America’s housing stock is in a dire situation. Shortages are chronic, housing prices skyrocketing.

I have covered this topic both within the newsletter and on my blog and hear from people in real estate about their frustration over the lack of significant action. There is a strong need for a once-in-a-generation response to address decades of underinvestment in housing.

The nation has faced a shortfall of 5.5 million to 6.8 million housing units since 2001. Total stock rose 1.7% annually between 1968 and 2000 but has since dropped to an average rate of 0.7% in the last decade.

The reasons are varied and sometimes depend on location. They include strict zoning regulations, rising materials costs, skilled labor shortages driven by unfavorable immigration policies, and unprecedented demand as Millennials enter their prime home-buying years amid historically low interest rates (which crashed below 3.0% in early August and are at lows not seen since October).

“There is a strong desire for homeownership across this country, but the lack of supply is preventing too many Americans from achieving that dream,” said Lawrence Yun, chief economist for the National Association of Realtors® (NAR). “It’s clear … that we’ll need to do something dramatic to close this gap.”

No one can dispute the situation is holding us back from being a better America. Additional housing, particularly more affordable units, will only help strengthen the health of the public and economy.

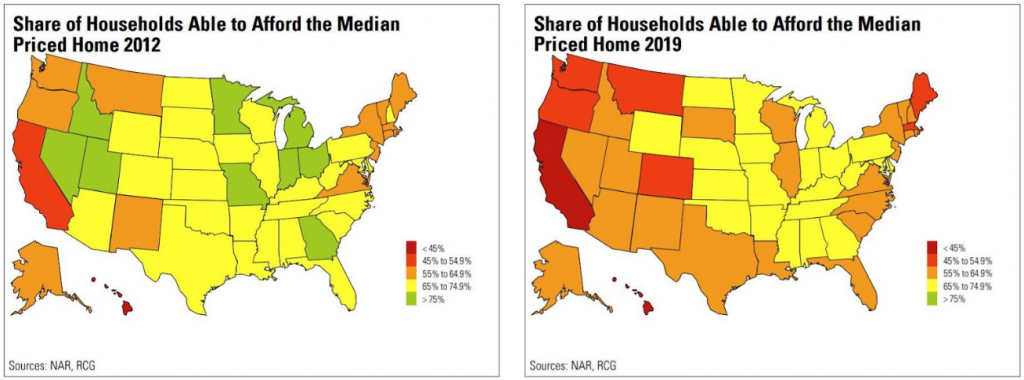

Housing affordability decreased in 45 of the 50 states from 2012 to 2019. Among those states, the share of households able to afford the median-priced home declined by an average of 7.2 percentage points. The largest fall was in the Mountain West (particularly Nevada, Utah and Idaho), as well as states with sizable population growth like Washington. In all these states, the share of households able to afford the median home price declined by more than 15 percentage points.

These maps put the situation in stark relief. Washington state now (right) has less than 45% of all households able to afford the median priced home (as of 2019, when the state’s median figure was more than $100,000 less than today). Look at the green states of Idaho, Nevada and Utah on the 2012 map; they have seen housing affordability plummet by 2019, skipping past the yellow category to brown in less than a decade.

In another study, released earlier this month, Seattle’s housing affordability index fell 20%, the second-sharpest year-on-year decline after Phoenix (23%) among major U.S. cities. The index showed a growing difficulty to afford a home even while household income and mortgage rates improved compared to last year. And, Seattle’s attempt to force building developers to incorporate more affordable homes within their new residential endeavors yielded only 21 units in 2020 out of a swell of 224 construction projects. Developers opted to pay fees to the city totaling $68M instead, funds that help construct affordable homes in other parts of the city.

The direction this country is heading on housing affordability and supply is dangerous for people and communities. The Biden administration’s $2T infrastructure plan included $213B for housing, with a focus on low- and middle-income homeowners and potential buyers. Sadly, the modified $1.2T plan approved by the Senate last week struck all of that funding.

