The gross income multiplier is a metric used in commercial real estate valuation by analysts and appraisers. It is easy to calculate and requires little information, but it does come with some limitations. In this article, we’ll take a closer look at what the gross income multiplier means with several examples, including the potential gross income multiplier and the effective gross income multiplier.

What is Gross Income Multiplier

The gross income multiplier (GIM) is defined as the ratio between the sale price or value of a property and its gross income from rent and other income sources.

The gross income multiplier is a metric used in commercial real estate analysis to compare the income-producing characteristics of properties. It can be calculated using either potential gross income or effective gross income for a property.

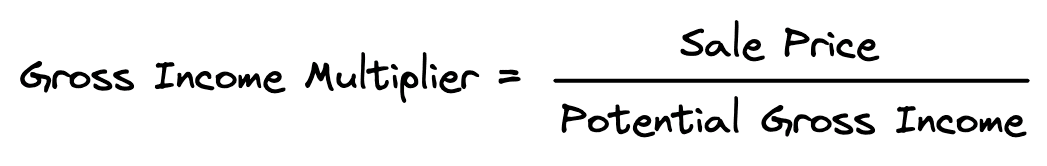

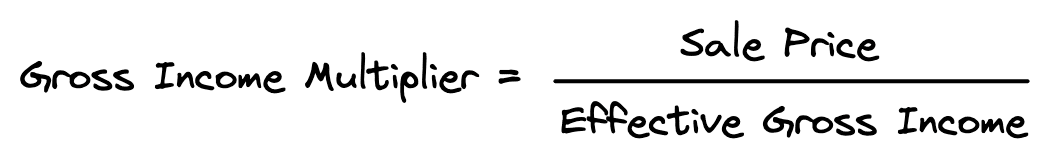

Gross Income Multiplier Formula

The gross income multiplier formula can be calculated using either the potential gross income (PGI) for a property or the effective gross income (EGI) for a property.

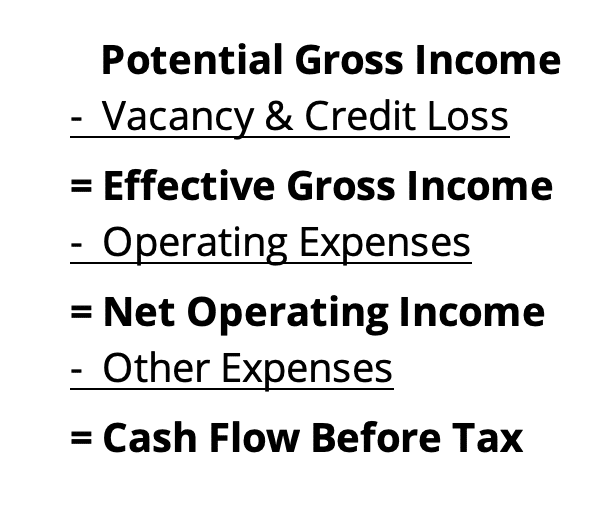

The key difference between PGI and EGI is that potential gross income considers all sources of income for a property and does not make any deductions. On the other hand, the effective gross income starts with the potential gross income and then subtracts vacancies and collection losses.

Since the gross income multiplier can be calculated in more than one way, it is important to clarify how the GIM is calculated and to use a consistent methodology when making comparisons.

How to Calculate Gross Income Multiplier

Let’s take a look at some examples of how to calculate the gross income multiplier. First we’ll look at how to calculate the potential gross income multiplier, and then we’ll cover how to calculate the effective gross income multiplier.

