The signs are generally pointing in the right direction for our local (and national) residential real estate scene, but it is taking more time than usual to turn a cruise-ship-sized sector around without leaving damage in its wake.

“After nearly a year, the housing sector’s contraction is coming to an end,” notes Lawrence Yun, National Association of Realtors® chief economist, speaking about the U.S. market. “Existing-home sales, pending contracts and new-home construction pending contracts have turned the corner and climbed for the past three months.”

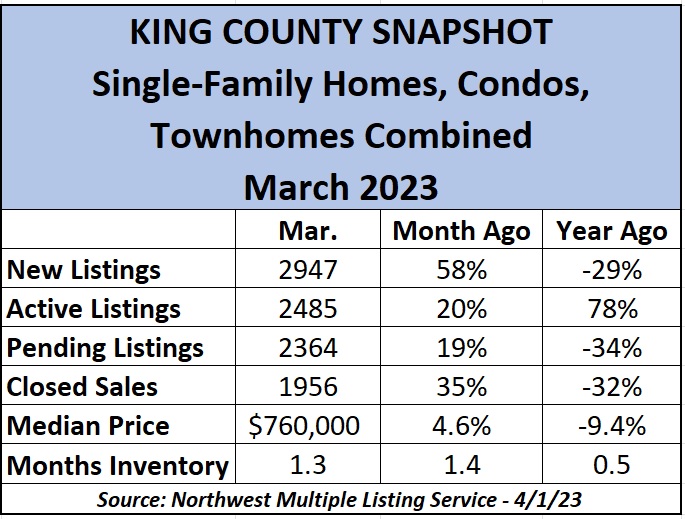

Locally, the number of home buyers signing pending-sale contracts has risen for four consecutive months – indicating an increase in demand. There were 2364 Pendings in March on all home types combined in King County, a 19% increase from February and the highest total since August.

That’s not saying much since the housing market has mostly been in hibernation during the fall/winter months. In fact, after the first quarter, we are on pace to deliver the county’s third-fewest annual home sales in this still-young century.

Pending sales are one of our favorite housing market data points – along with the number of mortgage applications and new listings – to track buyer intent and market intensity. Speaking of which, applications for mortgages rose four consecutive weeks before falling a bit during the days leading up to the Easter/Passover holiday. And while overall housing supply is historically low, the totals for March showed a 58% increase in new listings since February though still 29% less than a year ago for all homes in King.

We are also enjoying an expanding number of Active listings in the county – 2485 homes, or 20% more from February and 78% more from a year ago; these are the available homes on the market as of April 1. The stats are similar for the single-family-home category, with 20% more homes for sale at the start of this month (1787) versus March 1 and 84% more year-on-year (YoY). Total home sales are up 35% (1956) from the previous month but down 32% YoY.

It’s safe to say that we are witnessing a tale of two housing markets in the U.S., as reported by The Wall Street Journal (my work address for 15 years). In its March 27 article (paywall), The Journal said the disparity is stark between “booming” prices in the East versus still-falling figures in some key Western cities. While that storyline was true for about a half-dozen consecutive months here, there are signs that Seattle/King County is experiencing a pricing turnaround as the spring buying season picks up.

Median prices in King for all homes (single-family, townhome, condo combined) stood at $760,000, up 4.6% from February but down 9.4% YoY. Prices jumped 17% ($1.22M) on the Eastside and added 2.5% ($768,832) in Seattle in the past month, but they are down 7.6% and 11%, respectively, since this time last year.

Single-family prices across the county were up 5.0% ($840,000) for the month but down 9.7% for the year. Median prices in Seattle added 5.5% ($869,975) since February but slid 10% YoY, while Eastside single-family prices gained 5.3% ($1.41M) for the month and dropped a whopping 17% YoY.

To be sure, median home prices are all over the place right now when examined on a hyper-local level against the same month last year. For example, prices in Redmond and Carnation combined are 6.9% higher YoY for all home types but 3.7% lower among only single-family properties. As noted above, most areas are seeing rising prices month to month but much lower on a 12-month basis.

Why? One reason is the fallout from a pandemic-driven buying surge that saw parts of the Eastside in a pricing frenzy with homes selling as much as 50% higher YoY. Now, those same areas of King are experiencing a price correction – to the relief of buyers.

Prices more broadly are expected to move in a narrowly mixed range in April and May before they likely rise versus a year ago. That’s because we are nearing our region’s pricing peak – May 2022 – and 12-month comparisons should become less shocking and even appear higher when we head toward the fall. Again, hyper-local markets are often subject to their nuances.

“When we breach the peak price of 2022, the pace should slow again,” notes local economist Matthew Gardner, quoted by the Northwest Multiple Listing Service. “We will likely return to positive year-over-year price growth by the end of the year.”

———-

You can receive free monthly insights on home sales activity for any area of the Puget Sound region. The one-page report includes new listings, pending sales, sold homes and prices for any area – a city, ZIP code or even a street. Let me know if you would like to begin receiving customized summaries via email.

———-

It’s important to remember that we typically only report median prices because they are more instructive than averages by reducing the impact of extreme values. But if lower-priced homes are selling quickly and luxury homes are lingering on the market – and both are true today – the median sales price will be impacted lower than in a typical housing season.

