The Seattle area housing market right now reads like a mystery novel with half the pages missing. So far, the narrative has included a mix of suspense, a hint of optimism and a whole lot of uncertainty.

The year in residential real estate nears its end amid twists and turns like a good book but it’s waiting for the storyline to improve as we fill out the empty pages in 2024.

Suspense has centered on the Federal Reserve and its decision to raise, maintain or lower its short-term interest rate. The optimism comes from signals in economic data that show improving conditions and a likely end to rising mortgage rates in the coming months – a story that we are all looking forward to reading.

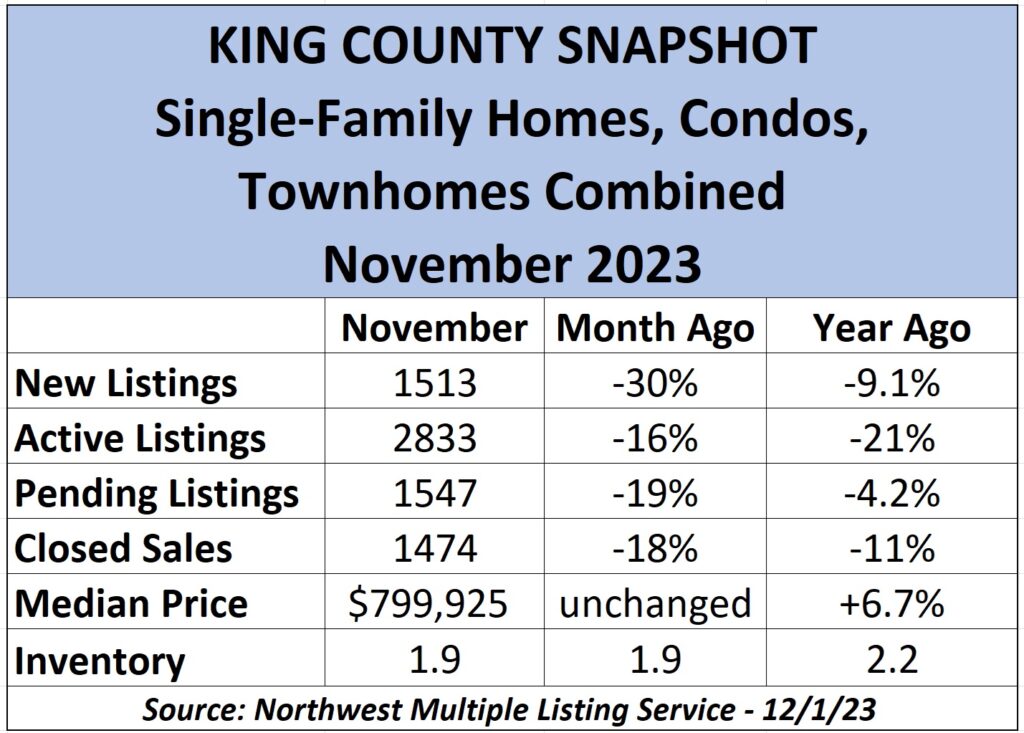

November featured a sharp drop in activity and mixed home prices across King County. The market assessment makes for uninspired reading:

Only 1513 listings hit the market in the month for all home types, a devastating 30% decline in one month. The Eastside led the way with a 33% drop-off in new listings (420) and Seattle fell 31% (586).

