[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook

Miller Samuel

FEBRUARY 22, 2024

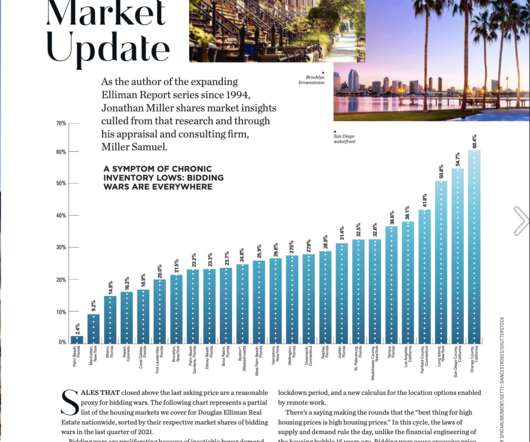

I joined the folks at 27East again for a discussion on the housing market outlook for 2024 in the Hamptons. They always foster a great conversation and I enjoyed this one as I always do. 27east.com · Real Estate Analyst Gives 2024 Hamptons Outlook The post [27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook first appeared on Miller Samuel Real Estate Appraisers & Consultants.

Let's personalize your content