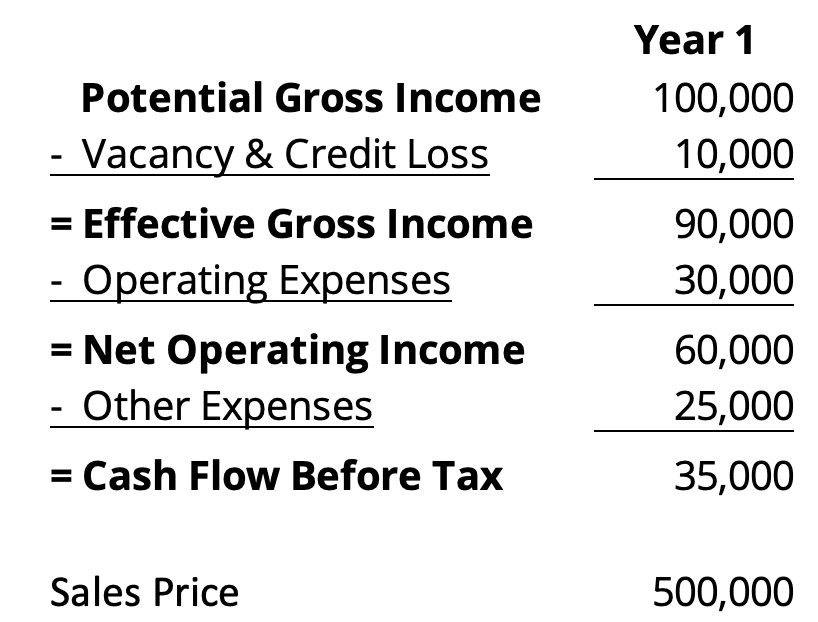

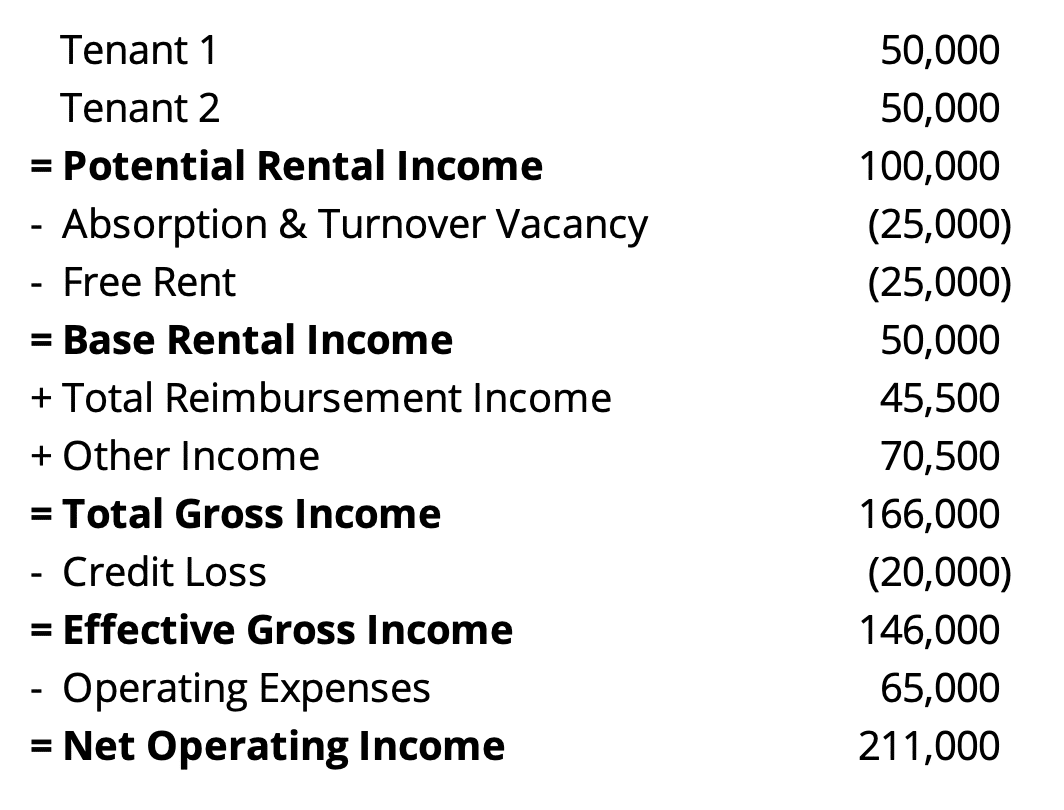

Suppose we are evaluating the following simple proforma:

Let’s see how to calculate the gross income multiplier using the figures from the example proforma above.

Potential Gross Income Multiplier

The potential gross income multiplier uses the potential gross income line item on the proforma. In this case, the potential gross income multiplier would be calculated by taking the sales price of 500,000 and dividing it by the potential gross income of 100,000. This results in a potential gross income multiplier of 5.00.

Effective Gross Income Multiplier

Effective gross income is calculated by taking potential gross income and subtracting out any vacancy and credit loss.

The effective gross income multiplier uses the effective gross income line item on the proforma. In this case, the effective gross income multiplier is calculated by taking the sale price of 500,000 and dividing it by the effective gross income of 90,000. This results in an effective gross income multiplier of 5.55.