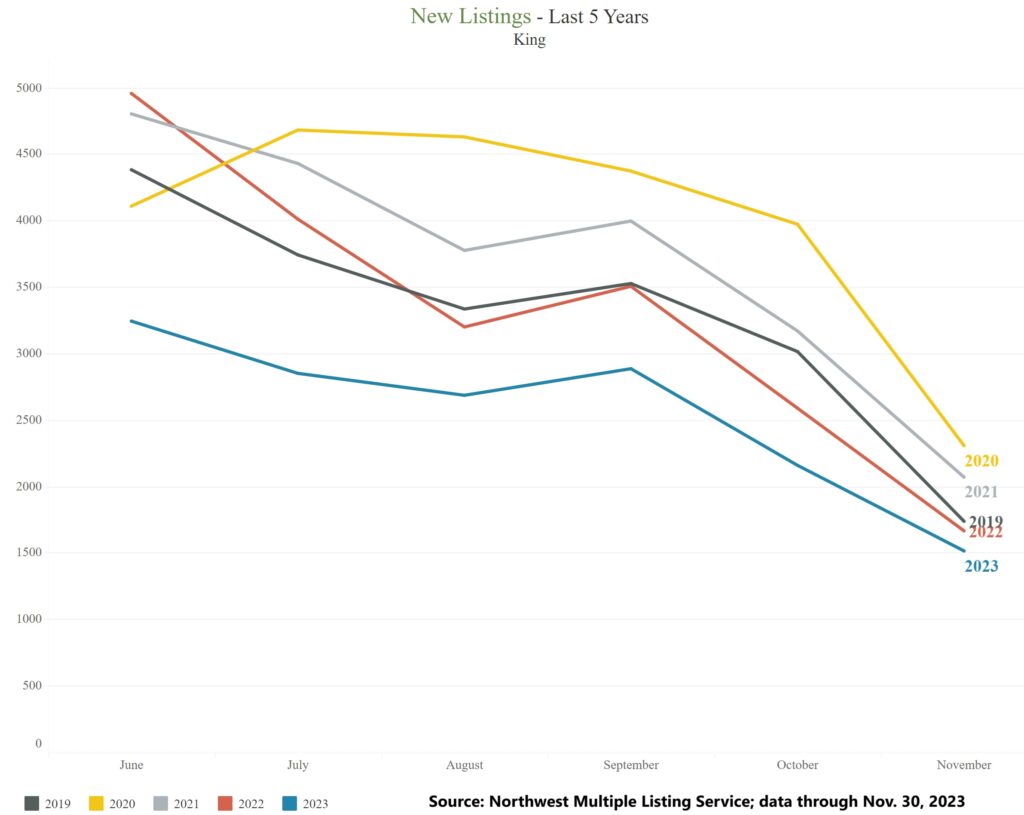

These are lows not before seen in any November, dating to at least 1996 when data was first archived online. By comparison, there were exactly 2900 new listings across our county in November 20 years ago. Here’s a glimpse at new listing totals in King over the past five years, with 2023 (blue) at the bottom of the chart:

Of course, there remains great uncertainty about when our market will improve. The housing environment hasn’t exactly been an enjoyable page-turner for more than a year.

Existing home sales fell 18% between October and November for all homes on the market and are off 11% Year-on-Year (YoY). King County’s 1474 monthly home sales is the lowest for any November since 2010 (1331) – in the middle of the housing crisis.

Americans are selling homes at an annual rate of 3.8M units, a 13-year low. Since January 2022 – when home sales were 6.3M annualized – the number of closings has plunged 40% nationwide. A typical year will include 5.2M sales.

Similarly, the single-family-home market is weak (if not bleak), with new listings down 29% (1128), Active home listings (as of Dec. 1) are down 18% (1889), and Pending/Sold figures fell about the same rate. Notably, the Eastside saw a 25% decline in Pending sales (homes under contract) but are still 9.2% higher YoY. Most other submarkets – Seattle (down 13%), Southeast King County (down 15%) – are experiencing far weaker YoY Pending sales. Closed sales are also lower, off about 17% since October and 13% YoY across the county.

The median price of a King County home (single-family, townhome, condo combined) stood at $799,925, statistically unchanged from October and up 6.7% YoY. Single-family prices were at $885,500, up 0.3% month-to-month and 7.1% higher YoY, with Seattle prices rising a significant 4.9% since October to $944,000. Prices for single-family homes on the Eastside were down 1.4% for the month ($1.4M) but up 6.4% YoY.

Months of inventory for single-family homes was flat at 1.7 (or 51 days) across the county. Inventory was at 1.9 for the Seattle market (vs. 2.0 in October) and 1.4 on the Eastside (1.6).

The county’s condo market was on an island of its own. While it joined the single-family category with far fewer new listings (down 33% in the last month alone!) and falling sales, the price of condos stood out. The median price of all condos sold in November hit $485,000, down 10% in a month and up a moderate 3.6% YoY. Seattle prices slipped 1.6% for the month ($582,750) and are up a whopping 21% YoY. You can fetch an Eastside condo for a median price of $620,000, down 5.6% from October to November and up 8.9% YoY.

Most eye-popping, inventory for condos surged to “buyer market” levels in November. They stood at 4.1 months of supply in Seattle (vs. 3.4 in October) and 9.3 months (from 6.7) for the area comprised of Belltown and downtown. Eastside condo supply was more muted at 2.0 months (up from 1.6).

Homes in our county remain on the market longer than they did a year ago. The average number of days that listings sit for sale has been stuck at around 25 since early spring, The figure in November 2022 was 15 days.

In addition to King County’s unchanged median price on all home types ($799,925), Pierce County saw the sharpest change – up 1.8% from October to November ($529,500). Snohomish prices inched 0.5% higher ($703,635) while Kitsap dropped 0.5% ($547,400). November single-family home prices were mixed in the four-county region, with Pierce again up the most, 1.9% higher for the month to $539,950, and King up 0.3% to $885,500. Kitsap experienced a 1.1% monthly price decline ($549,950) and Snohomish prices fell 0.7% ($725,000). Year-to-year, single-family median prices are now all higher compared with a mostly mixed report all year. Kitsap leads with an 8.8% gain, followed by 7.1% higher in King, Snohomish up 3.6% and Pierce up 2.9%.

“Although the number of sales transactions and housing inventory levels typically drop in the fall and winter months, the expected seasonal slowdown continues to be exacerbated by the high interest rate environment for buyers relying on mortgages [to finance their purchase],” the Northwest Multiple Listing Service said in its latest market report released last week.