POTENTIAL TAX SAVINGS

Skyrocketing property values in our area have their downsides. Owners face higher annual property taxes, and many are reporting difficulty paying, particularly older residents on fixed incomes.

In response, the state added in 2020 exemptions for senior and disabled property owners that offer to reduce or eliminate their tax obligations. The intent is to make it easier for more people to age in place by increasing the tax exemption for owners aged 61 and above that earn below $58,400 annually in King County (different rates apply in other counties).

Owners must apply for the exemption – it’s not an automatic benefit. Learn more here.

The county’s Assessors Office issues its updated property assessments between now and November. A so-called value notice card will appear in the mail for property owners to review. The assessed value is the basis for next year’s property tax rate. (An owner’s mortgage servicer may receive the card; check with the servicer or contact the Assessors Office website for the assessed value.)

Appeals on the assessed value can be made through the county but must be submitted within 60 days’ receipt of the notice card.

BY THE NUMBERS

>> Seattle home prices have skyrocketed 68% since May 2016, according to new data from the Case-Shiller Price Index. That’s 27 percentage points higher than the national average for the same period. The latest index reading had Seattle prices up 23% in the last year alone, the biggest-ever, one-year leap for the city.

>> A full 28% of all Seattle home listings are priced at or above $1M, according to a report published on SeattleAgentMagazine.com. The report also noted 3% of Seattle listings are at or above $3M and 1% are above $5M in the city, which had a median home price of $857,000 at the time of the survey.

>> The National Association of Home Builders says government regulations account for $93,870, or 24%, of the current average sales price ($397,300) of a new single-family home in the U.S. Of that figure, $41,330 is attributable to regulation during development – before a nail hits wood – and the balance is from regulation during construction.

>> More than 600,000 Latinos purchased a home with a mortgage in 2020, impressive for both the 13% rise from 2019 and for accomplishing the feat in the year of Covid-19. The National Association of Hispanic Real Estate Professionals also noted the median age of the Latino population is 29.8, almost 14 years younger than the country’s white population and still heading toward their prime homebuying years.

>> What did Americans do while in pandemic hibernation? Many dug into savings and had their homes renovated or repaired. About half (53%) of more than 70,000 owners surveyed had work done on the home or outdoors last year, spending a median $15,000 (up from $13,000 in 2019). A surprising 3% used the time to build a new house. Homeowners had planned to spend a median of $10,000 on their project but ended up adding about 50% more to the bottom line.

>> The National Association of Realtors’® top economist forecast 2021 will end the year with 6.1 million home sales. Lawrence Yun also said this figure will be the highest rate of sales since 2006. Currently, the nation is selling at a seasonally adjusted annual pace of 5.9 million homes (existing single-family, condo, townhome, co-ops combined), through June.

>> The City of Kent reported home prices increased 88% between 2010 and 2018, while incomes for homeowners rose 11% in that time. As the population grew 39% – twice as fast as the rest of South King County – the city has struggled to provide adequate, affordable housing. Kent is in the midst of drafting a 20-year plan to address the issue.

>> The Washington Office of Financial Management reported on the latest population stats for our part of the country. The state grew 1.5% from April 1, 2020, to the same day in 2021, to 7.77M residents. King County added 32,500 people for a total population of about 2.3M, and Seattle gained 1.1%, or 8400 residents, for a population of 769,500. Black Diamond saw the greatest population burst in the county, up 15%.

>> The same state office reported Washington added 46,700 housing units in the 12-month period ending April 1. Of that number, 15,250 were added in King County. About 57% of all new housing was classified multifamily (four or more units in one location).

AUGUST HOUSING UPDATE

A sliver of a silver lining developed in our still-hot housing market, as King County saw more homes for sale at the end of July than 31 days earlier. Prices continued to rise but fractionally compared with previous month-to-month gains. Both are welcome signs for buyers but they should not be interpreted as a trend.