In this simple proforma we are only considering vacancy and credit loss, but the gross income calculation could be more nuanced with a more complicated proforma. For example, here is a more detailed commercial real estate proforma:

In this more detailed proforma the gross income multiplier could be calculated using the total gross income line item or the effective gross income line item. In practice, you may also see some deductions or add-backs left out or other variations on the gross income multiplier. The important point to remember is that you should clarify how the gross income multiplier is calculated, and then use a consistent methodology when making comparisons.

What is a Good Gross Income Multiplier

A good gross income multiplier depends on how you are using it, but in general is one that meets your requirements. For example, suppose you require any acquisition to have a GIM that is close to the market average. If you identify 5 comparable properties and determine that they have an average gross income multiplier of 7.00 then a good gross income multiplier for a property under consideration would be one that is close to that average.

For an appraiser, a good gross income multiplier for valuation purposes is one that is based on comparable properties with truly similar characteristics.

However, it is important to understand that the gross income multiplier does not consider any operating expenses, capital expenditures, appreciation, or future changes in income. So, while a property might have a good gross income multiplier, it could also turn out to be a bad investment. On the other hand, a property might have a bad gross income multiplier based on a group of comparable properties, but because of your investment strategy or operational advantages, it might still be a superior investment.

The bottom line is that the gross income multiplier should not be used in isolation because there is no silver bullet when it comes to investment analysis. Instead, the gross income multiplier should be considered along with other investment metrics when possible such as the cap rate, equity multiple, cash on cash return, IRR, NPV, as well as the overall strategy and risks that come along with the opportunity.

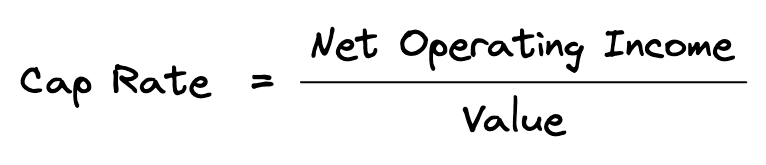

Gross Income Multiplier vs Cap Rate

The overall capitalization rate is used by appraisers to estimate the market value of a property:

The cap rate can be estimated using various techniques, such as derivation from comparable sales or the band of investment method. However, the overall capitalization rate can also be derived using gross income multipliers. Let’s take a look at how this works.

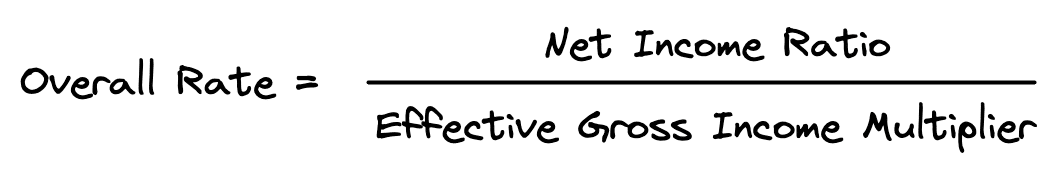

Sometimes appraisers cannot derive an overall market capitalization rate directly because strict data requirements for comparables cannot be met. If there is still recent and reliable transaction data that contain gross income for comparable properties, then the cap rate can instead be estimated using this gross income data along with the net income ratio.

The net income ratio (NIR) is the ratio of the net operating income to the effective gross income. The net income ratio is the complement of the operating expense ratio (OER) because NIR = 1 – OER.

Appraisers can often obtain market averages fairly easily for operating expense ratios and effective gross income multipliers. With this data, the appraiser can use the following formula to derive the overall capitalization rate:

For example, suppose you identify a comparable property which recently sold for 375,000. The potential gross income for the property is 80,000 and its effective gross income is 75,000.

The operating expense ratio for the property is 58.50%, which results in operating expenses of 43,875 and a net operating income of 31,125 for the comparable property.

The effective gross income multiplier is 375,000 / 75,000, or 5.00. The net income ratio is 31,125 / 75,000, or 0.415. That means, we can derive the overall capitalization rate from the comparable property as follows:

0.415 / 5.00 = 8.3%

If this procedure was completed for all comparable properties, then an overall capitalization rate could be estimated by reconciling each of the cap rate indications derived from the comparables.

Gross Income Multiplier vs Gross Rent Multiplier

What’s the difference between the gross income multiplier and the gross rent multiplier? The gross income multiplier considers income from rent plus all other sources for a property. In contrast, the gross rent multiplier only considers the gross rental income for a property and does not include ancillary sources of income.

