So How’s The Birmingham Housing Market?

With the first quarter of 2022 under our belts, I thought I would take a quick look at how the numbers stack up against past years, and for March.

We’ll take a look at some key metrics including sales volume, median sales price trends, days on market, the sale price to list price ratio, active listings, and months of supply.

Number of Homes Sold

The number of homes sold is a key indicator of market activity. There is a direct relationship between the health of the market and buyer activity.

While the number of home sales for the first quarter as well as March is down from last year, it is higher than the prior years. Last year was record-breaking in many areas, so to only compare the present activity against it would not be fair.

If we continue to see a trend that might signal a shift in the market, so we’ll want to keep our eyes on what is happening. Will the continued increase in interest rates have a big impact on home sales?

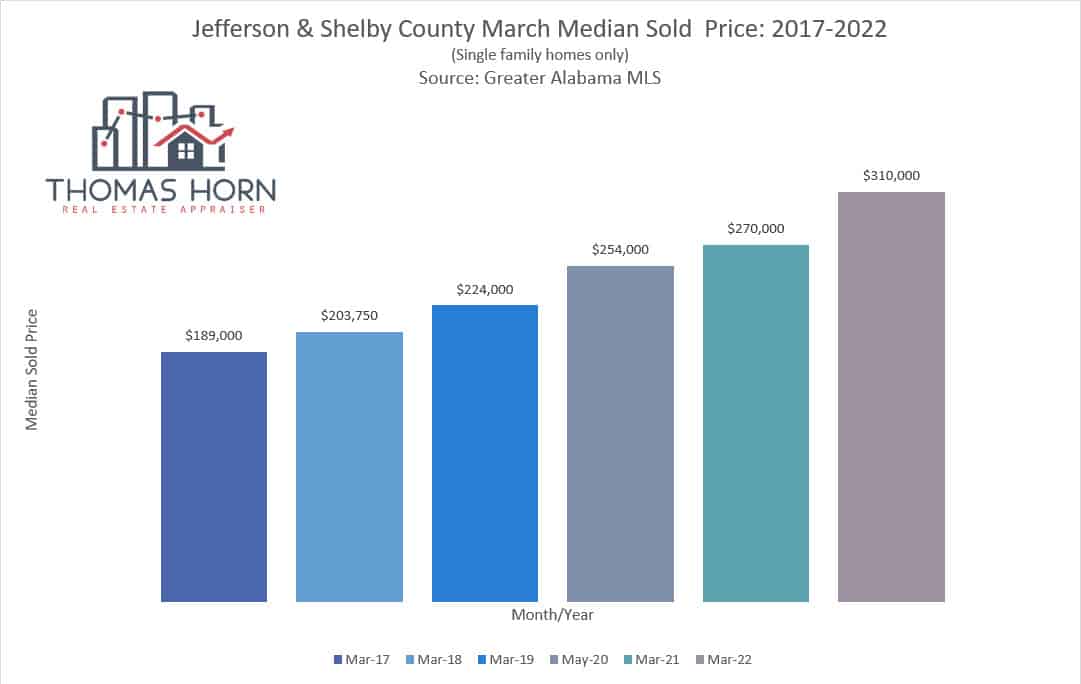

Median Sales Price

Median home prices continue to rise as a result of high demand and limited inventory. First-quarter stats show a steady increase from 2017 to the present.

A shocking stat to me was the steep increase in median prices for the month of March from 2017 to 2022. In March of 2017 the median price, as reported by the Greater Alabama MLS was $189,000 compared to March of 2022, which came in at $310,000, an increase of 64%.

This increase, combined with higher interest rates, may keep many buyers out of the market as rates continue to rise. I believe that the increase in institutional buyers has driven prices up and contributed to the frustration buyers experience when they lose deals.

When this happens they are more willing to make an over-the-list price offer the next time they find a house they like which continues the cycle of price increases.

Days on Market

The amount of time a home stays on the market before going under contract continues to decline as buyers snatch up what limited inventory is available. While there is some seasonality to this stat the overall downward trend is still present.

This stat is tied directly to the type of market we are in. We are currently in a seller’s market, with limited housing inventory, and buyers are quick to make an offer before another motivated buyer beats them to it.

In a buyer’s market, the inventory is much higher and buyers have more choices. Houses tend to stay on the market longer which increases the days on the market stat.