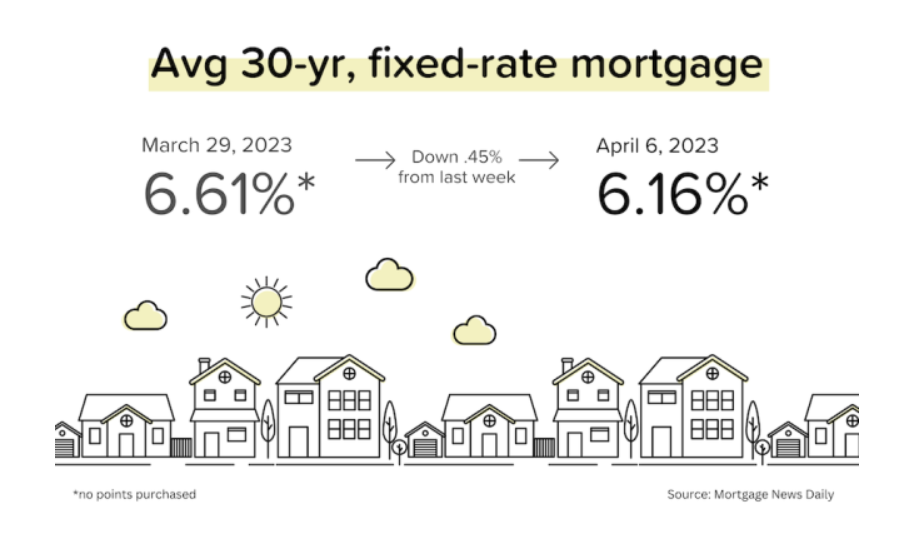

With conflicting signs on prices and strong concerns over inflation, interest rates and job security, the market should be quiet – but it’s not. My assessment still needs honing but lower interest rates this year compared to last fall’s 7% level, plus easing home prices compared to 2021-22 and seller concessions for the past several months have helped to deliver some of the best opportunities for buyers who can afford to make a move.

Also noteworthy, recorded home prices don’t reflect seller concessions. Maybe sellers would not accept a $10,000 price cut, perhaps simply out of pride, but they agree to pay $8,000 in closing costs. In these cases, the true bottom line is not registered in the Northwest MLS stats.

Buyers remain cautious as we watch economic indicators and read the tea leaves in the office about job status. At least 5,000 tech workers have been handed pink slips in our immediate area this year, according to state figures. (Fortune reports the 2023 figure is closer to 150K tech jobs nationwide.) Job uncertainty can contribute to a market slowdown, particularly on the Eastside where Amazon, Google and Microsoft have a large presence and many of their employees live, however other companies – such as Boeing – are benefitting from the situation.

As for the condo market, activity is strong – with sales up 31% from February across King – as median prices gained 8.2% to $507,000. Prices, however, are down 6.1% YoY. Seattle prices rose 3.9% ($535,000) for the month and added 4.9% for the year. There is 1.6 months’ condo supply in the county and 2.3 in Seattle.

The supply of all homes for sale remains low and many of the demand drivers that existed pre-COVID (Millennials reaching home-buying age and life-changing moments) are still there. Supply in King County for all home types is at 1.3 months and 1.2 for single-family homes.

In addition to King’s 4.6% median price month-to-month increase on all home types, to $760,000, Snohomish County saw a rise of 2.3% from February to March ($680,000) and Kitsap added 2.0% on its median price ($510,000), while Pierce was 1.0% lower ($516,000). Single-family home prices in King jumped 5.0% in a month ($840,000), followed by Snohomish up 4.8% ($724,000) and Kitsap added 3.5% ($517,500). Pierce experienced a 1.0% decline ($526,000) for the month. Year-to-year, single-family median prices fell in our region, led by a 9.7% drop in King, 9.5% lower in Snohomish, 5.6% in Pierce and down 3.9% in Kitsap.

Mortgage rates are still inflated compared with a year ago – about 1.4 percentage points higher – but are about a half-point less than last fall. Once lower borrowing costs are coupled with seller concessions and easing home prices versus last year, you have buyers coming back into the market.

What to watch for? The Federal Reserve may still raise the rate banks charge one another. Fed funds rates do not directly impact mortgage rates but the overall financing market watches central bank actions and may adjust lending costs on all types of loans – from cars to homes.

So, yes, mortgage rates may rise a bit more this year, leaving buyers wondering if they can afford a home purchase today. The monthly principal and interest payment on a median-priced home in the U.S. has improved this year but is still up about $800/month over the past 18 months.

A word of caution to prospective buyers waiting for mortgage rates to drop to a more comfortable level: Rates should not be the reason to buy a home. If you wait to buy until lower rates return, you may be competing against pent-up consumer demand and ultimately paying more for your dream home.

Finally, the recent struggles of Silicon Valley Bank and a few other financial institutions were reasons for concern, leading to lower interest rates as investors moved money into bonds. And while that issue could still impact a few more banks, according to one report at least, the general mood is that the federal government and the strongest banks acted quickly and in a reassuringly coordinated way to stave off any serious run by depositors to pull out their money. One lesson learned: Diversify your assets in multiple banks and other savings instruments rather than put all your reserves into one institution.