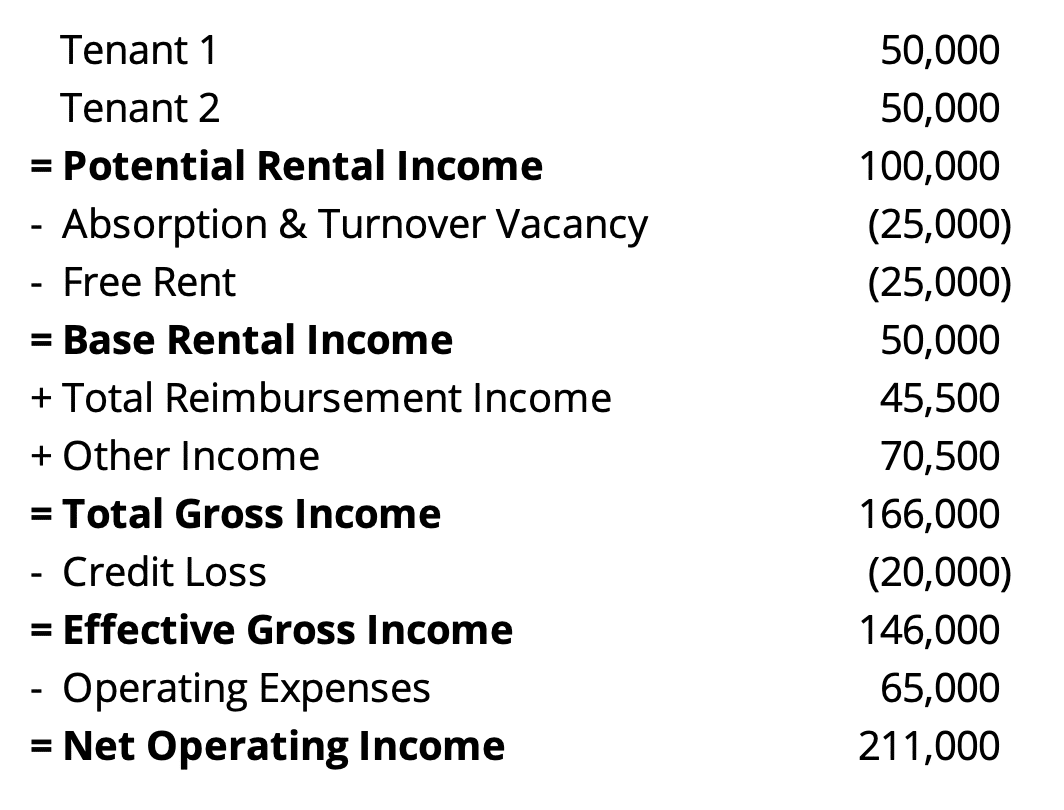

Let’s take a look at an example of the difference between the gross income multiplier and the gross rent multiplier. Consider the following proforma:

In this case, the gross rent multiplier would only consider the potential rental income line item of 100,000. If the sale price for this property is 2,637,000 then the gross rent multiplier would be 2,637,000 / 100,000 or 26.37.

In contrast, the gross income multiplier would consider all sources of income, not just the rental income. In this case, the gross income multiplier could be calculated as 2,637,000 / 146,000, or 18.06.

There could be variation in how these multipliers are calculated, so it’s important to clarify how a calculation is performed and to use a consistent methodology when making comparisons.

Limitations of the Gross Income Multiplier

The gross income multiplier is a useful ratio to have in your toolbox when evaluating commercial real estate. Its strength is that it relies on data that is more easily obtained because it only requires gross income for a property. However, since the GIM only uses high-level income data, that also means it won’t be as accurate or reliable as other metrics that do consider expense data for a property.

When net operating income data isn’t available, then you can use gross income along with market averages for operating expenses. This will allow you to estimate market value by using only gross income and market averages for operating expense ratios. However, it is not uncommon for two similar properties to have approximately the same net operating income but much different gross incomes. This could be due to differences in property age, mismanagement, etc. These are all factors that the gross income multiplier does not consider.

Conclusion

In this article, we defined the gross income multiplier (GIM), reviewed the gross income multiplier formula, discussed how to calculate it, what a good gross income multiplier is, and then compared the GIM to the gross rent multiplier and the cap rate. In our discussion of the capitalization rate, we reviewed one way appraised can estimate the cap rate using the effective gross income multiplier. Finally, we discussed some of the limitations of the gross income multiplier that you should be aware of.