 2 Know – The Webinar Handling Distressed Markets and Sales Conditions– George Dell’s Valumetrics

The Appraisal Update Podcast 2.21.23 – Appraisal News & a Quick Tip– Appraiser eLearning

What You Need to Know About ROVs– Appraisal Buzz

So we will keep watching all that is going on in our markets. Market conditions and market analysis is crucial in valuation. If you have any questions about appraising or appraisal services please reach out to us at www.dwslaterco.com.

And in California right now we’re getting some snow in various places where that doesn’t happen. Yet, it’s “snow” really because it’s not covered everywhere. Anyway, here’s to hoping weather doesn’t get too crazy, and let’s keep watching the market… 🙂

Brr, the weather seems to be getting more extreme. I hope ya’ll get back to the sunny and warm California that you know and love soon! And yes, we will keep watching the market to see how we handle this spring. 🙂