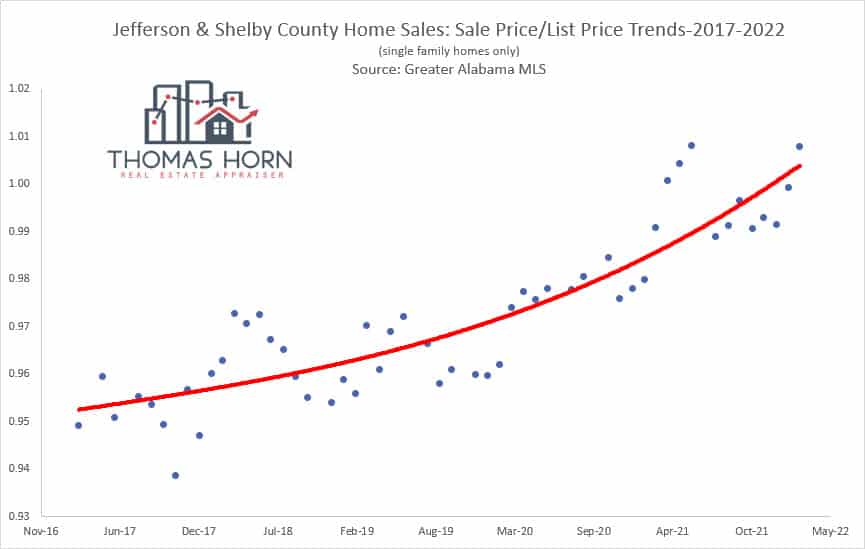

Sale Price to List Price Ratio

The big story in the Birmingham area, as well as other areas of the country, has been how many homes have been selling for over their list price. As I just noted, this is a direct result of buyers who want to make sure they win the offer, both individuals and investors.

Investors have deep pockets and they are willing to pay an over-the-market price due to the good rental market since the homes they buy will typically be rental units. This is true of new homes as well and many builders are starting to build homes specifically to sell to the investment buyer who will put the home on the rental market.

Individual buyers are being aggressive as well if they are lucky enough to find a home to make an offer on. Losing out on past deals has motivated them to make their best offer upfront in hopes of winning the deal.

Number of Active Listings

If we want to get a true feel for what is going on in the real estate market we need to keep an eye on the number of active listings. If they rise it could signal a softening of the market.

Year over year numbers from 2017 to 2022 is down for active listings. This is nothing new since we all know that overall inventory levels have been historically low.

It will be important to keep an eye on the change in inventory throughout 2022 as interest rates continue to rise. If they rise high enough a lot of buyers will drop out of the market because they cannot afford the payments.

If enough buyers leave, this could result in less competition and more inventory staying on the market. Will it be significant? We’ll have to wait and see.

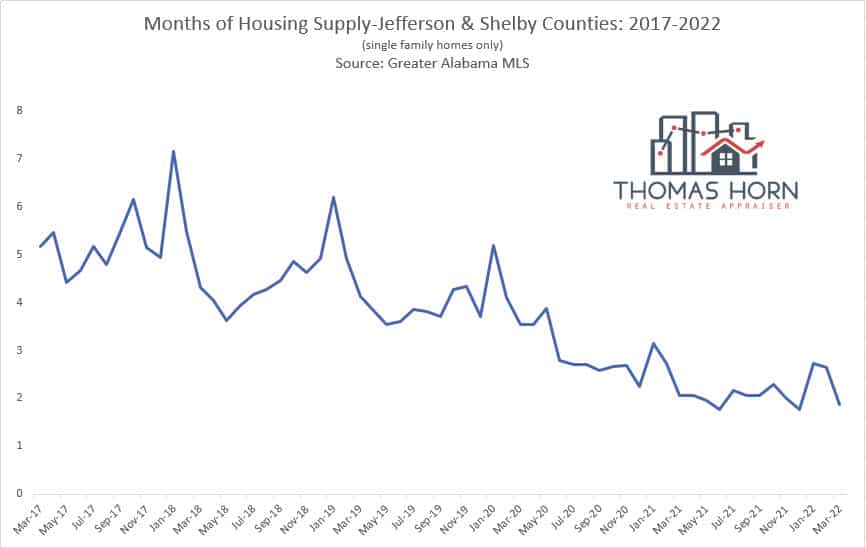

Months of Supply

The number of months of supply stat is a measure of the number of active listings and the recent rate of sales. A low inventory and a high rate of sales result in lower months of supply.

If interest rates rise enough to knock a significant number of buyers out of contention to purchase a home, and the inventory increases the months of supply will increase. This will be another metric to help us gauge the health of the market.

Remember that in a balanced market there are anywhere from 4-6 months of inventory. Anything less than four months would be a seller’s market and anything more than 6 months would be a buyer’s market.

While we are pretty far away from a balanced market we still need to at least look to see what direction we are headed. This will help us to understand what is going on.

Question

Do you have any questions about the local real estate market? If so, let’s connect. You can leave a comment below or reach me through any of my social media channels. As always, thanks for reading.

If you liked this post subscribe by email (or RSS feed).

We submitted a reconsideration of a VA appraisal after the VA appraiser came in grossly undervalue & that reconsideration has been rejected.. My question is will a low VA appraisal keep us from getting a higher offer / being able to sell it for more if a conventional or cash offer is made?

I am not a VA appraiser, however, I do FHA appraisals which are similar. I believe that VA appraisals only stick with the property if it uses VA financing. If you get a seller using conventional or cash the appraisal should not stay attached to the property.

Nice job with the stats for your market! It is always amazing to see how markets everywhere have such similar trends. It will be interesting to see what happens in the next few months.

Thanks, Shannon. I agree, it is very informative to see what is happening in other areas and compare it to the local numbers.

Nice job, Tom. The stats looks elevated. Seems like a competitive market from an outsider’s view of things.

Great eye, Ryan. Our market has been more competitive over the last several years than it has ever been. Historically the Birmingham market has been relatively stable but after the pandemic, this changed.