May Newsletter- Change on the Horizon?

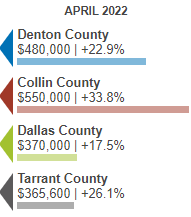

As we have been reporting the last year, the North Texas markets have experienced extraordinary appreciation in housing with very little signs of slowing. The median sale prices have had double digit increases within the past year. This is on top of the increases that we have been experiencing within the past 5 years- Denton County alone has experienced a 77.45% increase in 5 years as the median sales price in May of 2017 was $270,500 and now it is $480,000.

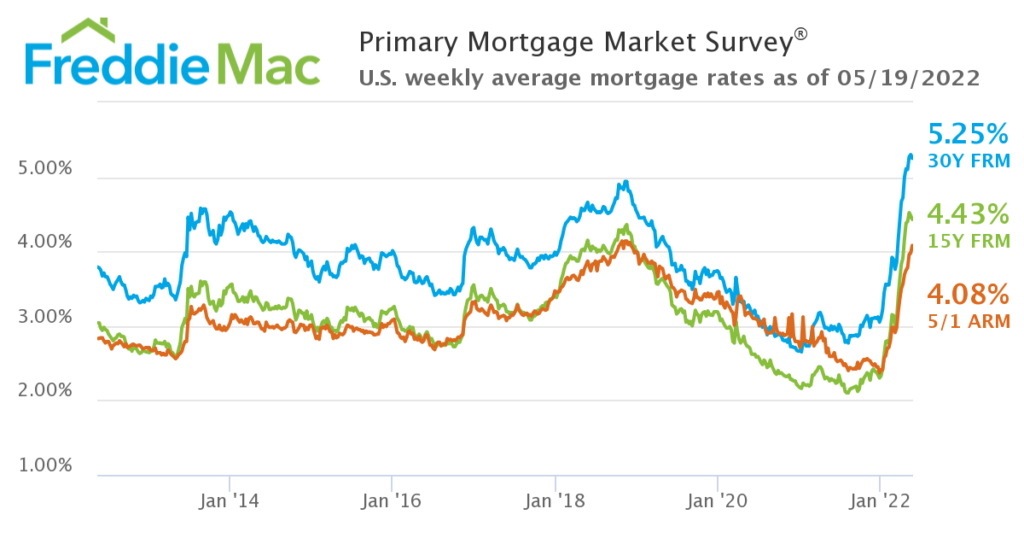

Reasons for this increase? Population growth- Denton County has increased in population 16.42% over the past 5 years and 37.39% the past 10 years. Along with population growth, demand for housing has also increased with the shift in workspace. The pandemic created a need to work from home and historically low mortgage rates increased buying power which fueled the demand. Of these factors, the mortgage rates have now begun to increase, which will create a shift in the demand as buyers will not have the same buying power as before. Mortgage rates began to rise in January with significant jumps in March and are now at their highest in over a decade.

The impact of the rising rates has not yet been felt as there is a lag in the time for transactions to occur when buying a home. Buyers would have had rates locked in and typical closing time is around 30 days. Also, once rates began to rise, other buyers suddenly felt pressure to buy before they got higher, which increased the demand. Some of this initial reaction increases the demand but many are forecasting a decline but only a slow one in the coming months.

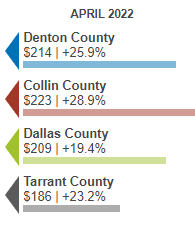

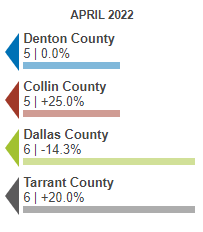

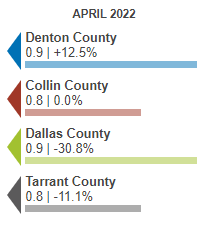

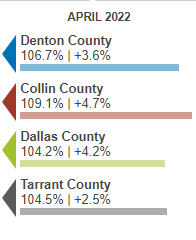

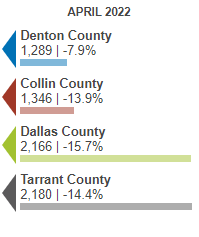

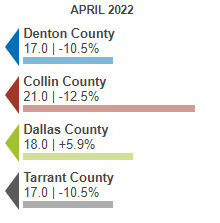

What are we seeing in North Texas? Only very small signs of any slow down. Note that the numbers are from April but price appreciation is still occurring. There is a slight leveling out in price per square foot for Denton & Collin Counties. Other very slight signs of change is a very very slight increase in inventory. Months supply of inventory is still incredibly low but it did increases slightly from the previous month. Volume was stagnant from the previous month and homes sold over list price. These are about the only current signs of a cooling or shift in the markets we see. Here are the numbers:

Median Sales Price

Median Price Per Sq Ft

Days on Market

Months Supply of Inventory

Percent of Original Price

Volume

Showings to Pending

Appraiser Corner

Check out this month’s information just for real estate appraisers. If you have information that you think would be good here, please let us know

Great Appraisal Reads

Appraising in a Crazy Market- Working RE

Proposal to Eliminate the VA Panel– Appraiser Blogs

Housing Demand & Remote Work-NBER

An open letter to sellers about today’s housing market– Sacramento Appraisal Blog

Copacobana? No Silly, It’s Cubicasa!– Cleveland Appraisal Blog

Do We Need a Neighborhood Section? – George Dell

Do We Need a Neighborhood Section?- Part II – George Dell

Do We Need a Neighborhood Section?- Part III – George Dell

Can EBV Support Diversity and Fairness? – George Dell

Single-Family Starts Decline as Rates, Headwinds Increase– NAHB

Why House Prices Sometimes Skyrocket- John Wake

While Looking for Housing, I Dig a Pony– Housing Notes

Cubicasa Home Measurement From Inside a House- Appraisal Today

Webinars

Free Webinar- The Appraisal Foundation Q2 Update– McKissock

Virtual Appraisals and Their Potential to Speed Servicing Decisions and Decrease Risk – Incenter

Desktop Appraisals- Yes, No, Maybe?– Appraisal Buzz

We will continue to follow the markets and let you know how they react to the different factors impacting real estate. Let us know if you have any questions or comments. Thanks, as always, for your input! Are you subscribed to this newsletter? If not, sign up here!

For the longest time we had people saying that nothing could change the temperature of the market…. Well, it turns out mortgage rates above 5% really matters for affordability. Let’s keep watching the market closely and being objective as always about the stats and narrative.

Ryan, absolutely, higher mortgage rates decrease buying power of borrowers which in turn impacts the market. As your multi-layer cake analogy demonstrates, so many different factors impact real estate and it’s important to consider each of them. Yes, let’s keep a close watch to see exactly how the markets are impacted and at what rate.