Some highlights from the Northwest Multiple Listing Service (through July):

- The combined number of condo, townhome and single-family homes on the market as of Aug. 1 (2679) is 19% greater than July 1. However, we are miles from a balanced market, with King County total active listings still 31% fewer than this time last year.

- The number of new listings for all home types (4428) fell 7.8% in July from June and 13% in Seattle (1518). This should not be a surprise since we are past the customary height of the housing season (March-May).

- For single-family homes, new total listings (3373) fell 11% month-to-month across the county, including down 17% on the Eastside and 15% in Seattle. Total active single-family listings available on Aug. 1 (1784) rose 23% vs. July 1 in the county, led by a 57% gain in Southwest King and 37% rise in Southeast King. Seattle has 7.9% more active listings from the previous month and the Eastside has gained 22%.

- The number of sales were up 1.1% among King County single-family homes in an otherwise little-changed review of sales activity.

- Median prices for all county homes sold in July dipped 1.2% ($789,000) month-to-month and climbed 18% since last year, while rising 1.3% among single-family homes ($871,000) vs. June and 20% since July 2020. Seattle single-family prices gained 1.0% from June ($896,500) and 11% from a year ago. Eastside single-family prices fell 2.5% for the month ($1.33M) but soared 32% year-on-year, led by a 54% annual jump ($1.54M) in the area south of I-90 from Factoria to Upper Preston.

- Months of inventory improved slightly from June but remain extremely low. Across all home types in King, there was 0.7 months on the market – or 21 days for the entire supply of homes to be cleared if no others hit the Northwest MLS. That is an improvement on the previous month’s figure of 0.6.

- Among single-family homes, county inventory increased to 0.6 months from 0.5. Seattle improved to 0.7 months (0.6 in June), while the Eastside continues to suffer a fast absorption rate with only 0.4 months of inventory available compared with 0.3 the previous month.

- The county’s condo market saw a 12% increase in available units month-to-month, with a 1.0% median price drop since June and a 7% decline year-on-year to $460,000 ($492,500 in Seattle). There is 1.1 months of condo inventory in King (up from 0.9 in June), including 1.8 months in Seattle and 0.7 on the Eastside – slight improvements from the previous month.

What may be happening – summer lull as people hit the beach or mountains … or something else?

Prospective buyers may be taking up more space on the sidelines until prices ease. Industry wonks in King County tell me that, while the buyer pool may be thinner now than this spring, demand is still strong and a market correction – if any – will be small and unlikely worth the wait when considering costs of the delay.

James Young, director of the Washington Center for Real Estate Research at the University of Washington, offered a deeper analysis, quoted by the MLS:

“With a lack of new construction coming on the market in suburban areas after years of under building, increasing demand still has few places to go,” he said. “With interest rates staying at historically low levels [as low as 2.75% for some applicants] and less than a one month supply throughout the region, the perfect storm for rising house prices will continue, but perhaps not as ferociously as before.”

King County experienced the sharpest increase in median month-to-month prices for all home types, up 1.2% to $789,000. Kitsap saw prices inch 1% higher since June to $507,500, while Pierce prices slipped 1.2% to $501,500. Snohomish County prices were unchanged from June ($675,000).

Single-family home prices in King added 1.3% since June ($871,000) but fell 2.2% in Snohomish ($700,000) and dropped 1.2% in Pierce ($510,000). Single-family prices in Kitsap were unchanged from June ($510,000). Year-to-year, single-family median prices continued to climb in our region, led by a 22% jump in Snohomish, 20% each in Pierce and King, and up 19% in Kitsap.

Click here for the full monthly report.

CONDO NEWS

KODA opened its doors in June and is welcoming new residents nearly every day. The 17-story condo is the tallest residential building in the Chinatown International District and has created a buzz among renters seeking somewhat affordable purchase options.

I recently visited the site and received a tour of one showcase unit – #1306, a Southwest-facing, 2-bed, 1.75-bath, 1002 sq. ft. beauty. Picture the view of Lumen Field to the south and unobstructed westerly vistas of Elliott Bay and beyond. It can be yours for $1.23M.