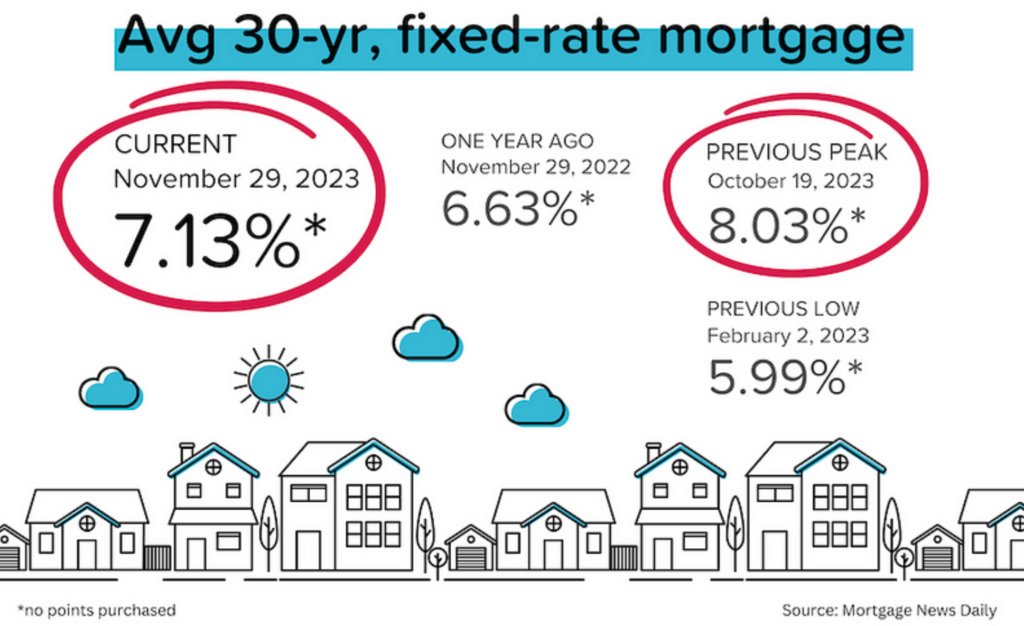

For the first time since March, buyers are enjoying falling mortgage interest rates, which have dropped six consecutive weeks (Freddie Mac) to just north of 7.0%. Buyers are paying attention, sending mortgage applications up 6% from October to November – a 40% increase from the previous year, according to the Mortgage Bankers Association.

Applications are one of the industry’s first measuring sticks in the home-buyer journey. Increasing interest in this consumer pool reflects a growing number of potential buyers for the weeks and months ahead.

Rates have eased following positive news on the economic front. Specifically, the cost of living has inched lower – to 3.5% on an annual basis – thanks in part to falling energy prices and the continuing decline in shelter costs. As a reminder, the Federal Reserve has targeted for about two years now an inflation/cost-of-living rate of 2.0%.

The Fed’s governors meet this week to evaluate the economy. Chairman Jerome Powell will hold a news conference on Dec. 13 to update America when the central bank will likely hold firm on short-term lending rates.

We are heading in the right direction but most economists believe the rate of inflation will take several more months (possibly longer) to come close to the Fed’s target. While the central bank doesn’t directly set mortgage rates (mortgage investors do), it has a significant influence on the overall lending environment in the U.S.

To be clear, there are no signs of mortgage interest rates returning to levels seen during the pandemic. That was probably a one-time event. No, instead we are in a reset environment of mortgage rates in a 6%-7% range for the coming year. (Next week’s blog post will offer a picture of what we can expect in 2024. Watch for it here starting Dec. 19.)

Homeowners, meantime, have little or no incentive to sell – unless they must for a life-changing moment. More than 60% of U.S. home loans have rates below 4.0%, according to Black Knight, a real estate data consulting company.

Higher interest rates erode buyers’ budgets by driving up their monthly payments. On average, a one-percentage-point rise in mortgage interest delivers a 9% decline – or disincentive – in the rate at which people decide to move, according to a study from the University of Illinois-Urbana Champaign.

The luxury market – homes listed at $2M and above in our region – is slow but steady with activity. Data show that many of these buyers are paying cash or with a high down payment and small loan. In other words, this buyer group is less sensitive to mortgage rates. Some are taking advantage of interest rate buydowns and other sales promotions offered by developers of new homes.

As we prepare to close this year’s chapter on the Seattle area housing market, the plot remains unpredictable – much like that gripping novel. With every turn of the page, we eagerly anticipate the developments of 2024 to unveil the next development.

The twists, suspense and hints of optimism have painted a unique narrative this year, and just like any compelling story, the ending holds the promise of resolution and new beginnings. So, let’s eagerly await the unveiling of the next pages, confident that the tale of our local real estate market is bound to captivate us with its twists and turns, and ultimately, a satisfying conclusion for buyers and sellers alike.