Homeowners typically buy a home by getting a mortgage, with the property functioning as collateral. The mortgage holder is expected to make timely payments and, failing that, the home could be seized by the lending institution in a foreclosure.

The loss of a home after not meeting debt obligations became a common occurrence during the 2008-2010 housing crash. Rising interest rates and declining home prices resulted in about 6M defaults in the U.S. While those days are in the rear-view mirror, there is always the chance for foreclosures to return on a smaller scale.

Check that “side mirror” for approaching issues!

About one in every 100,000 homes today is a distressed property in the Seattle/Tacoma market and heading for – or already in – foreclosure. How does that compare with other markets? The Bay Area has 2.4 in every 100,000 homes listed as distressed or worse, Bremerton/Silverdale has 1.9 and Spokane 1.8, as of May 2023.

If a homeowner fails to make payments and cannot exercise better options like a short sale, the mortgage lender can begin foreclosure proceedings.

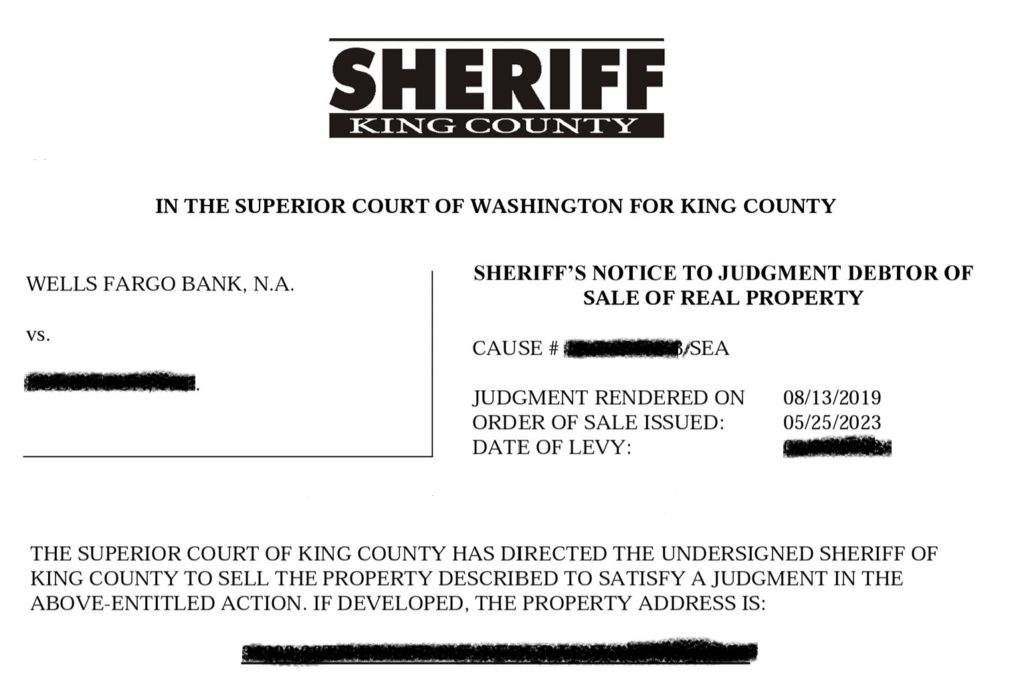

The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust. Generally, after the court declares a foreclosure, the property will be auctioned off to the highest bidder in what is called a sheriff sale.

The county’s Sheriff’s Office places notices of foreclosure in a local daily or weekly legal newspaper for four consecutive weeks. Additionally, the sheriff posts the notice in two public places, one of which is on or near the courthouse door in the county where the sale is to take place. These are published at least four weeks before the scheduled day of sale.

The notice contains the time and place of the foreclosure sale, the names of the parties to the deed, the date of the deed, recording information, a property description, the terms of the sale and the borrowers’ rights (or lack of) redemption.

The borrower typically has up to 11 days before the sale to stop the foreclosure process by paying the past due payments, plus expenses, including trustee and attorney fees.

If the borrower does not stop the process, an auction is held between 9am and 4pm near the courthouse doors on a Friday (unless it’s a legal holiday, and then the sale is held on the next business day). The sale cannot take place until at least 190 days after the date of default. The highest bidder receives a certificate of sale.

The sheriff may postpone the sale by giving notice and posting written notices of the adjournment under the notices of sale originally posted. King County’s scheduled sheriff sales of personal property and real estate are easy to find. The public notice may look like this (with personal info redacted):

The borrower may, within eight months after the date of the sale, redeem the property by paying the amount of the highest bid at the foreclosure, plus interest. However, this option may have been removed by the lender and is not always available. This is where having a real estate attorney read and translate all foreclosure documents becomes extremely helpful for both sellers and buyers.

But hold on: All is not lost for owners! A forbearance or repayment plan can save them from being kicked to the curb. If a lender approves, homeowners can delay payments for an agreed period – for example, during hardship while searching for a job or during hospitalization – and then resume payments along with the regular monthly outlays after getting back on their feet.

Another option: If interest rates are lower than when the owner acquired the mortgage and there is enough equity established, a homeowner may be able to refinance the mortgage instead of facing foreclosure.

Or, owners who have a mortgage payment low enough that market rent will allow it to be paid, can convert their property to a rental. The rental income can help pay the mortgage.

Alternately, owners with previously good credit may choose a Deed in Lieu of Foreclosure option. Also known as a “friendly foreclosure,” a deed in lieu allows the homeowner to return the property to the lender rather than go through the foreclosure process. Lender approval is required and the homeowner must also vacate the property.

In other scenarios, homeowners with poor credit to start with may choose to seek bankruptcy protection. This may be a viable option when owners have non-mortgage debts that cause a shortfall in paying their mortgage obligations, allowing a personal bankruptcy to essentially eliminate these debts.

A foreclosure means that a “default” will appear on the homeowner’s credit report. The credit score could take a 200- to 300-point hit and there is a seven-year moratorium on buying another home.

As if losing the home isn’t enough, secondary lien holders can file suit for unpaid balances and can potentially garnish wages from the people listed as owners of the foreclosed property. These liens could have been caused by unpaid bills or monetary legal judgments, or possibly missing child-support payments against one or more of the now-former owners.

Meanwhile, foreclosures can be an excellent opportunity for buyers seeking a home at a cut-rate price. Buyers are attracted to the idea of potential savings but they need to be prepared for a process that can easily take 4-6 months or longer to complete.

Resources

Washington State Foreclosure Law

King County Sheriff Sale website

Looking for legal counsel? Try speaking with the lawyers at McFerran Law in Tacoma, or Avvo presents a list of qualified attorneys in Seattle. (These are referrals only, not personal recommendations.)