We covered KODA earlier this year on my blog and detailed all the amenities. It’s probably best now to show you #1306, the amenities and, oh!, those views. Have a look:

——-

Without question, First Light is striving to achieve pinnacle status among downtown Seattle luxury condos when completed in 2023. The 48-story giant at 3rd Avenue and Virginia Street has great promise, with sleek architectural lines and a rooftop, cantilevered pool.

Activity was brisk when the sales gallery opened in 2018-2019 with about 60% of the 459 units pre-sold. Interest has returned after a quiet spell in 2020 (thanks, pandemic!). Buyers have now locked up more than 70% of the inventory – but home prices are not for the faint of heart:

Contact me if you would like to learn more about First Light or are considering a visit to the sales gallery. (Always bring a broker to represent you when thinking of buying new construction.)

LUXURY LIVING

Let’s start with the most expensive condo on the market. This 4-bed, 3.5-bath, 6397 sq. ft., full-floor penthouse sits atop Bellevue Towers and is unquestionably the most incredible home for those who don’t want to worry about raking leaves or repairing the downspouts. The unit features marble floors, porcelain tile, onyx counters, walnut paneling and an en-suite bath with chandelier – no expense was spared. How much, you ask? The sellers are seeking $17.98M, $2811/sq. ft. … and that comes with six parking spaces.

For something truly special, check out this 3-bed, 3.25-bath, 4850 sq. ft. houseboat on the ship canal under the Aurora Avenue Bridge. It’s a house, no, it’s a mansion, on water! What other houseboat has a large theater? Simply named Aurora, the houseboat was constructed in 2012 by the owners of Fremont Mischief Distillery and has had famous guests enjoy the home – reportedly including Ashton Kutcher and Mila Kunis on their first-year wedding anniversary. It’s yours for the asking price of $3.95M, $814/sq. ft.

We rarely feature homes in Cedar Park, the sliver of a neighborhood that hugs the northwest of Lake Washington near Lake City. Until now. This 5-bed, 4.25-bath, 5410 sq. ft., 2-story home was designed by local architect Peter Cohan. Built in 2018, the house sits on a hilltop and offers great water views in a park-like setting and features Scandinavian-inspired light wood and clean lines. I love the seamless indoor/outdoor living space. List price: $4.698M, $868/sq. ft.

This 5-bed, 4.75-bath, 5993 sq. ft. home is quintessential contemporary Clyde Hill. The modern masterpiece is looking for its first owner, if $6.498M ($1084/sq. ft.) is within your budget. What’s not to love: a 2-story great room, massive walk-in closets and outdoor firepit with TV. Amazing. Update: The home is now under Pending Inspection.

This contemporary new construction in Meydenbauer/Bellevue is listed at about $4.28M, $771/sq. ft. It offers a spacious 6 beds and 6.75 baths in 5553 sq. ft. There are modern touches wherever you look. I’m surprised it’s still on the market.

The Woodlands is a quiet, gated community nestled east of Redmond. This 4-bed, 4.75-bath, 6160 sq. ft. two-story home has all the luxury features a homeowner would expect: massive kitchen with center-island gathering space, theater room, and all sitting on 2.7 acres. A rare find in this part of King County. Asking price: $3.69M, $599/sq. ft.

Saving arguably the best for last … If you or a very dear friend are seeking a page out of “Lifestyles of the Rich and Famous,” then I have just the place. How does a 10-acre estate sound with helicopter landing rights, sports courts at every turn, 20-vehicle garage and the most spectacular Mt. Rainier views you will ever see from a residential property? This 5-bed, 6-bath, 11,412 sq. ft., 2-story stunner is yours for “only” $14.75M, $1293/sq. ft.

——-

For those who are new to my newsletter, welcome! You are among friends here … hundreds of them.

And if you’re new to me, here’s a little video bio…